Back to feeds

Anonymous 2

Stealth • 4h

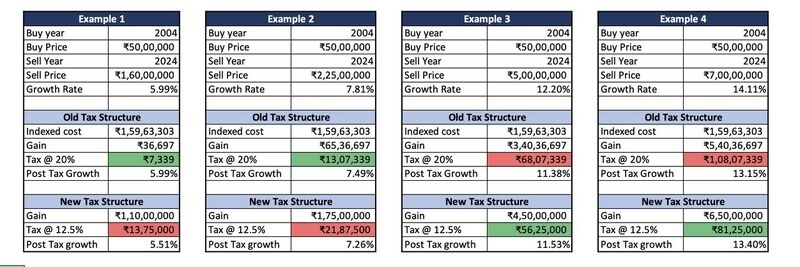

bro... have you seen what Marginal Relief is??. If your salary is 12.80L, tax will be 5,000 rs. Till your Margin exceeds Tax amount, you will pay the lesser of both. Always Check your doubts with Qualified professionals before jumping into any excitement after seeing 99 rs influencers Social media posts.

More like this

Recommendations from Medial

Download the medial app to read full posts, comements and news.