Back

Arijit Ray

•

Twilio • 1y

Happiness is: Getting approached by your crush ❌ Receiving your income tax refund after filing ITR ✅ PS: File your ITR before the month end guys 🙃

Replies (2)

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See Morecalculus

Your Bottom Line Our... • 8m

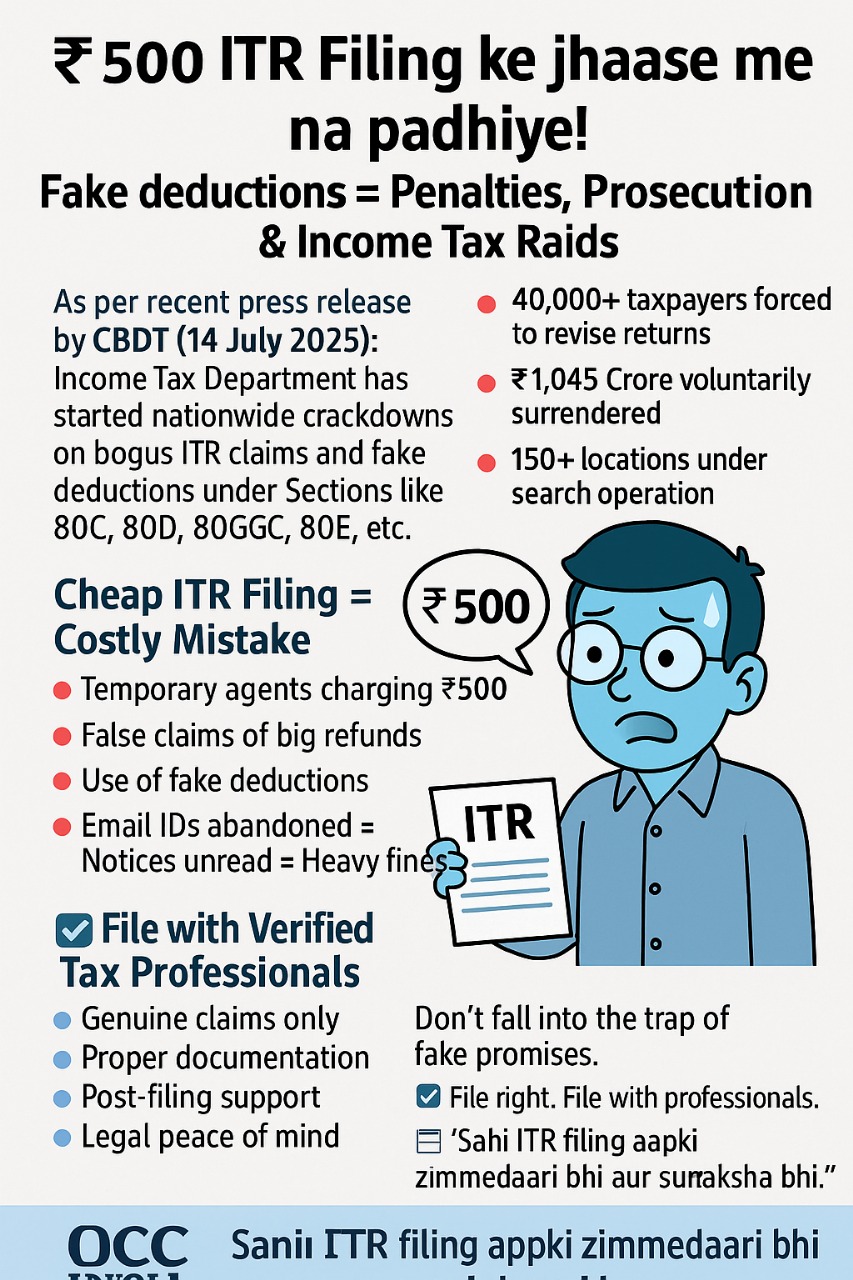

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreMock Rounds

Hey I am on Medial • 8m

Hey hey! 👋 Got an interview coming up? Or just wanna crush your next one? *Mock Rounds* is your secret weapon — 1:1 mock interviews with a real person. ❌ _*No AI*_ ❌ _*No boring courses*_ ⚡️ No scripts, all real talk ⚡️ Feedback that helps you win

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)