Back

Anonymous

Hey I am on Medial • 1y

One Tax Policy: A New Era of Taxation in India? What if income tax was the only tax you had to pay? A system where individuals pay a fixed percentage of their income as tax, and in return, they are exempt from all indirect taxes like GST and service tax. However, those who don’t pay income tax would still be subject to indirect taxes on goods and services. This could revolutionize tax compliance and incentivize more people to declare their income. But is it a sustainable model for India’s economy? Potential Benefits: ✅ Higher Compliance ✅ Simplified Taxation ✅ Reduced Burden on Businesses ✅ Exclusive Benefits for Taxpayers Possible Challenges: ⚠️ Revenue Balance ⚠️ Wealth Disparity ⚠️ Tax Collection Efficiency Would this "One Tax Policy" make taxation more efficient or create new challenges? Could this be India's future tax model? Let’s discuss! Drop your thoughts in the comments. ⬇️ #TaxReform #OneTaxPolicy #India #Economy

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreSai Vishnu

Income Tax & GST Con... • 11m

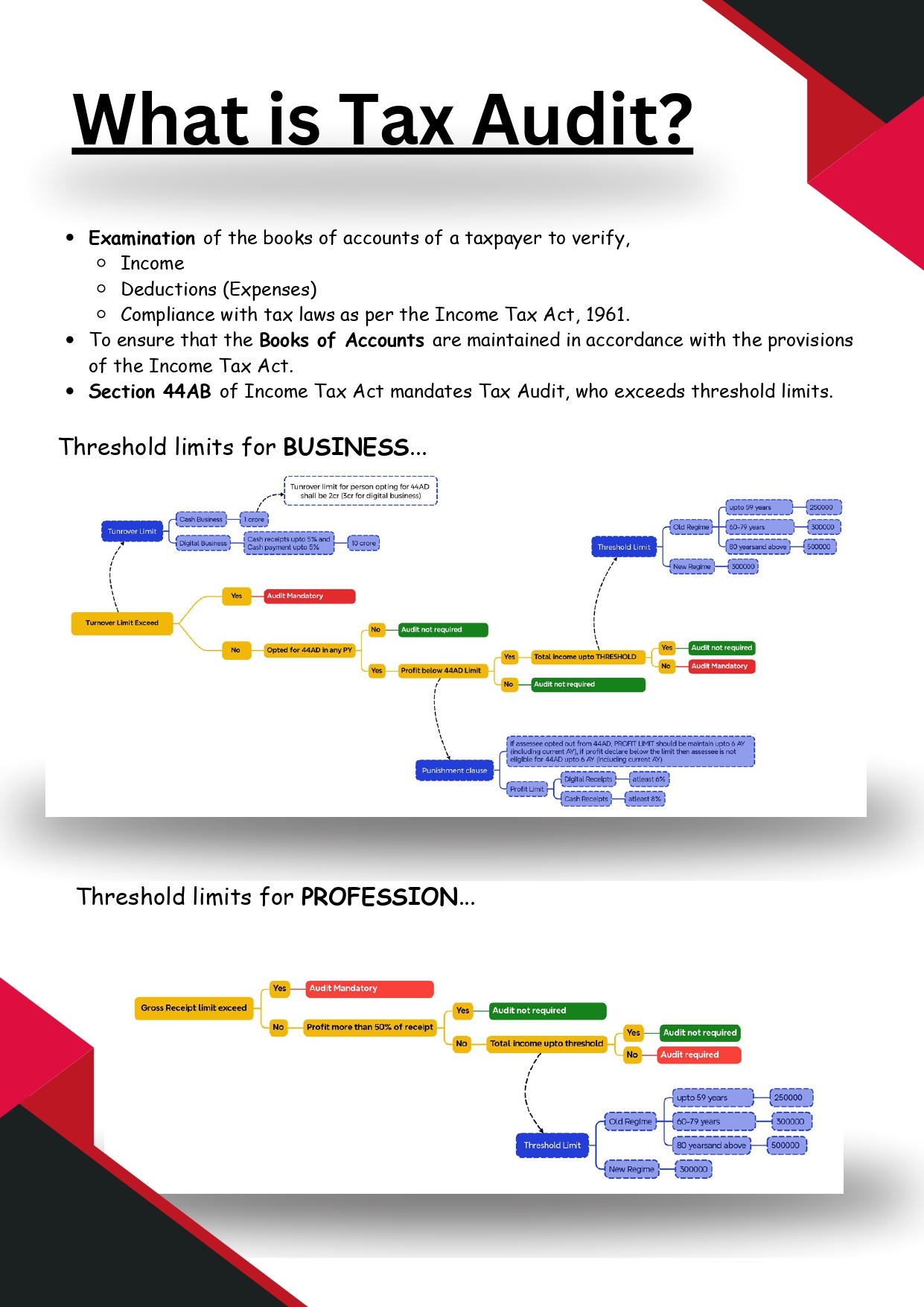

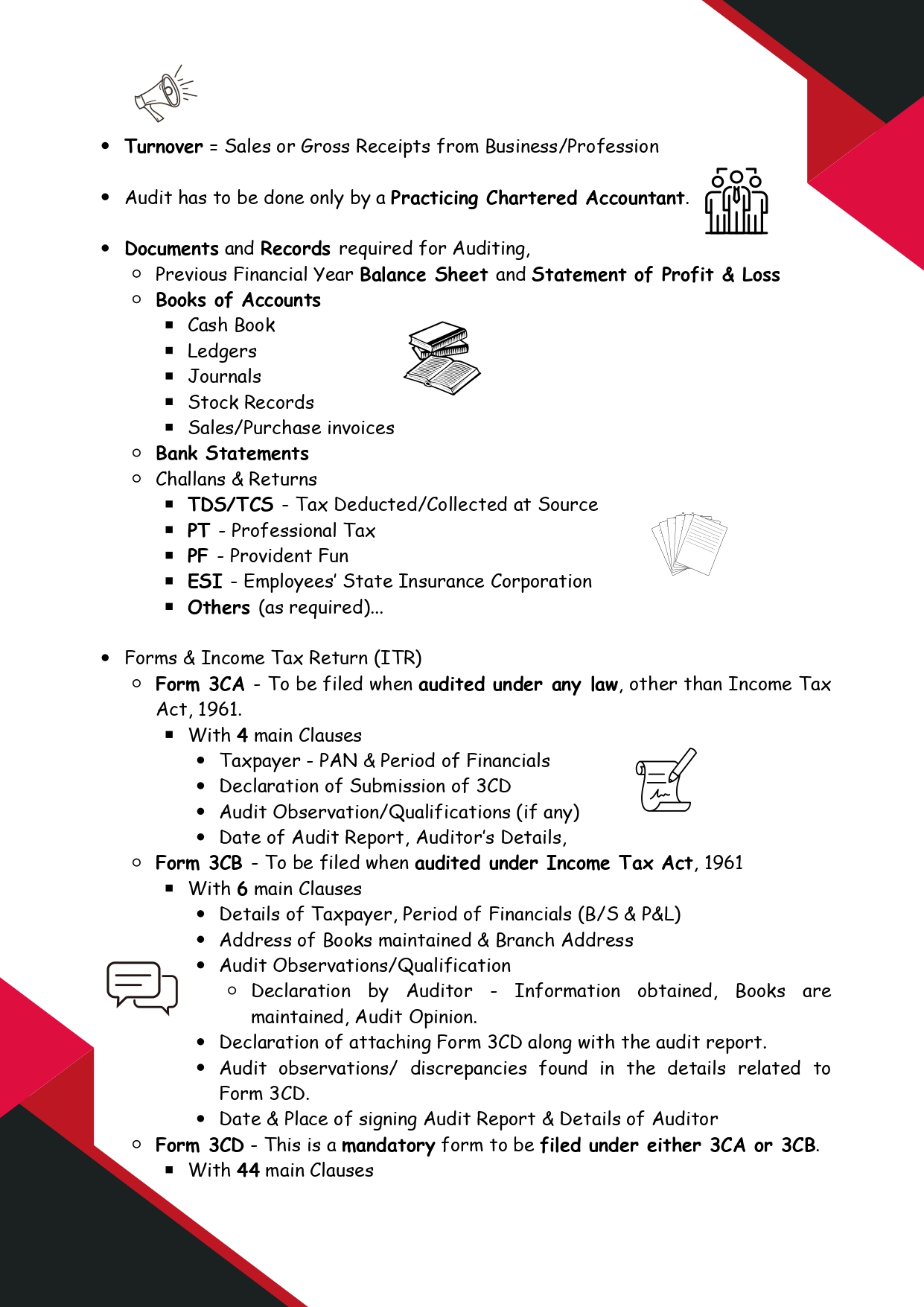

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreRishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)