Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Look at the image. That's what PM Modi did to the middle class in the budget today. Just the finger was a different one 📛📛 It made a mockery of the middle class in this budget. To be precise, it is all about two numbers- Rs 17.5k and Rs 7k crore. What are those numbers? Let’s dive deeper. .. Govt today revised the income tax slabs for the new tax regime. Plus, it revised the standard deduction for salaried from Rs 50k to Rs 75k. And in the BEST CASE, that will help the Indians in this tax regime save Rs 17.5k a year. And overall, as per Nirmala Tai, this will come for Rs 7k crore. Meaning, a relief of Rs 7k crore a year! Claps? Ghanta! Slaps 📛📛 .. Let's be real, Rs 17.5k in the BEST CASE scenario is hardly a game-changer. It might cover a few months of groceries, but it won't significantly impact their overall financial well-being. It won’t increase their disposable income. Nor will it strengthen their bank balances. Nothing. Worse, with inflation soaring and expenses piling up, this is a mockery of the financial burdens faced by the middle class. .. And let’s put that Rs 7k crore into perspective. India's middle class is estimated to be over 30 crore people. A Rs 7k crore sacrifice is a drop in the ocean compared to the taxes collected from this vast demographic 📛📛 .. So tell me, is the government truly committed to easing the financial strain on the middle class? Or is this a token gesture? The true answer is neither. .. This announcement was not about benefitting the middle class. This was about making the new tax regime appear more lucrative than the old one, which continues to be the choice for most taxpayers despite Modi Govt making new attempts year after year. .. While the government may claim to prioritize the middle class, its actions suggest otherwise. The Budget 2024 is a missed opportunity to provide real relief to those who need it the most. Maybe, the Indian middle class has no option but to find ways to send their sons and daughters abroad. After all, why the heck not? Who wants us here anyway?

Replies (4)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

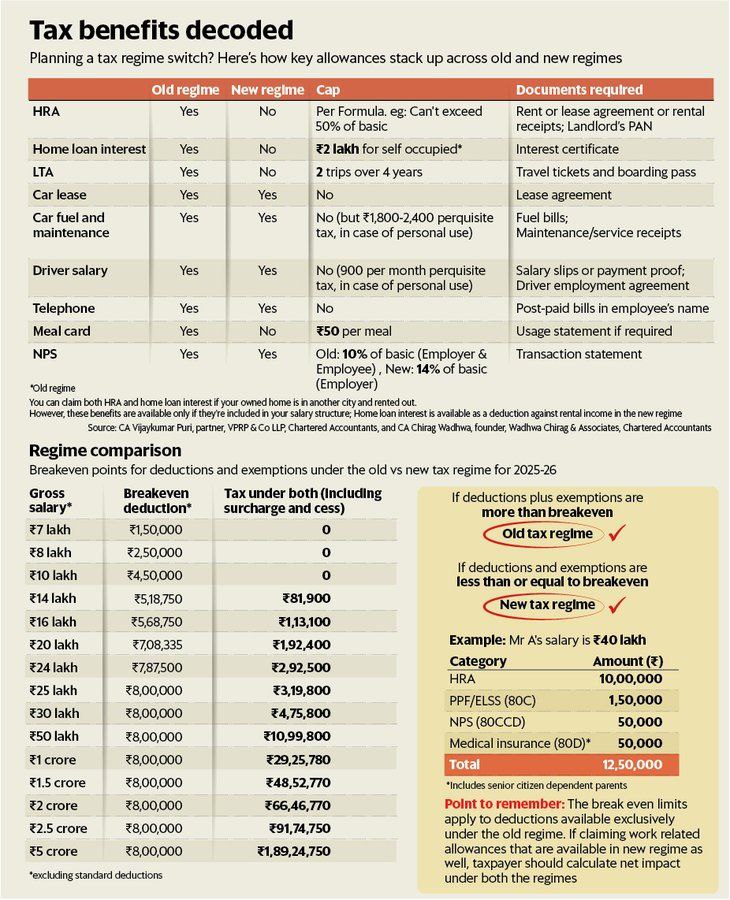

I won’t waste time on old tax regime for two reasons: -> 70%+ income taxpayers had already switched from it by the end of FY24 -> With what’s announced today, it’s anyway dead. One would have to be a fool to stick with it So, what about the News T

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

3k crore of taxpayer money burnt in the last two years 📛📛 And Modi Govt is set to burn another Rs 1.2k crore in FY25 for what is clearly another Air India in the making. For what? And worse, this time, there may be no buyers either. .. FY23: Go

See More

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)