Back

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime could save you more. Yup, old-school wins! Example: CTC ₹30L 🆕 New Regime Tax: ₹4.8L 🆙 Old Regime Tax: ₹4.32L (Exemptions: HRA ₹3,00,000, Other salary exemptions ₹75,000, 80C ₹1,50,000, 80D ₹50,000) Got a home loan? Old regime wins! 🏠💥 Still confused? Reach out to us, CA Theresa—Deadpool's personal tax guru. I’m always here to help. 9841975430

Replies (14)

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

CA Abhishek Singhal

Har Har MAHADEV • 9m

If you're an employee, you've got an in-hand salary hike today! This is because of Nirmala Sitharaman's tax cut for the new regime. April 2025 is the first month you see it in action. Your company would've cut lower TDS in accordance with the new sl

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

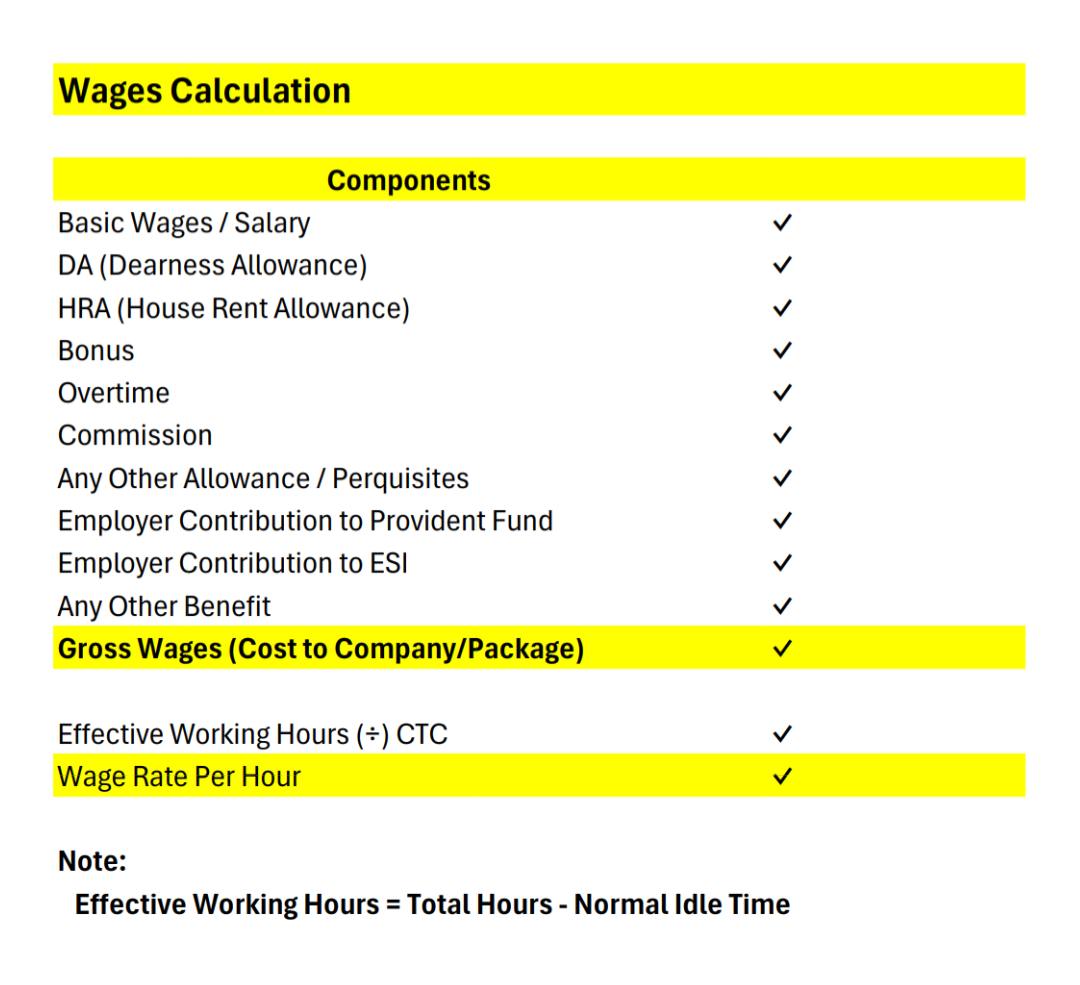

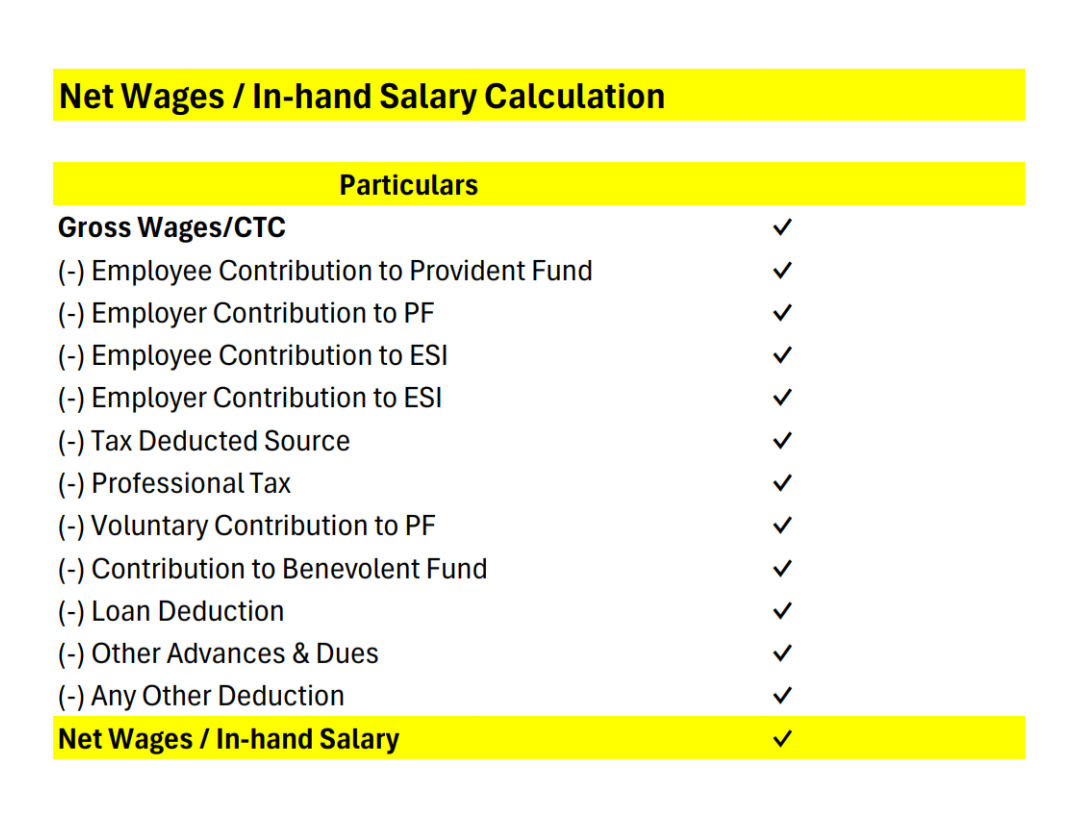

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Sairaj Kadam

Student & Financial ... • 1y

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically redu

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)