Back

CA Saloni Jaroli

Grow & Glow • 11m

Hey, Come fast 31st March is near about & it's time to take all your refund. Be on time, file your income tax return as soon as possible.

More like this

Recommendations from Medial

Mehul Fanawala

•

The Clueless Company • 1y

When the income tax return filing date is near, the income tax department goes into full marketing mode to remind taxpayers to file on time. Guess what? Even they have targets and quotas like our marketing and sales teams! 🎯 Imagine the tax offic

See More

CA Dipika Pathak

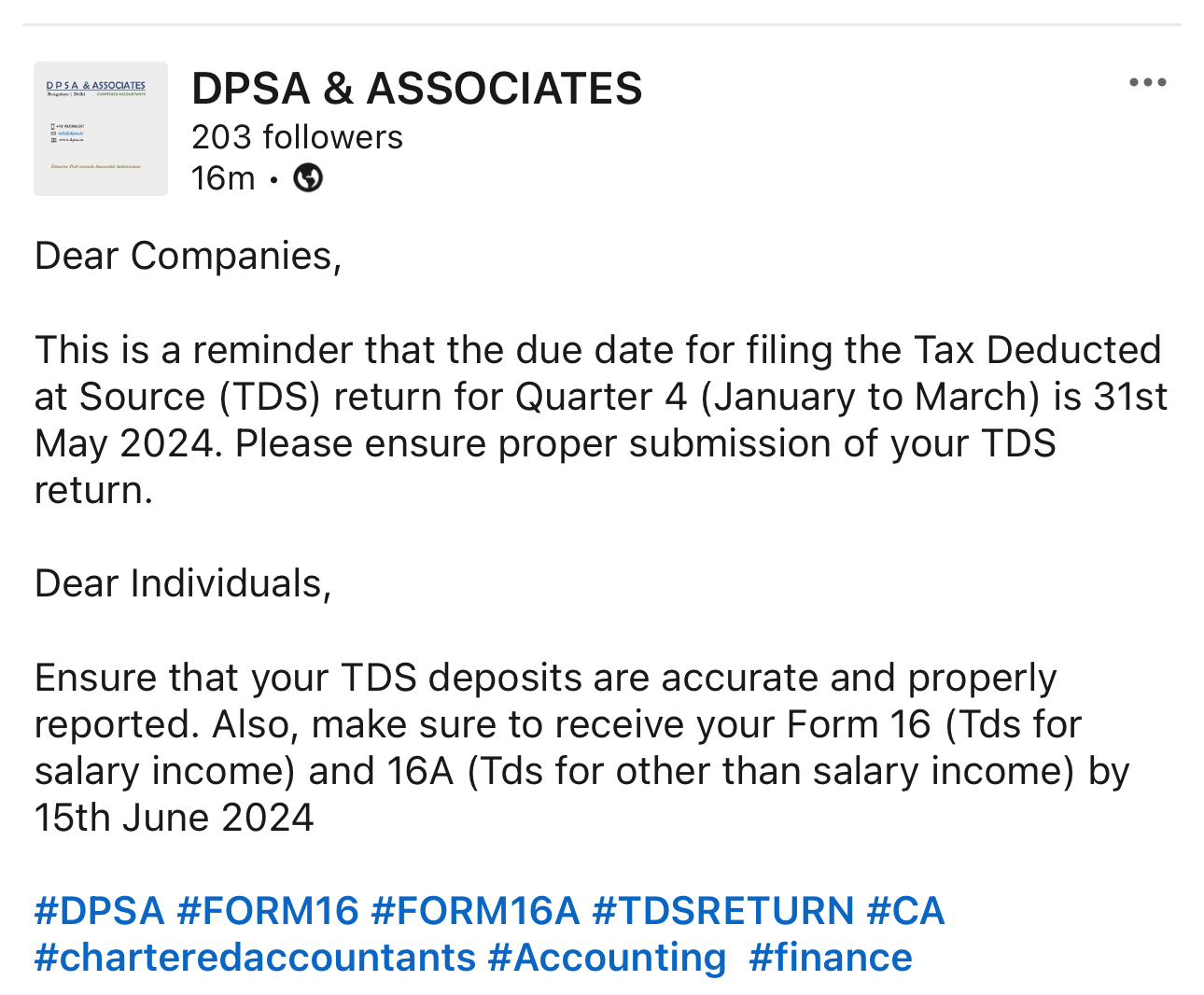

Partner at D P S A &... • 1y

Dear Companies, This is a reminder that the due date for filing the Tax Deducted at Source (TDS) return for Quarter 4 (January to March) is 31st May 2024. Please ensure proper submission of your TDS return. Dear Individuals, Ensure that your TDS d

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)