Back

CA Rahul Nahata

•

Upwork • 7m

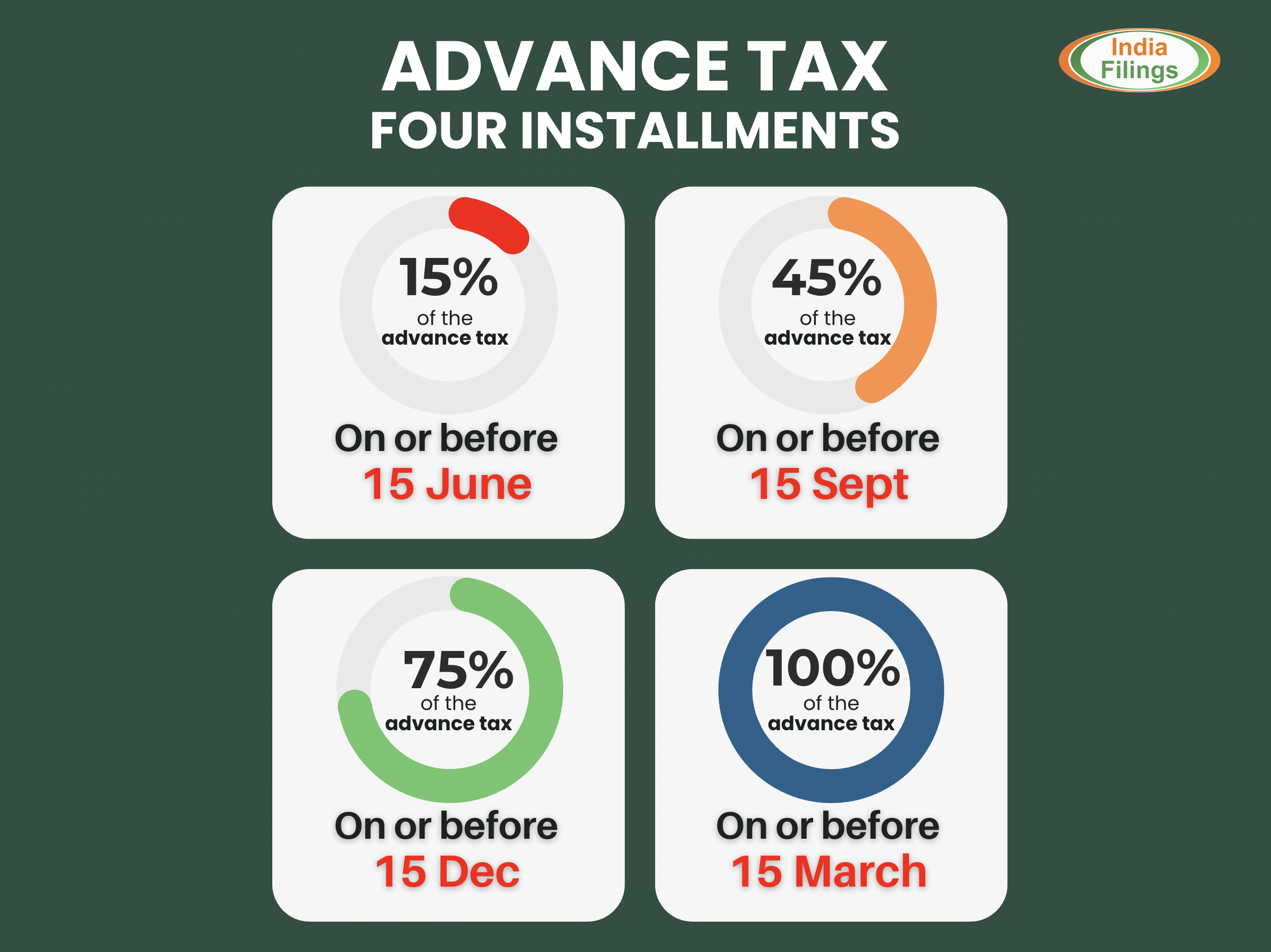

📌 Why Tax Planning is Crucial: A Real-Life Client Insight Tax planning is not just about saving taxes—it’s about avoiding penalties, improving cash flow, and gaining financial clarity. Here’s a recent case we handled that shows why timely tax planning matters: 🚨 What Went Wrong? One of our clients, with income from salary, business, and capital gains, waited until the last filing date for their Income Tax Return (ITR) without proper planning. The result: 💸 Interest on late tax payments: ₹45,000 (u/s 234B & 234C) 😰 Stress & cash flow crunch due to last-minute tax liability ❌ Missed deductions & exemptions 🔧 Our Solution: For FY 2025-26, we created a comprehensive tax planning strategy, including: 📊 Quarter-wise advance tax calculation 📝 Optimizing deductions (80C, 80D, etc.) and comparing with the new tax regime to choose the better option 💹 Planning capital gains with indexation benefits (for land & shares) 📈 Monitoring income from all sources to avoid surprises ✅ The Result: Zero late interest charges (advance tax well-planned) Cost savings of ₹45,000 Clear financial roadmap for the year 💡 Key Takeaway: Waiting till the last date to file your return = Paying extra! Start your tax planning for FY 2025-26 now and file your ITR for FY 2024-25 on time to avoid interest & penalties.

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 8m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreShubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See Morecalculus

Your Bottom Line Our... • 9m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreBharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)