Back

Rishabh Jain

Start loving figures... • 1y

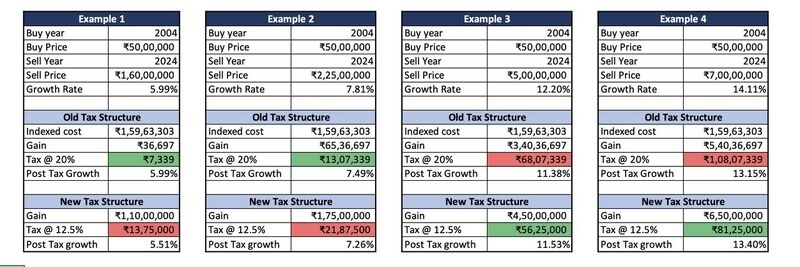

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreign investors scratching their heads. Lets discuss our views on Indian taxation policy?? It’s time we balanced revenue needs with a business-friendly vibe because no one wants to pop away potential investments.

More like this

Recommendations from Medial

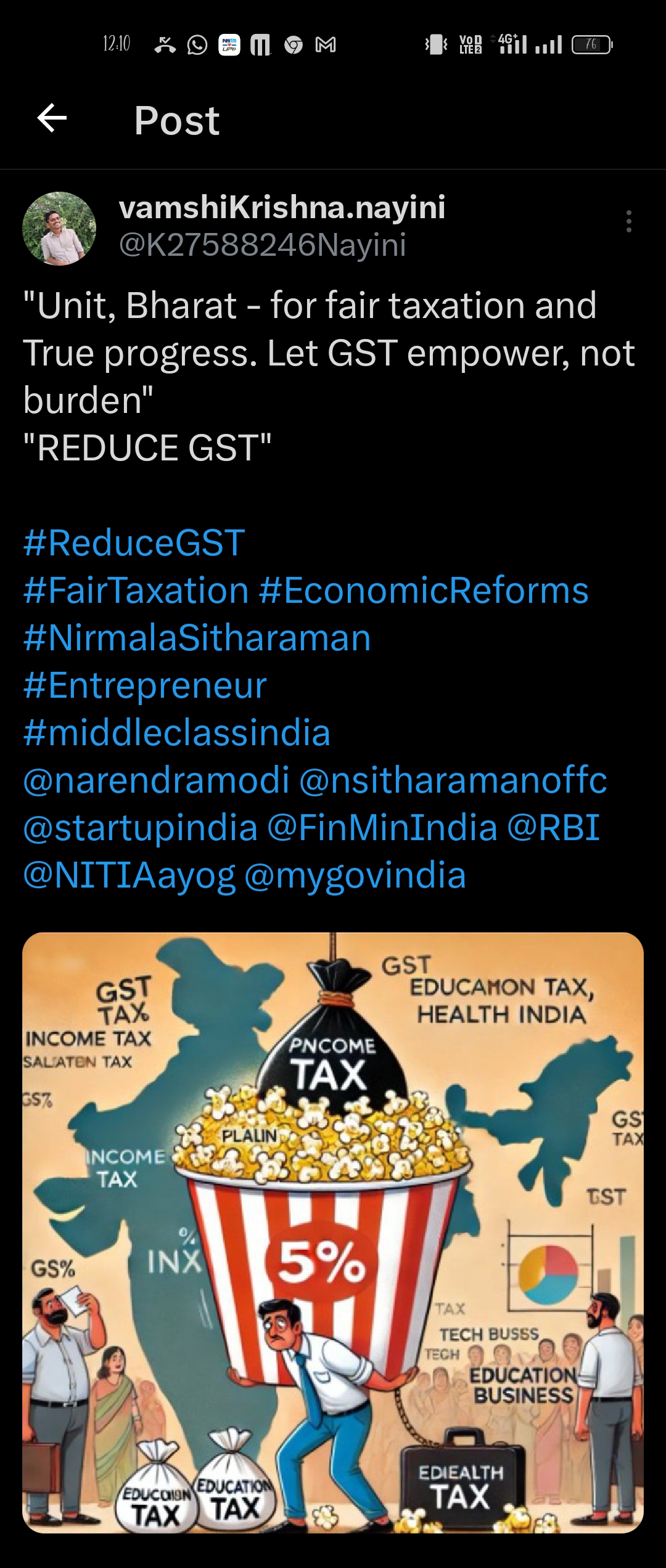

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

TREND talks

History always repea... • 1y

😠 Leave India, where they even tax your popcorn – statement from a startup founder has sparked a lot of aggressive discussions 💬 🚀 The founder, who returned to India after studying at top institutes in the U.S., set up a business employing 30 pe

See More

CA Jasmeet Singh

In God We Trust, The... • 9m

🚨 Breaking Tax News: The TCS Chronicles – April 2025 Edition 🚨 Brace yourselves, tax enthusiasts! The Finance Ministry has rolled out a new TCS (Tax Collection at Source) rule that's turning heads and emptying wallets. Effective April 22, 2025, ce

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)