Back

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic from the manufacturer for ₹100 +10 tax for making bottles. And the expense I did to make bottle from the plastic is ₹70. Then I have to pay 7 as taxes on the 70 valued added. Not on the whole 180(100+10+70) which would have been 18. 2. Continous chain of credit - GST offers Input tax credit (ITC) at each stage for the purchases. In the above example. Total sales- 170+17 taxes wherein 10 would have been available to the seller as credit. Therefore, only 7 will be paid as taxes. 3. GST has subsumed various central taxes(Excise, Service tax, Sales tax,etc) and state taxes (entertainment tax,VAT,Luxury tax, etc). Though there are some indirect taxes which are still levied (Customs, Central excise on tobacco products, 5 petroleum products, etc.

Replies (2)

More like this

Recommendations from Medial

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Aditya Arora

•

Faad Network • 5m

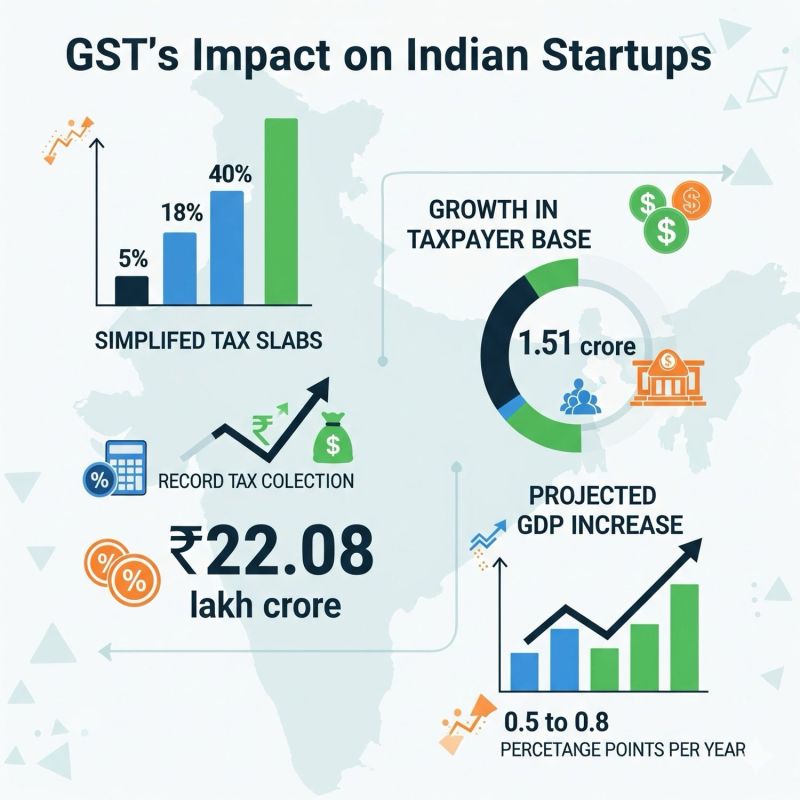

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

CA Kakul Gupta

Chartered Accountant... • 1y

The Central Board of Direct Taxes (CBDT) has specified that no tax deduction at source (TDS) under Section 194Q of the Income Tax Act, 1961, will be required for purchases made from units of International Financial Services Centres (IFSC), provided b

See MoreCA Kakul Gupta

Chartered Accountant... • 5m

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)