Back

Sairaj Kadam

Student & Financial ... • 1y

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically reducing deductions and exemptions, the government is subtly shifting the tax burden to individuals. This means less disposable income over time and a potential hit to savings and investments. It's a trade-off that needs more discussion. Many felt that the budget did not adequately address the rising cost of living and the increasing tax burden on the middle class. While there were some measures announced, critics argued that they were insufficient to provide significant relief. Such as 👇 × Insufficient focus on job creation: Many felt the budget did not adequately address the unemployment crisis. × Concerns over fiscal deficit: Some experts expressed worries about the government's ability to meet its fiscal deficit targets.

More like this

Recommendations from Medial

K Shreenathan Nedunghadi

An professional with... • 1y

The Union Budget for 2025-26, presented by Finance Minister Nirmala Sitharaman, introduces significant reforms aimed at stimulating economic growth and providing relief to the middle class. Key highlights include: Income Tax Reforms: Revised Tax Slab

See Moretheresa jeevan

Your Curly Haird mal... • 1y

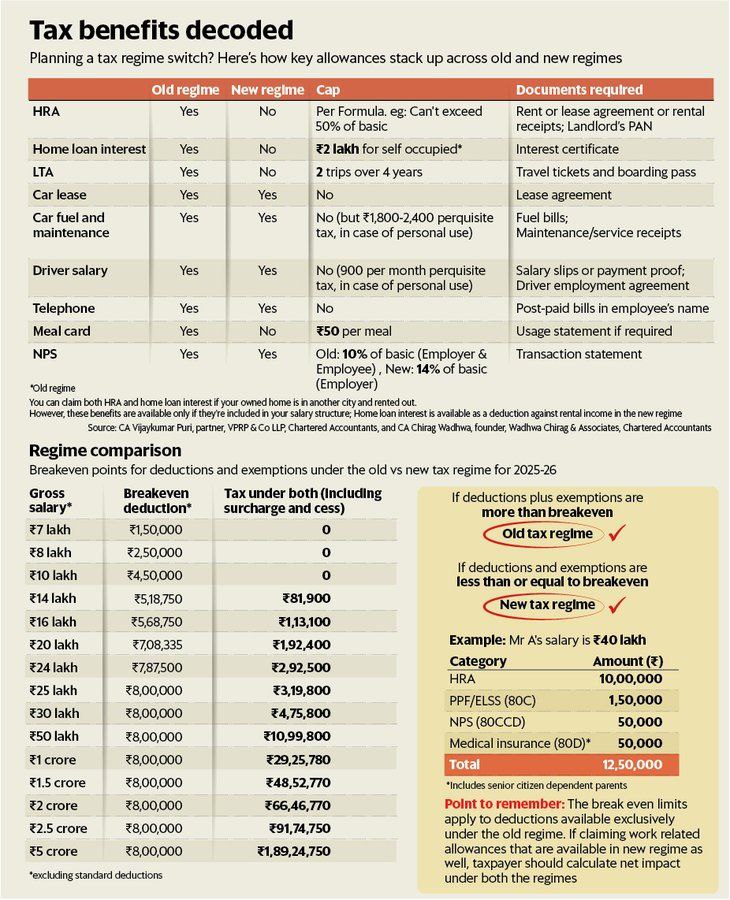

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

B Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)