Back

RV Dhameliya

Student • 8m

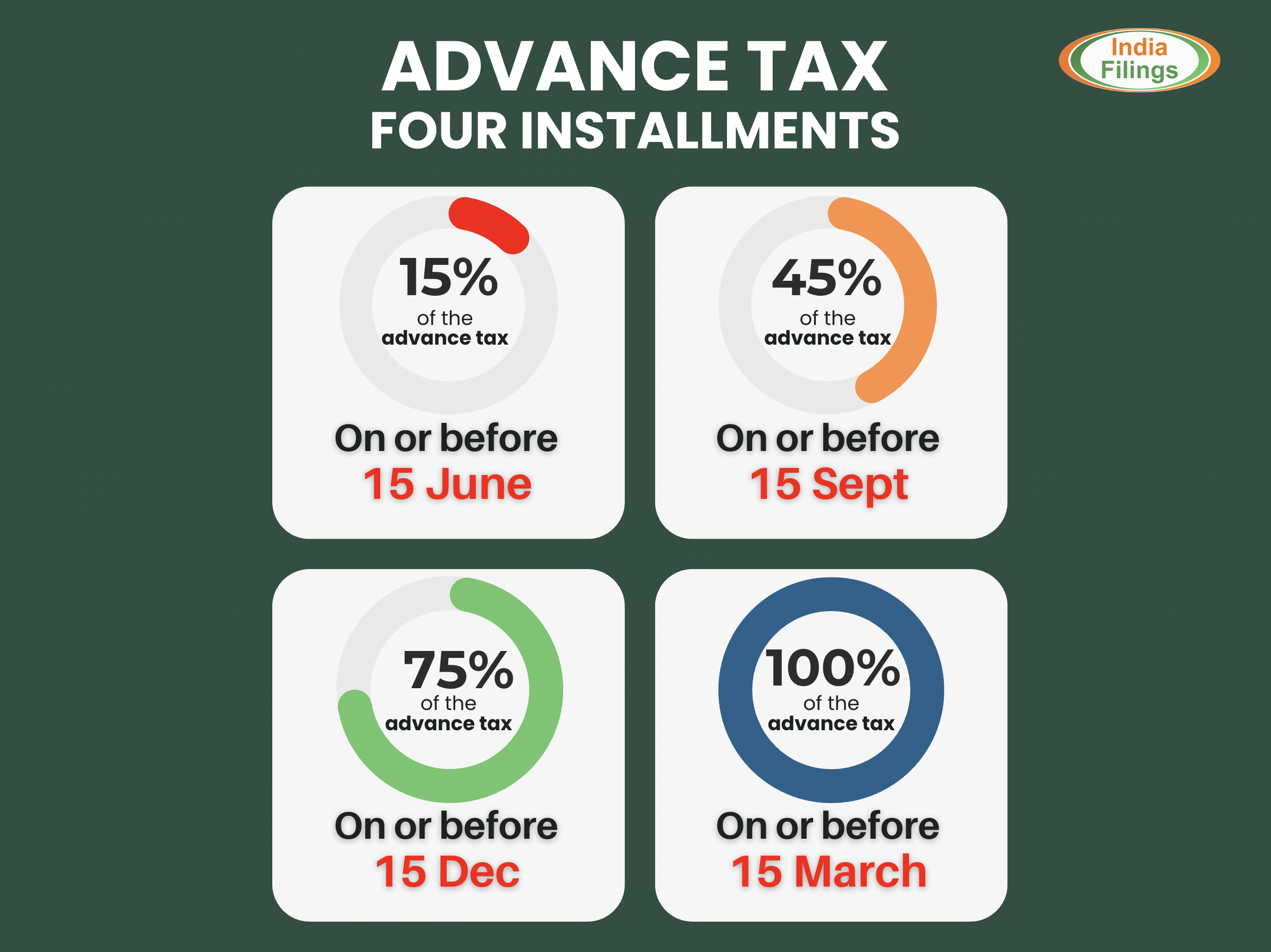

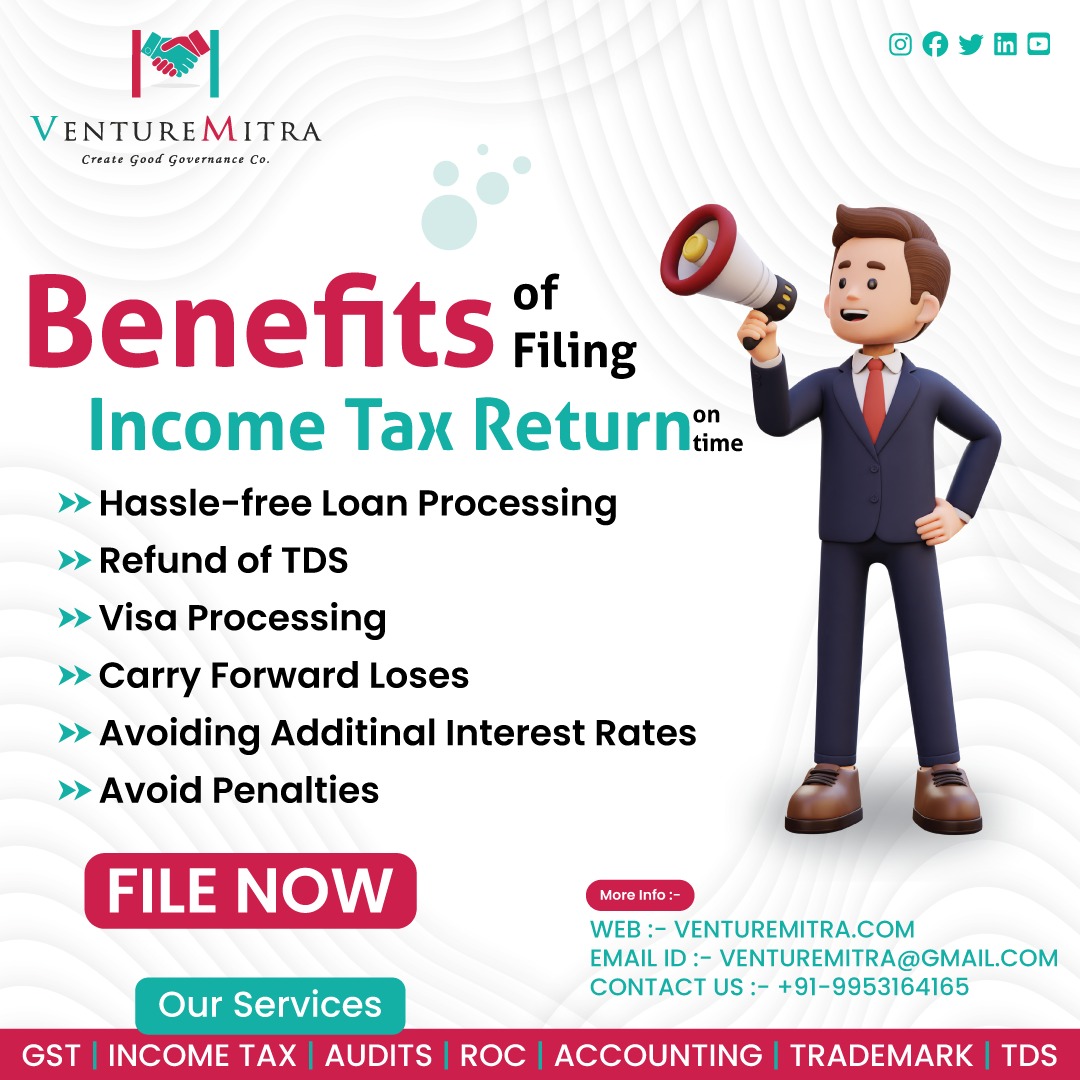

🧾 TDS, Advance Tax & Refund — Simple Summary TDS (Tax Deducted at Source) is tax cut before you receive your income (like salary, interest, freelance payments). It’s paid to the government by the one who pays you. Advance Tax is tax you must pay in advance, during the year, if your total tax is ₹10,000 or more (mainly for traders, freelancers, or side income earners). If more TDS is deducted than required, you can claim a refund by filing your Income Tax Return (ITR). If your income is ₹3,00,000 with no deductions, you’ll pay tax on ₹50,000 → Tax = ₹2,500. If your company deducted ₹5,000 as TDS, you’ll get a ₹2,500 refund after filing ITR. Use Form 16, 26AS, and AIS to check your TDS.

More like this

Recommendations from Medial

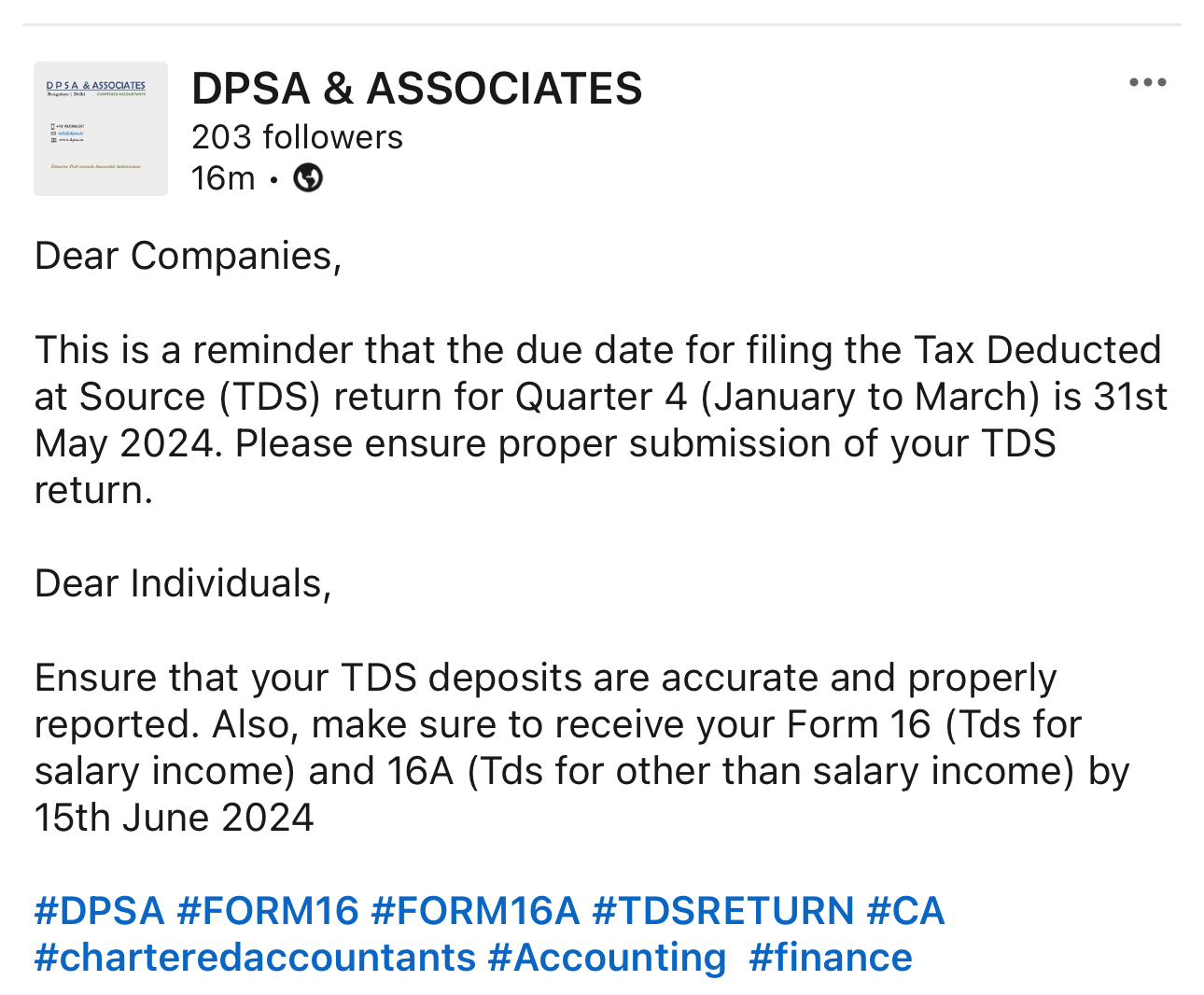

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS d

See More

calculus

Your Bottom Line Our... • 8m

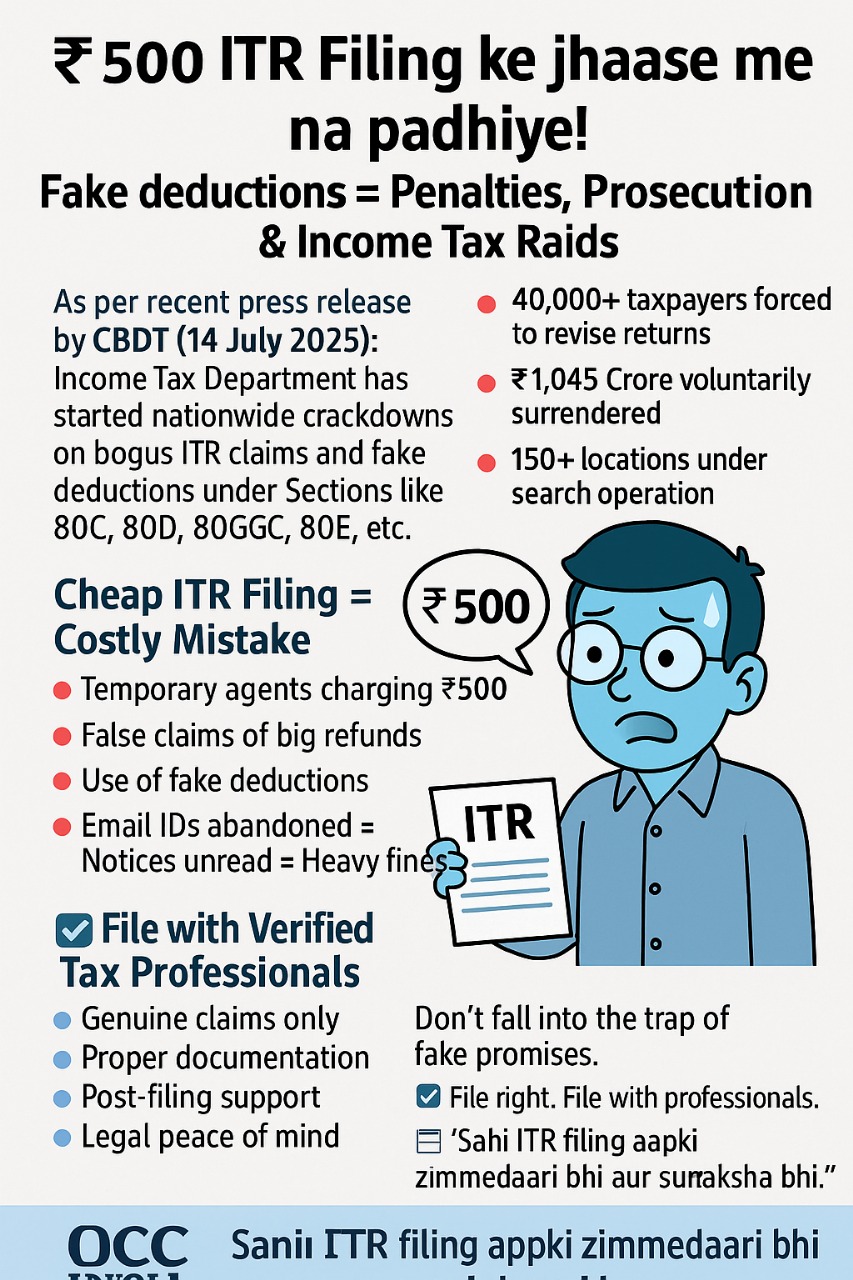

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreRabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreRecouptax Consultancy Services

Onestop solution for... • 10m

Hi Guys, Does anyone need help with book keeping, accounting, Gst filing/TDS filing services. We are offering affordable and reliable services for Individual Tax Filings, Book keeping, Accounting, GST & TDS filings and all other registrations.

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)