Back

TREND talks

History always repea... • 1y

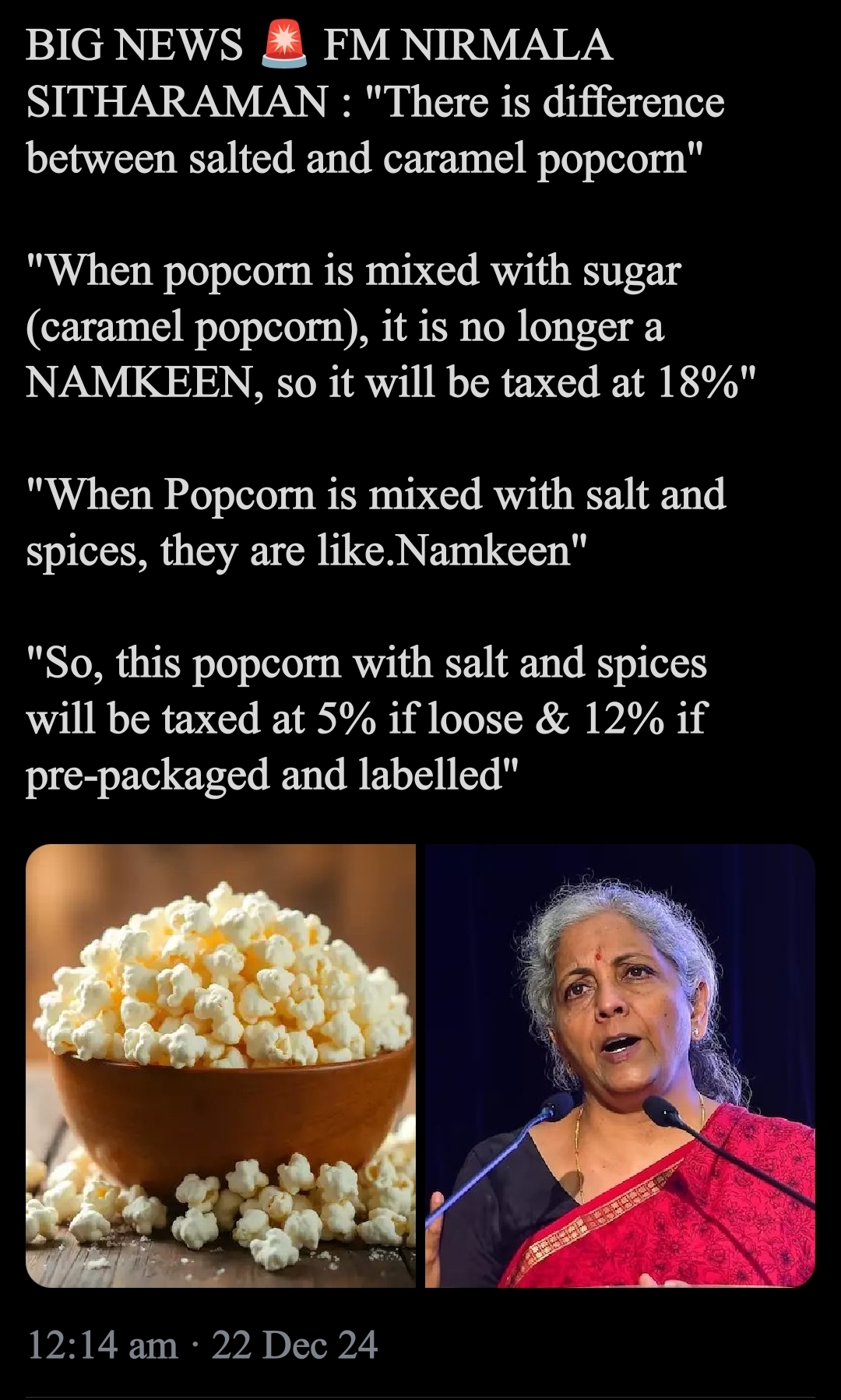

😠 Leave India, where they even tax your popcorn – statement from a startup founder has sparked a lot of aggressive discussions 💬 🚀 The founder, who returned to India after studying at top institutes in the U.S., set up a business employing 30 people with an average salary of ₹15 lakh. 💼 Despite securing substantial funding and growth, the founder voiced frustration with India's taxing system, especially the high GST rates on even the most basic items, like popcorn. 🍿 🥺 This statement highlights a larger issue – high taxes that burden both businesses and individuals. The founder's frustration isn't just with taxes on luxury items, but with the overall economic environment that hinders innovation and growth. 🚧 High-income Indians are particularly affected by taxes, which seem to limit their ability to grow wealth and contribute to the economy. 💰 🇮🇳 The recent debate around the GST rates on popcorn is just one example of how the tax system is seen as overly complex and sometimes unfair. This public outcry reveals deeper concerns about India's regulatory environment, which is still evolving. ⚖️ 👨💻 For entrepreneurs, this brings attention to the need for policy reforms that can foster a more business-friendly environment. India's growth could be accelerated if taxes were simplified and more focused on encouraging innovation, entrepreneurship, and high-paying jobs. 📈 🪨 As India continues to evolve economically, it's essential for policymakers to consider how these taxes and regulations are impacting businesses and individuals. More balanced and fair tax structures could go a long way in driving India's future success. 🚀 😢 What's your take on this matter ?

Replies (4)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreShubham Patel

•

E-Cell, IIT Bombay • 1y

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

Vamshi krishna Nayini

Hey I am on Medial • 1y

Plain popcorn: 5% GST. Salted popcorn: 12% GST. Caramel popcorn: 18% GST. This is the state of taxation in India! As a tech business owner, how can we thrive in an environment with such irrational policies? India is already ranked 1st worldwid

See More

Rishabh Jain

Start loving figures... • 1y

Is India Taxing Too Much Fun? (POPCORN TAX) India’s tax system has gone global thanks to the popcorn taxation buzz. While we’ve made strides with reforms like GST and corporate tax cuts, quirky rules and compliance hurdles can sometimes leave foreig

See More

Rohan Saha

Founder - Burn Inves... • 12m

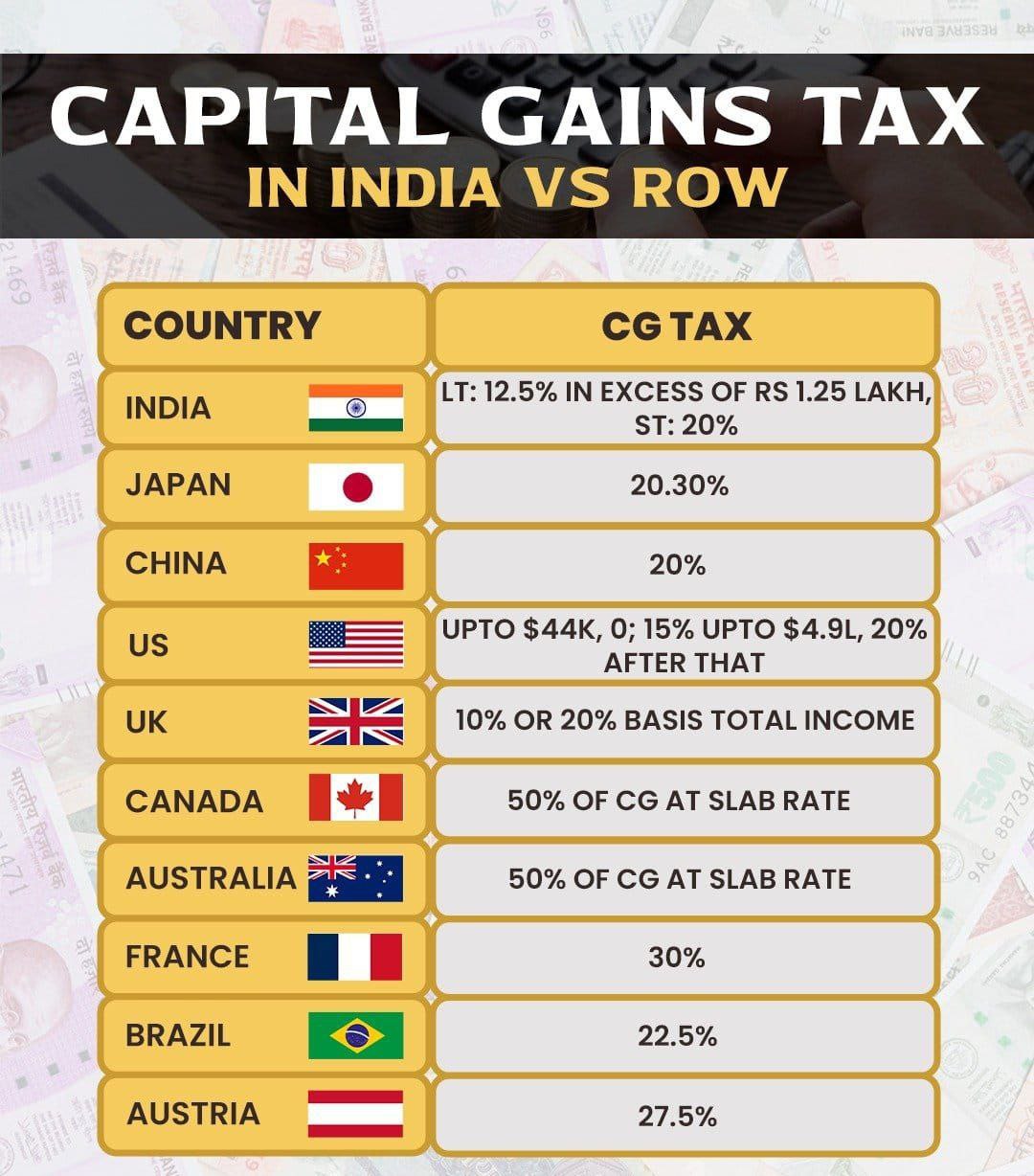

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Se

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)