Back

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods and Services Tax (GST) rules and regulations for FY 2023-24 by GST-registered taxpayers. If the taxpayer misses today’s date, he/she may lose out on claiming ITC benefit for FY 2023-24 under GST if any ITC claims are pending. It will result in a loss for the taxpayer as he/she will not be able to offset output GST liability with input tax credit.Dinesh Jotwani, Co- Managing partner at Jotwani Associates says, "Section 16(4) of the Central Goods and Services Tax Act, 2017 reads as follows: A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following.

More like this

Recommendations from Medial

CA Jasmeet Singh

In God We Trust, The... • 12m

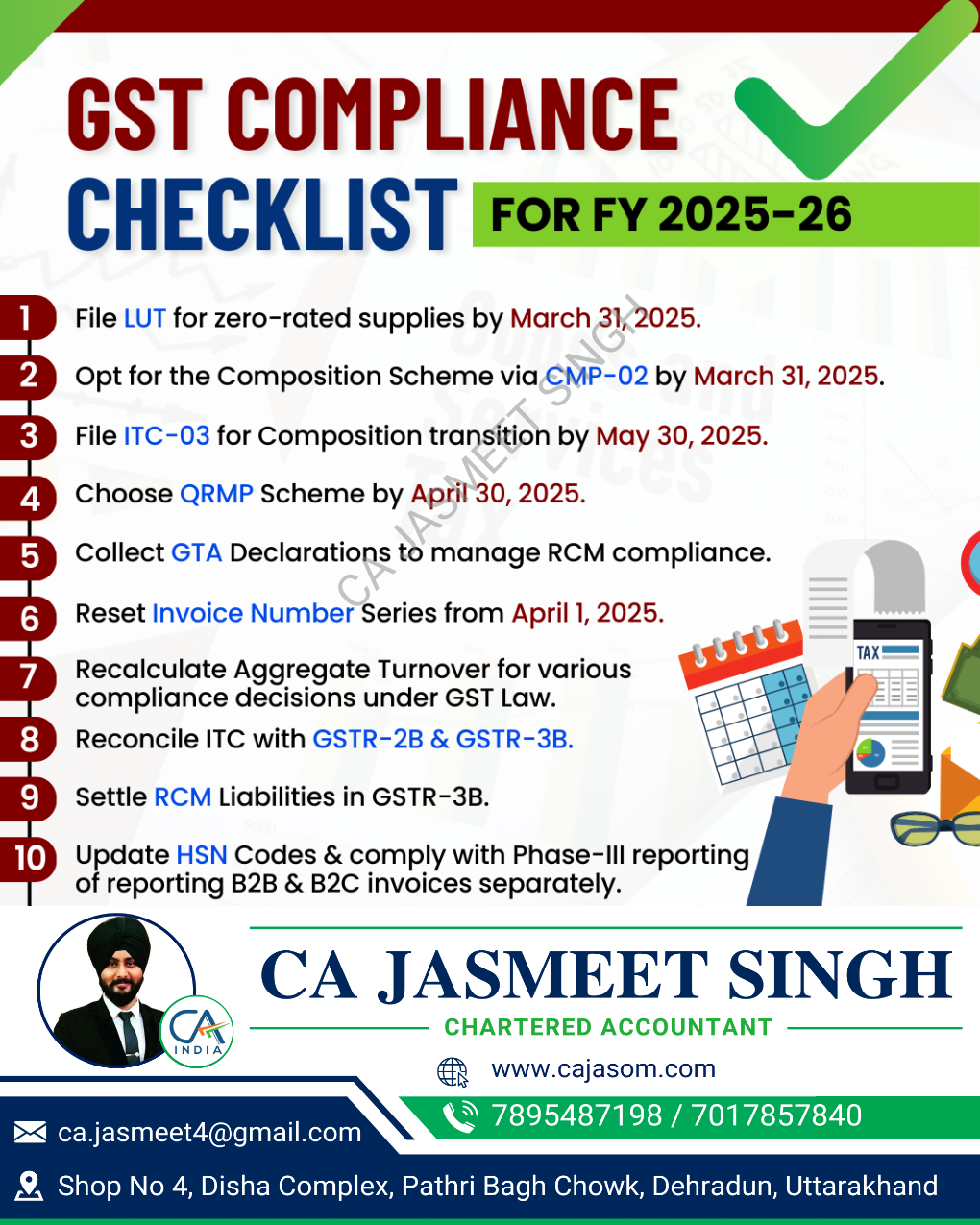

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreCA Kakul Gupta

Chartered Accountant... • 5m

🏠 GST & Real Estate Update Realtors are waiting for govt clarity on how GST input tax credit benefits should be passed on to homebuyers. This decision will directly impact whether home prices go up or come down under the new GST regime. What do you

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

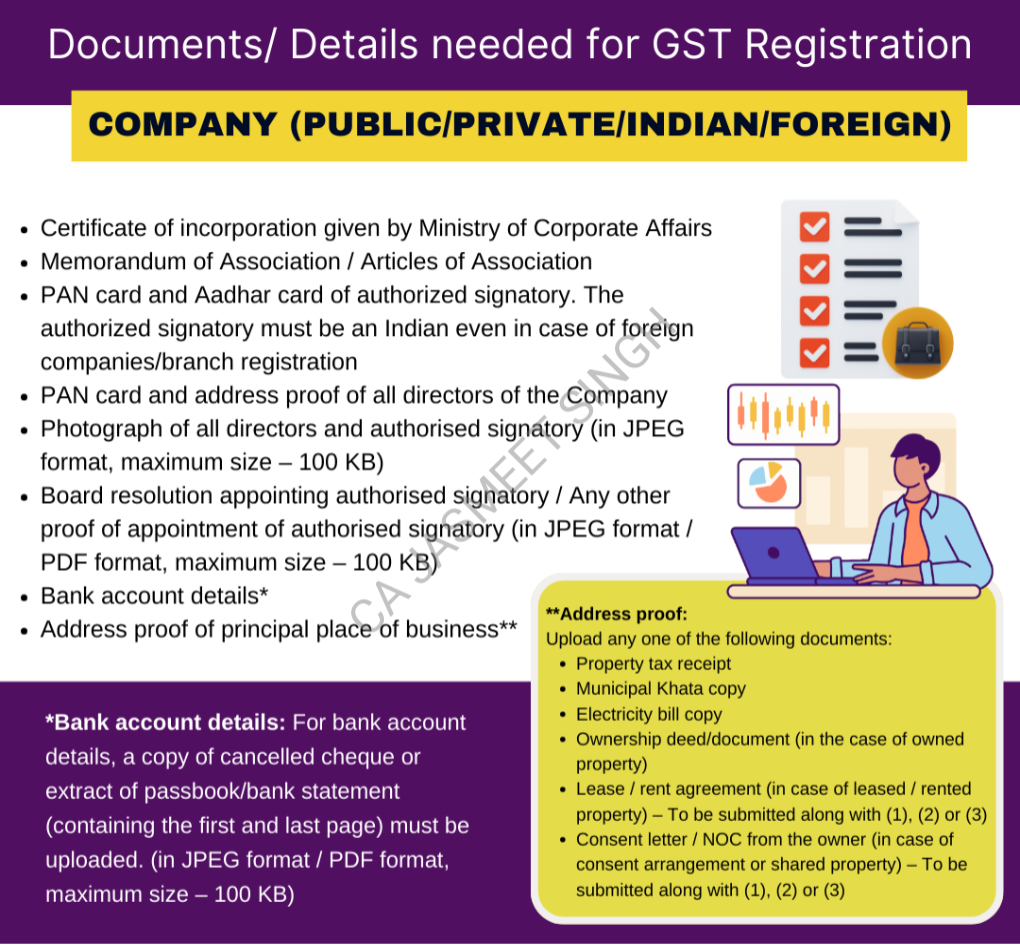

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

CA Chandan Shahi

Startups | Tax | Acc... • 12m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)