Back

CA Kakul Gupta

Chartered Accountant... • 7m

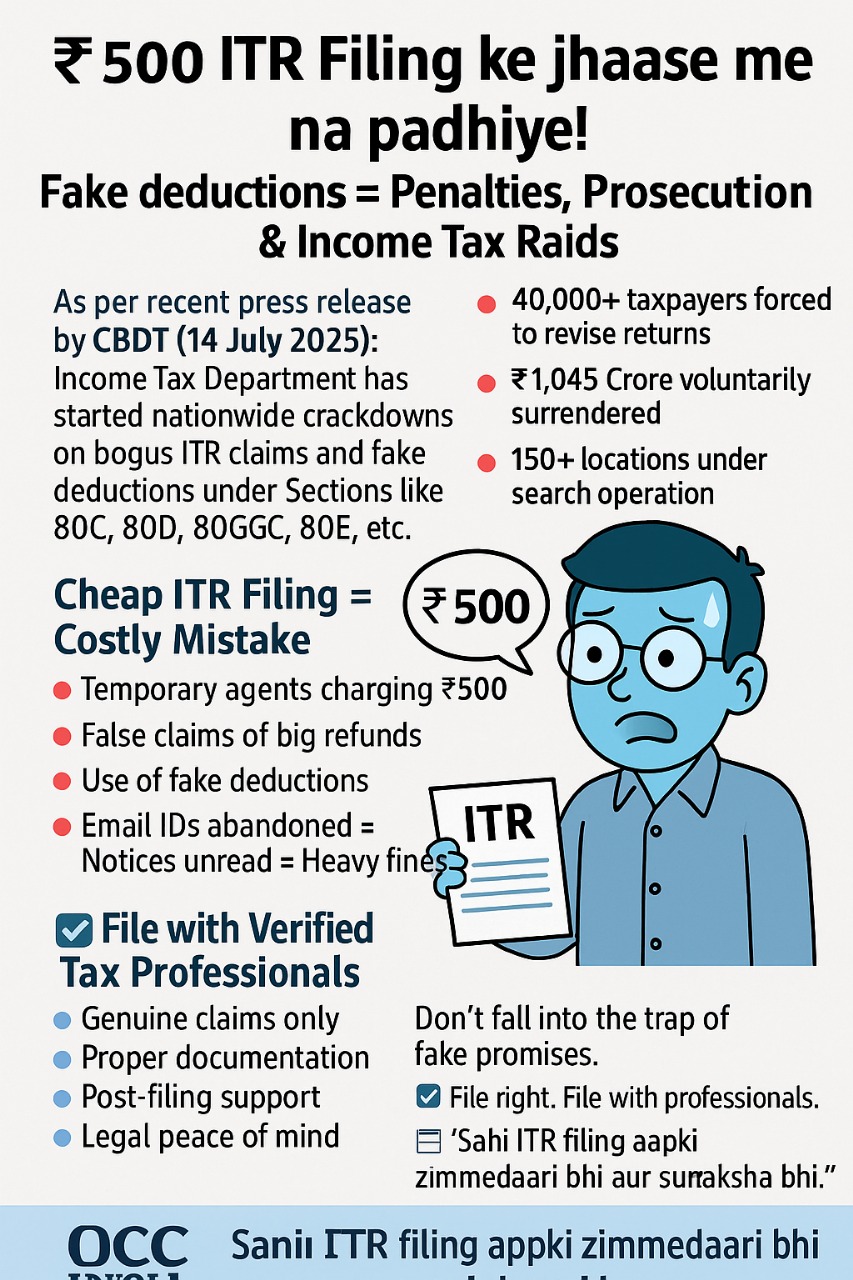

don't file your ITR just for TDS refund!

Reply

5

More like this

Recommendations from Medial

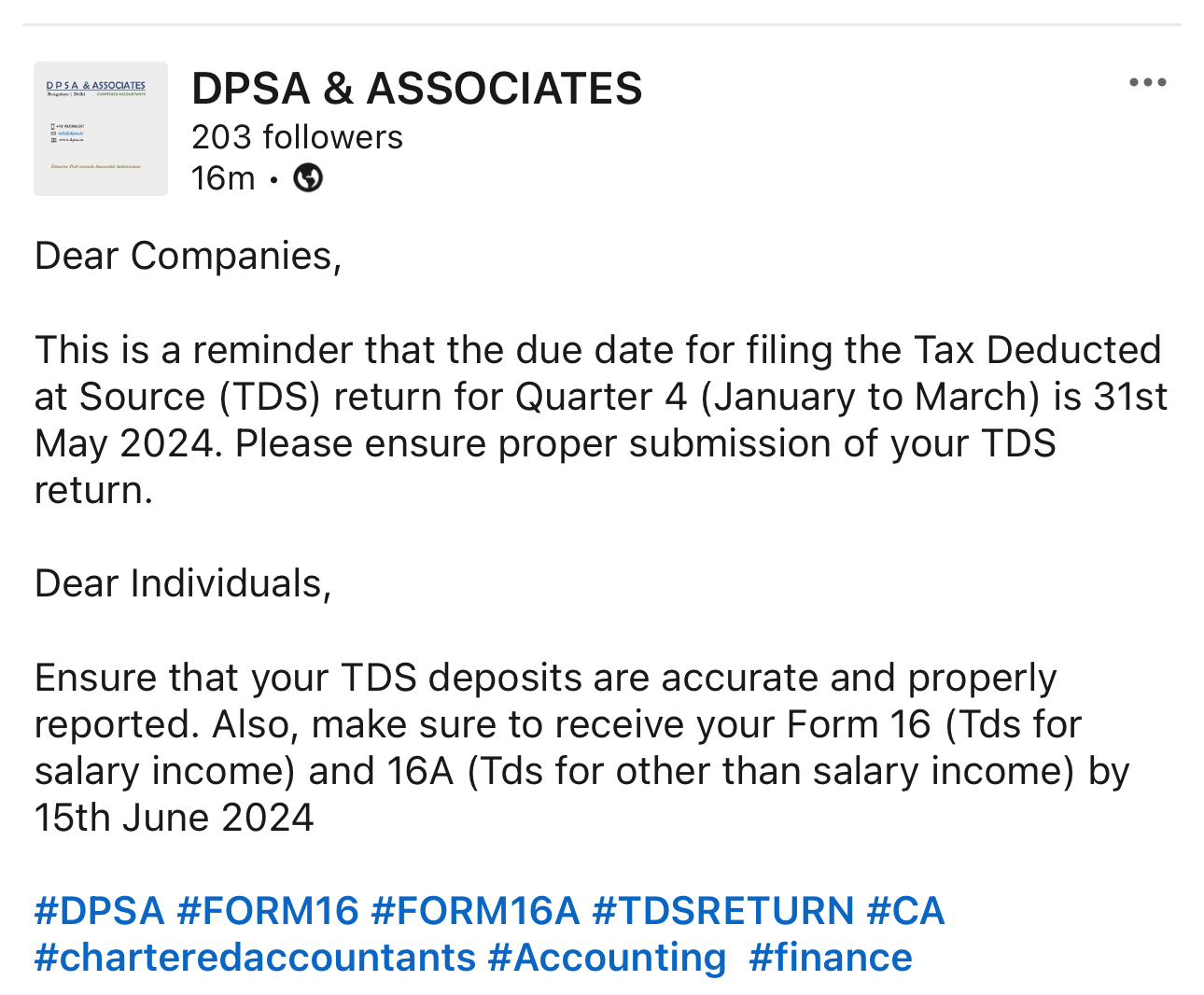

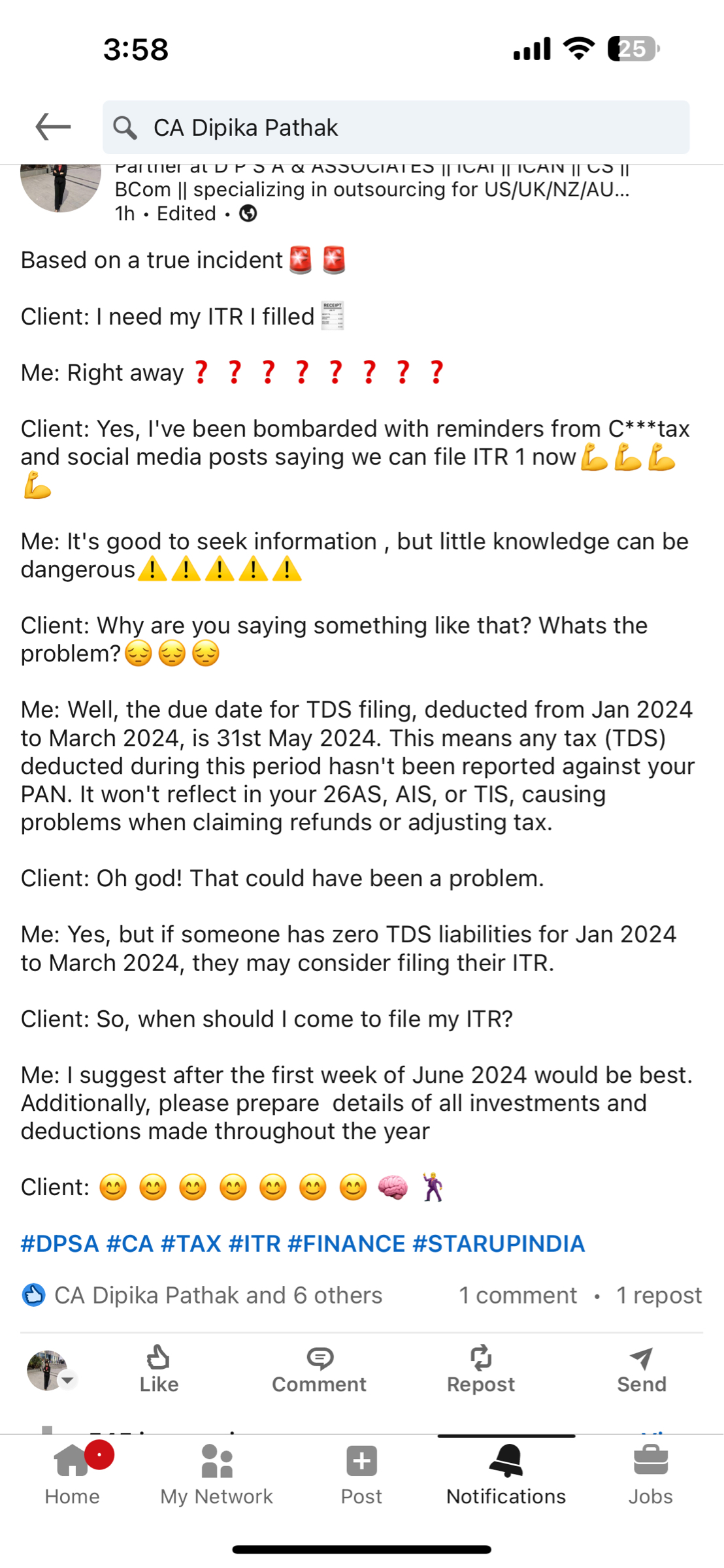

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS d

See More

Reply

9

Premsukh kumawat

Hey I am on Medial • 6m

Proudly sharing Bizrelievo's upcoming launch on July 27th! Your Partner for Seamless Business & Tax Compliance. What is Bizrelievo? It's your dedicated partner for comprehensive business incorporation, meticulous ongoing compliance, and expert in

See More

Reply

3

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)