Back

Anonymous

Hey I am on Medial • 1y

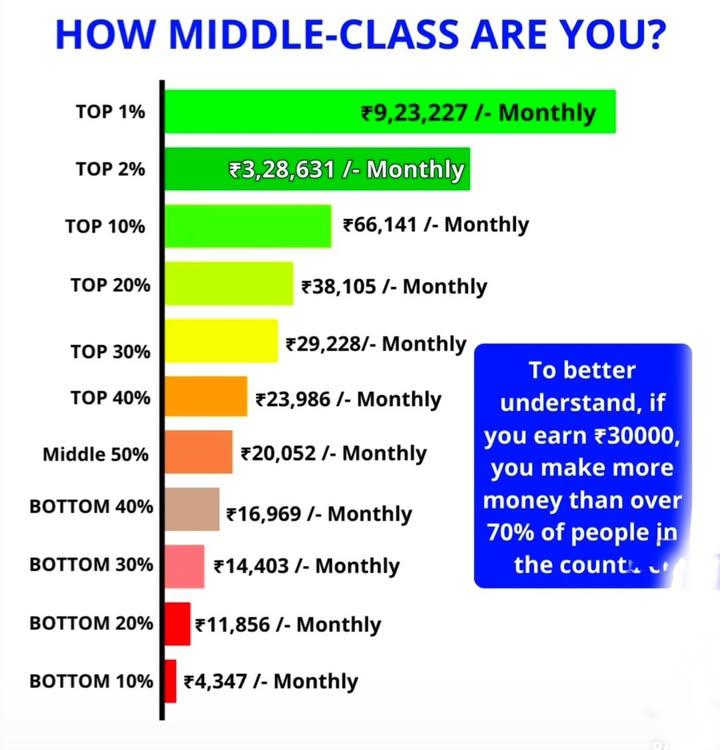

Middle Class are getting crushed by the tax terrorists

Replies (1)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 1y

I think next civil war in India happens because of tax . We are facing this huge problem since 1947 and every government force only middle class people's for tax . According to reports only 3.5% people in India paying tax and other are just enjoying

See MoreAman Verma

BIT'Mesra Undergrad|... • 1y

Who are actually middle class of India ? I am really confused to get the ideal answer of it. Because in village there is only a class that is caste... Most of the rich (as per village standard having acres of land, home, Cars, and non tax incom

See MoreMedial User

Hey I am on Medial • 11m

Change my mind: A middle-class person who cannot afford to buy a home in a metro city takes a loan and spends a lifetime paying EMIs, while the government incentivizes this through tax deductions. This is a pure strategy to enrich the real estate t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)