Back

RootDotAi

From the ROOT to the... • 1y

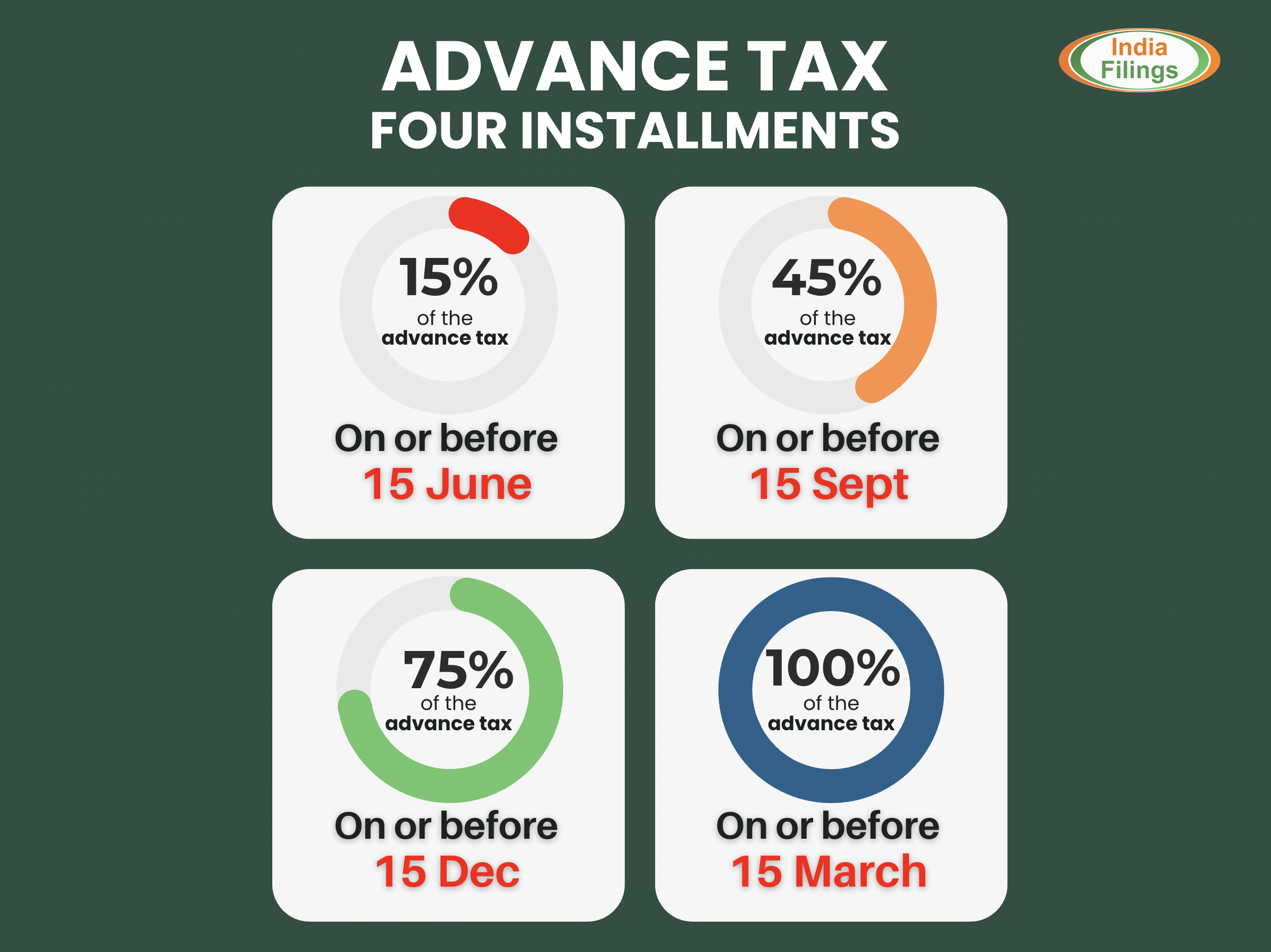

Key Things To do Before 31st March 2024 1 Invest in Tax Saving options Those who have opted for old tax regime must invest in tax saving options like ELSS MFs, Tax saver FDs, Life Insuarnace, PPF etc to claim deductions u/s 80C of the income tax act 2 Updated ITR Filing Deadline for FY 2020-21 (ITR-U) Taxpayers have until March 31, 2024, to file an updated income tax return for FY21 (AY 2021-22). This deadline offers a window for individuals who missed filing their returns for FY 2020-21 or need to rectify any errors in their previous filing 3 FASTag KYC Deadline: In response to issues faced by FASTag users, the NHAI extended the deadline for updating FASTag KYC details to March 31, 2024. FASTag users should ensure their KYC details are updated within this timeframe. 4 Tax Loss Harvesting Investors can use the strategy of Tax Loss Harvesting to pay lower or no capital gains tax on sale of shares / mutual funds

More like this

Recommendations from Medial

calculus

Your Bottom Line Our... • 8m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreRabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreAshutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)