Back

PRATHAM

Experimenting On lea... • 7m

Taxes like Remittance Tax can be easily avoided using crypto once Crypto is accepted for basic payments. It's a boon for us and a curse for the government ( the same government who doesn't utilise the taxes efficiently ) What's Your Thought on this 🤔

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreRavi Handa

Early Retiree | Fina... • 1y

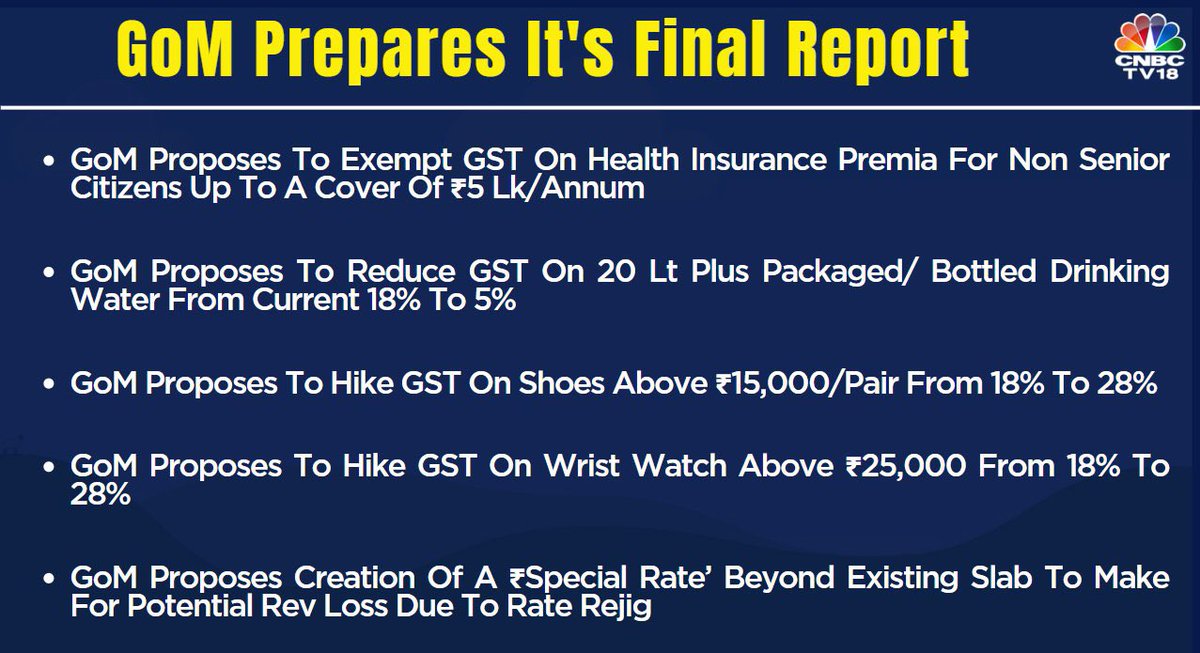

Before criticising the government, please have a look around you. You live in a very poor country. If you are buying shoes above 15k or watches above 25k - you are in a much better position than your fellow countrymen. You are not just the 1%,

See More

Harshajit Sarmah

Founder & Editor of ... • 1y

Crypto is starting to become more accepted, especially after the approval of #Bitcoin and #Ethereum exchange-traded funds (ETFs) in the U.S. and changes to accounting rules by the Financial Accounting Standards Board (FASB). However, like with any

See MoreintrepidAni

Exploring beauty of ... • 1y

Apologies if I'm missing any loop hole,but hear me out: What if we used crypto to simplify cross-border money transfers? Instead of dealing with high bank fees and taxes, you send money in your local currency, it gets converted to crypto in the bac

See MoreSalai Parashuram

Resourceful, Analyti... • 7m

Hello everyone! Due to using UPI payments in bangalore the government has filed a lot of taxes for the shopkeeper to be paid as fine for not filing GST so they are going to do Bandh on 25th of July so here is a hue billion dollars business idea oppor

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)