Back

Ronak Patel

Here you go! • 1y

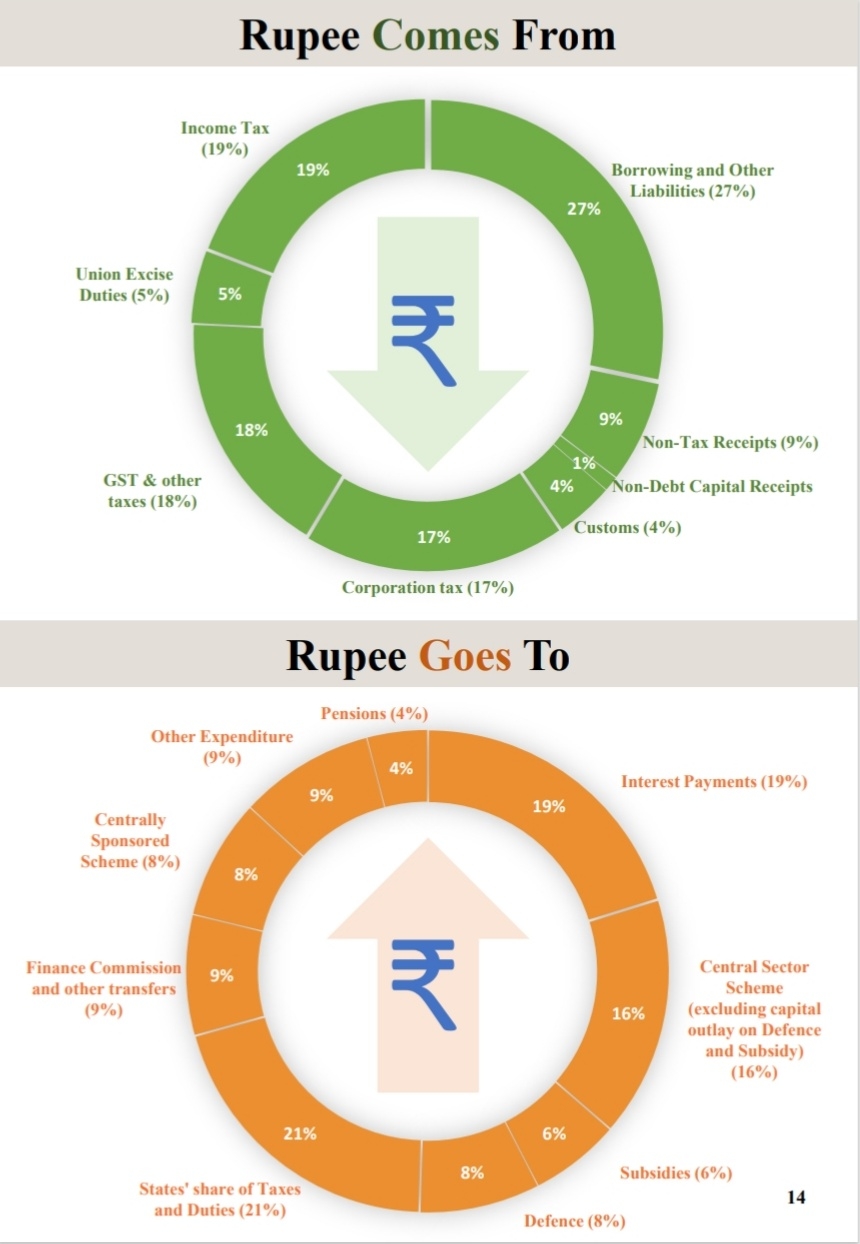

💸25 Basic terms you should know before watching Budget 2025 on Feb 1 Finance Minister Nirmala Sitharaman is preparing to present the Union Budget 2025, marking the second full budget of Prime Minister Narendra Modi’s government in its third term, and her eighth presentation. As the date approaches, it’s important to familiarize yourself with key budgetary terms. Here’s a guide to the essential concepts before the budget is unveiled on February 1: 1] Annual Financial Statement (AF):- The Annual Financial Statement (AF) is a document that summarizes the government’s receipts and expenditures for the fiscal year. 2] Budget Estimate:- The budget estimate represents the anticipated amount of money to be allocated to various ministries, departments, sectors, and schemes. It outlines expected expenses and how the funds will be distributed. 3] Capital Expenditure (Capex):- Capital expenditure, or capex, refers to the funds the government plans to invest in creating and acquiring assets that support economic growth. 4] Capital Receipts:- Capital receipts are the funds the government receives from borrowing, selling assets, or investing in equities. 5] Cess:- A cess is an additional tax levied on income tax to finance specific purposes like education and healthcare. It applies to the total tax liability, including any surcharge. 6] Consolidated Fund:- The Consolidated Fund of India comprises the total government revenue, market borrowings, and loan receipts. This fund covers all government expenses, except those financed by the Contingency Fund. 7] Contingency Fund:- The Contingency Fund is a reserve the president can access for unforeseen situations. Any money drawn from this fund must be reimbursed from the Consolidated Fund with prior parliamentary approval. 8] Direct Taxes:- Direct taxes, such as income and corporate taxes, are collected directly from taxpayers. 9] Divestment:- Divestment refers to the process through which the government sells its existing assets. 10] Economic Survey:- The Economic Survey, presented during the budget session, outlines the economic performance and provides a framework for the new budget. It offers an overview of the economy’s state for the upcoming fiscal year. 11] Finance Bill:- The Finance Bill proposes changes to the tax structure, such as imposing new taxes or maintaining existing ones. 12] Fiscal Deficit:- The fiscal deficit is the difference between the government’s total expenditure and its total revenue in a fiscal year. It is often bridged by borrowing from institutions like the Reserve Bank of India (RBI), and it is calculated as a percentage of the Gross Domestic Product (GDP). 13] Fiscal Policy:- Fiscal policy is a tool used to manage the state of the domestic economy. It focuses on government spending and taxation decisions. 14] Indirect Taxes:- Indirect taxes, including GST, VAT, customs, excise, and service tax, are levied on goods and services rather than income. These taxes are collected indirectly from consumers. 15] Inflation:- Inflation refers to the increase in the average cost of goods, services, and commodities in a country, which decreases the purchasing power of consumers. 16] New Tax Regime:- Introduced in 2022, the new tax regime features seven tax slabs with reduced rates. This system became the default regime for the 2023-2024 fiscal year, with the previous tax regime remaining as an alternative. 17] Old Tax Regime:- Under the old tax regime, there were four tax slabs, with the highest rate of 30% applied to incomes exceeding Rs 10 lakh. 18] Public Account:- The Public Account consists of money used for transactions where the government acts only as a banker, such as funds received on behalf of the state or central government. 19] Rebate:- A rebate is a reduction in income tax designed to ease the tax burden on taxpayers and encourage economic activity. 20] Revenue Deficit:- A revenue deficit occurs when the government’s revenue expenditure exceeds its total revenue. 21] Revenue Expenditure:- Revenue expenditure refers to the cost of operating government departments and providing services, including salaries, benefits, subsidies, and interest on debt. 22] Revenue Receipt:- Revenue receipts are the funds the government receives from taxes, fines, and goods and services it provides. 23] Tax Collected at Source (TCS):- TCS is the tax a seller collects from the buyer when goods or services are sold, which is then remitted to the tax authorities 24] Tax Deduction:- A tax deduction reduces the taxable amount, lowering the overall tax bill. Tax-saving instruments like PPF, NSC, and tax-saving fixed deposits (FDs) can provide such deductions 25] Tax Surcharge:- A tax surcharge is an additional tax applied to high-income earners. Those with annual income exceeding Rs 50 lakh are subject to a surcharge, which increases the overall tax liability. For example, a 10% surcharge on a 30% tax rate results in a total tax liability of 33%.😶

Replies (4)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

After a long time. Back to Reality: The Budget's Hidden Cost "Hidden Costs of the New Tax Regime" Everyone's talking about the lower tax slabs in the new income tax regime. But has anyone considered the long-term implications? By drastically redu

See More

Download the medial app to read full posts, comements and news.

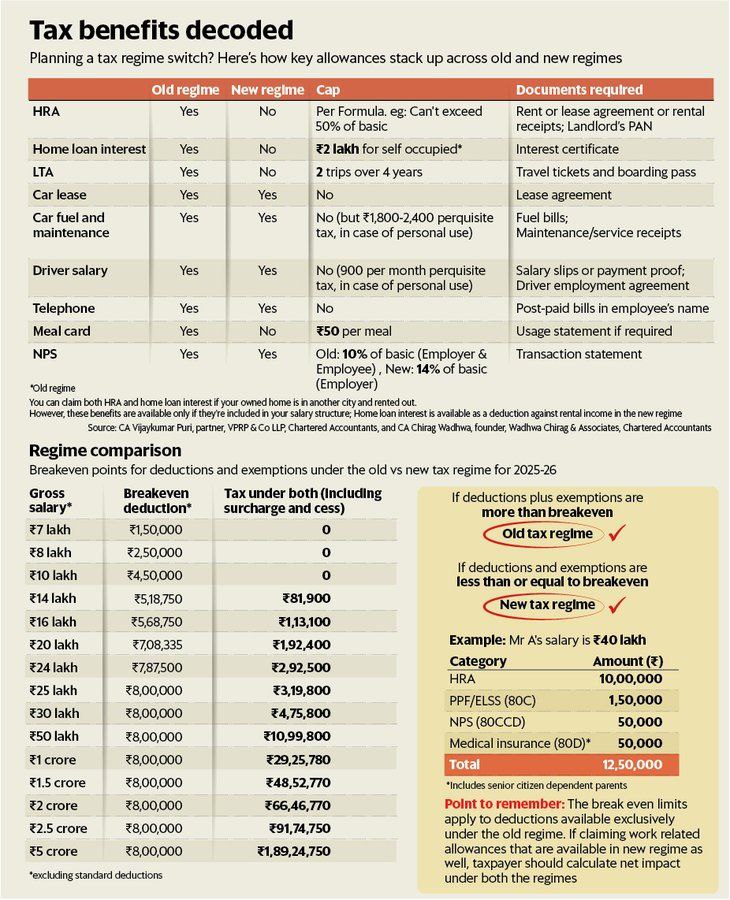

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)