Back

Rohan Saha

Founder - Burn Inves... • 11m

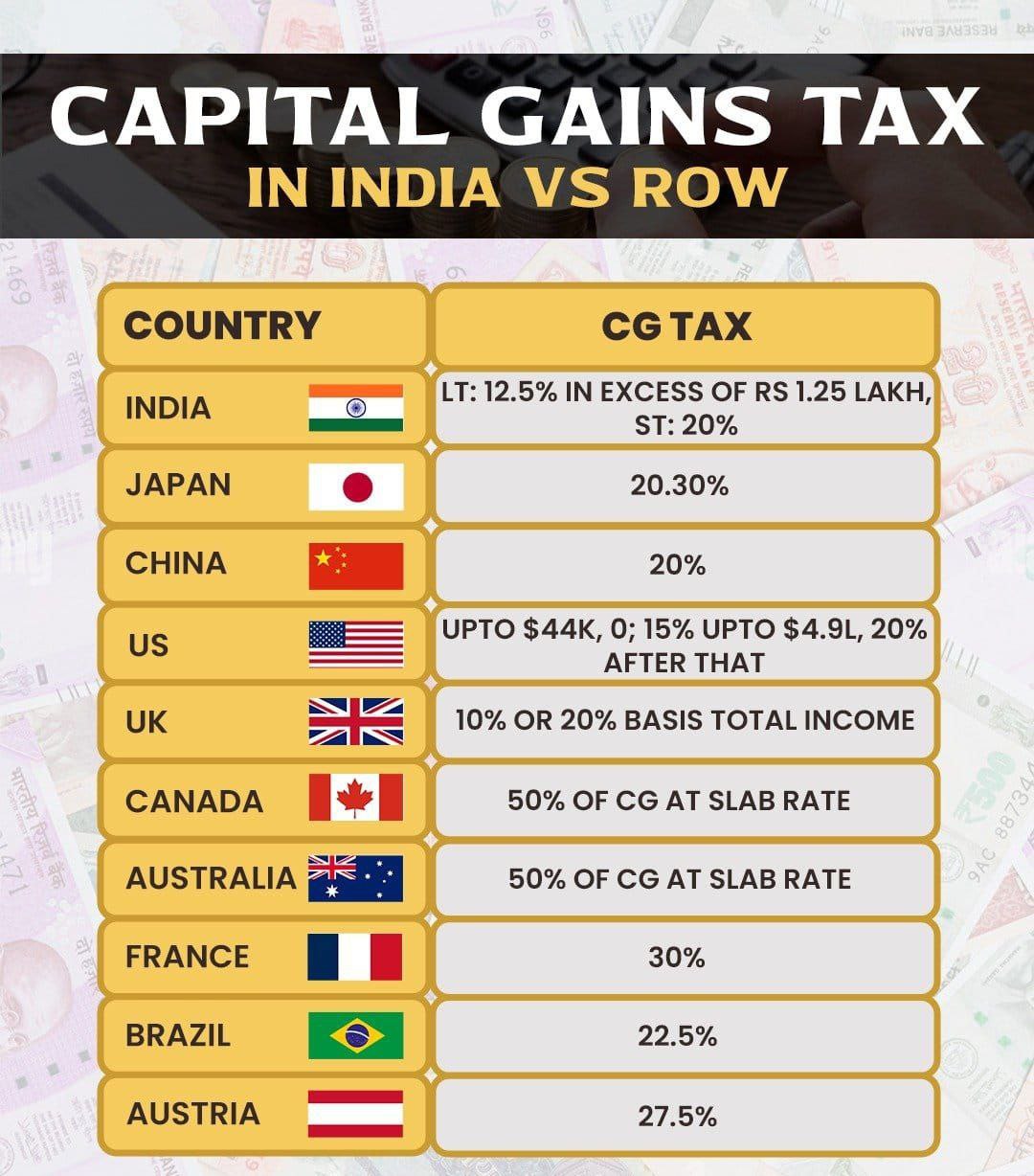

When comparing capital gains tax across different countries, India's main competitors are China and Brazil. Interestingly, both China and Brazil impose higher capital gains taxes than India. However, it's important to note that India also levies a Securities Transaction Tax (STT), which adds to the overall tax burden for investors.

Replies (1)

More like this

Recommendations from Medial

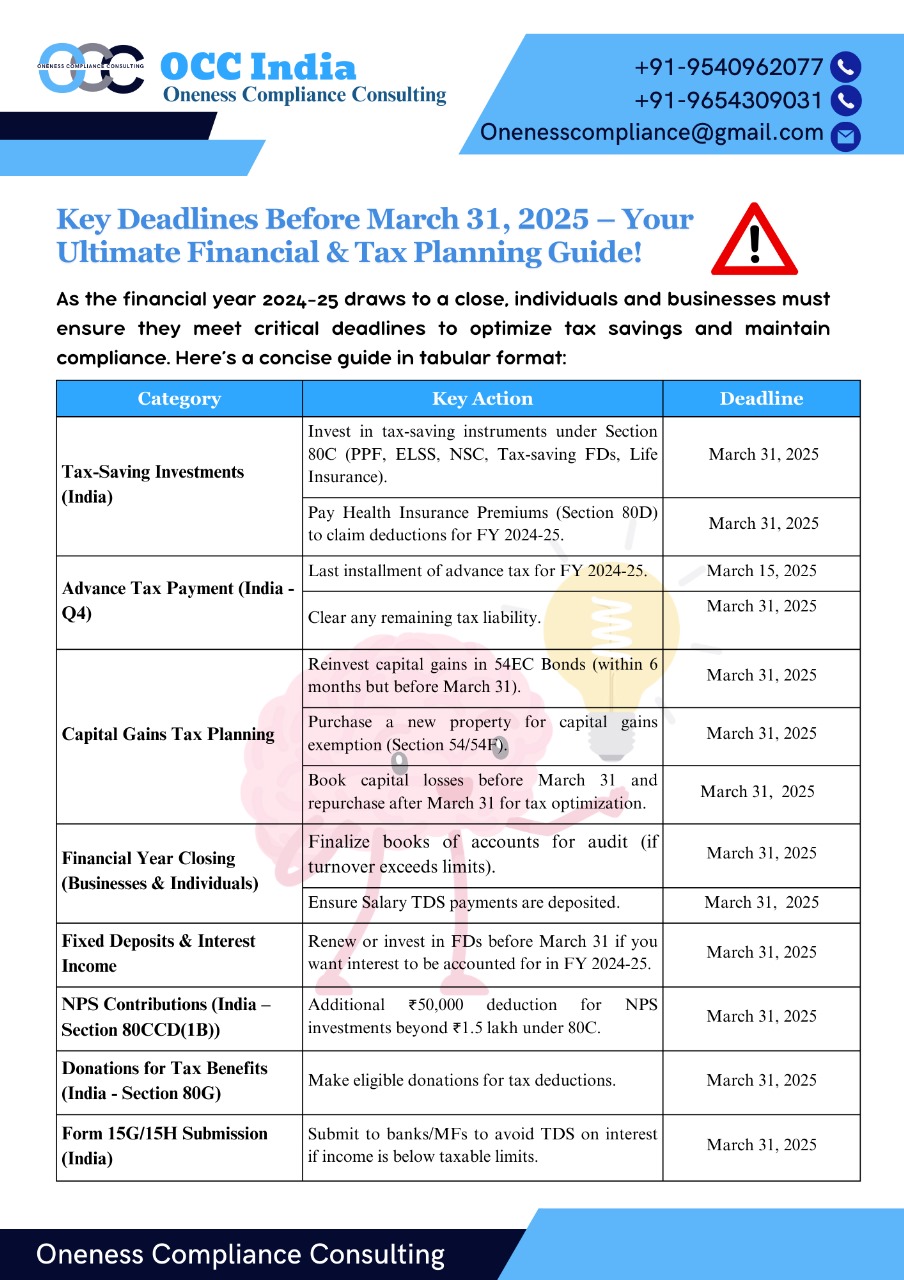

CA Kakul Gupta

Chartered Accountant... • 11m

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Rohan Saha

Founder - Burn Inves... • 1y

UBS has advised shorting the Indian rupee for now, which means FIIs may remain outside the Indian market for some time. Indian GDP growth is not looking impressive; at one point, China achieved over 10% GDP growth, while we have only managed to reach

See MoreAnirudh Gupta

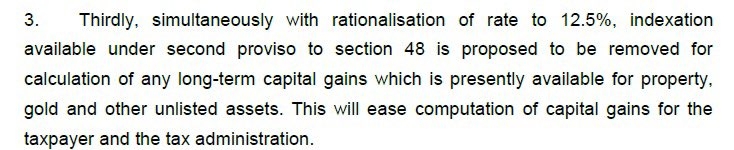

CA Aspirant|Content ... • 1y

Government is behaving mindlessly. What am I even seeing? The only benefit which reduces burden while an individual gets his capital gains is also taken away! Whenever you feel bad about making some dumb decisions just remember the budget 2024! No

See More

Linkrcap Studio

A digital news platf... • 18d

Shares of online brokerage platform Groww remain under pressure for the second straight trading session after the finance minister Nirmala Sitharaman proposed hiking securities transacation tax (STT) on F&O derivatives during her ninth Budget speech

See More

Ambalal Prajapati

Let's work together • 1y

Hey Guys Raymond demerging it's real estate business where shareholders are given 1 shars of every 1 share held in Raymond Do you know at the time of shares transferred it will not be considered for capital gains under income tax It will be consid

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)