Back

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

Government to introduce a new tax regime where people will be taxed based on the salary they tell their relatives #income_Tax

Replies (4)

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

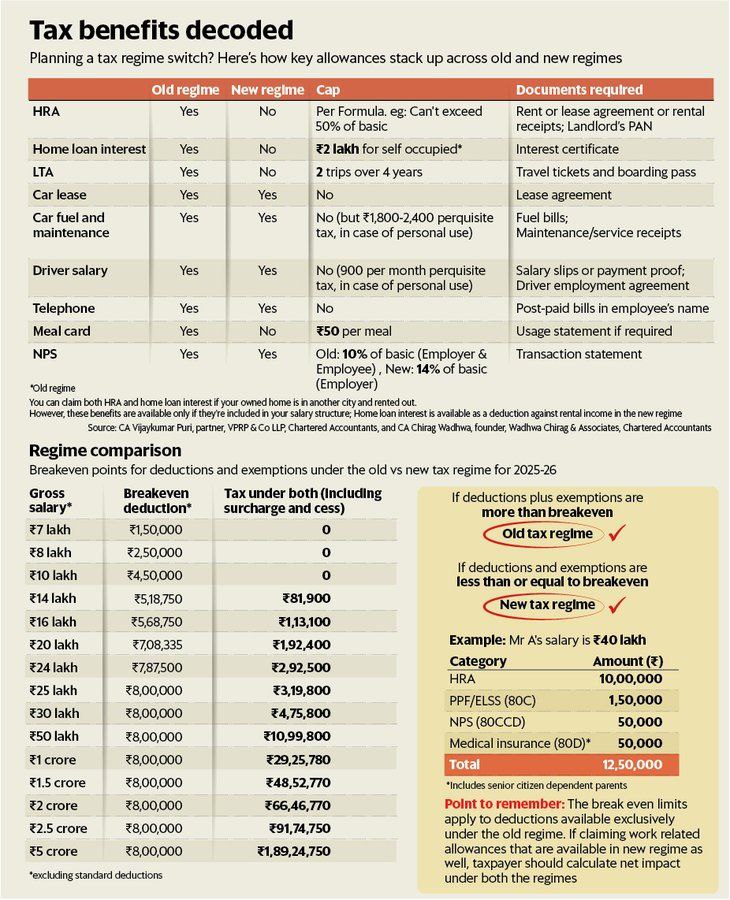

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

CA Abhishek Singhal

Har Har MAHADEV • 9m

If you're an employee, you've got an in-hand salary hike today! This is because of Nirmala Sitharaman's tax cut for the new regime. April 2025 is the first month you see it in action. Your company would've cut lower TDS in accordance with the new sl

See MoreB Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)