Back

calculus

Your Bottom Line Our... • 8m

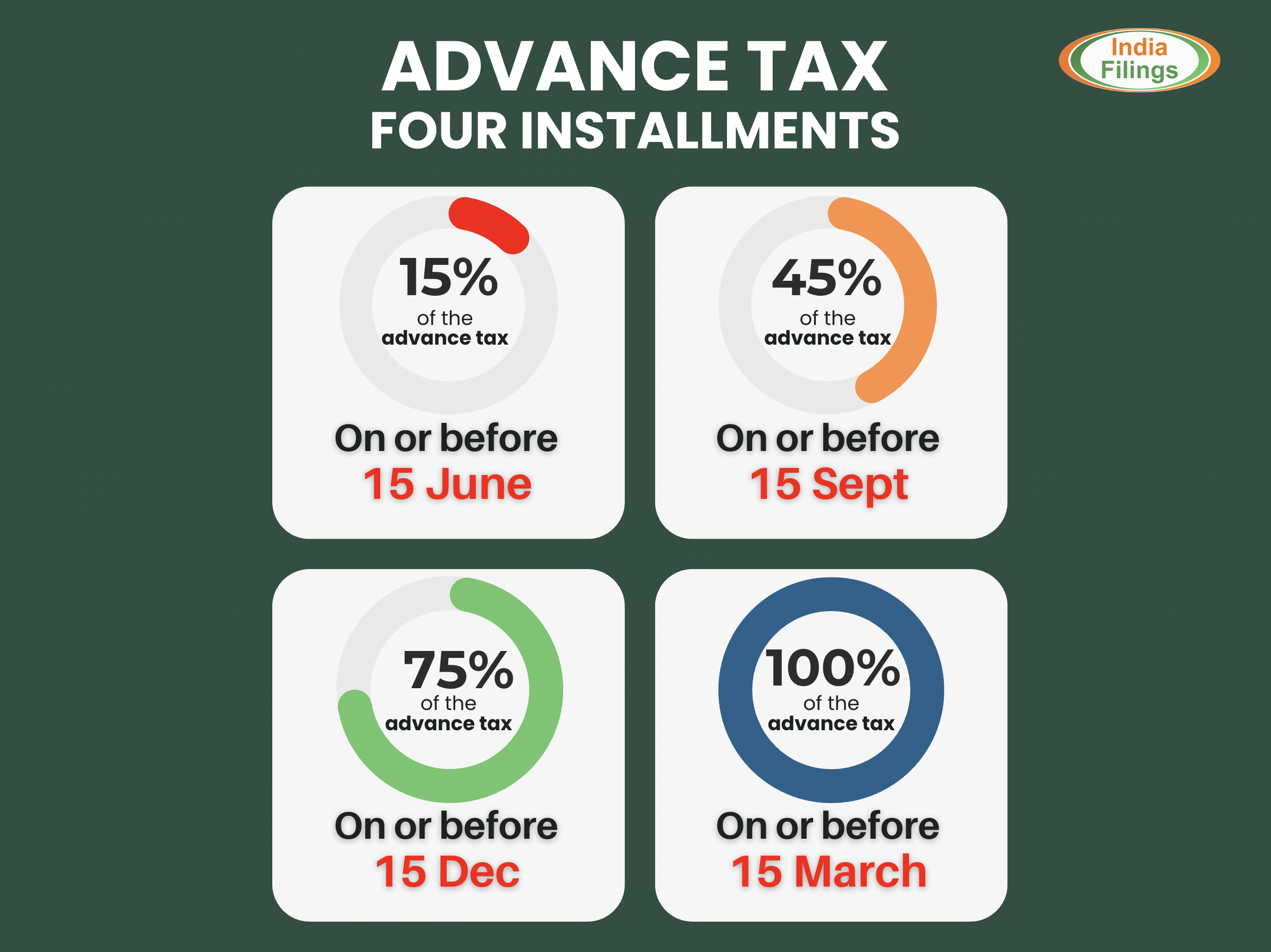

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️ Timely filing allows you to carry forward losses and ensures smoother loan/visa processing. 📅 Due Date: 15th September 2025 (for most individuals) 📄 Keep handy: PAN, Aadhaar, Form 16, bank statements, and investment proofs. 💡 Whether you're salaried, self-employed, or a freelancer – file your ITR on time. 🛠️ Need help? Contact a tax consultant or use trusted online portals!

More like this

Recommendations from Medial

Rabbul Hussain

Pursuing CMA. Talks... • 7m

Income Tax Update for AY 2025-26 Attention Taxpayers! Income Tax Department ne announce kiya hai ki Excel Utilities for ITR-2 and ITR-3 ab officially live hain! Yeh utilities Assessment Year 2025-26 ke liye hai, aur aap inhe portal se download ka

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Kakul Gupta

Chartered Accountant... • 9m

Kind Attention Taxpayers! CBDT has decided to extend the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025 This extension will provide more time due to significant revisions in ITR forms, system developm

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)