Back

Soumyadip Dey

Hesitation is Defeat... • 1y

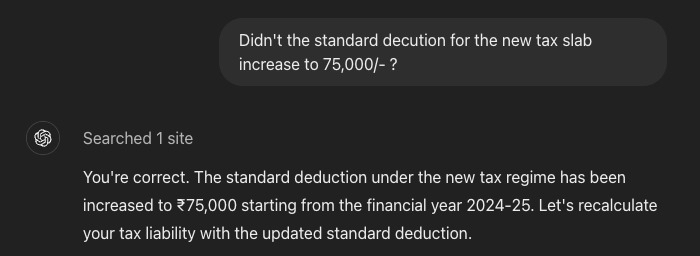

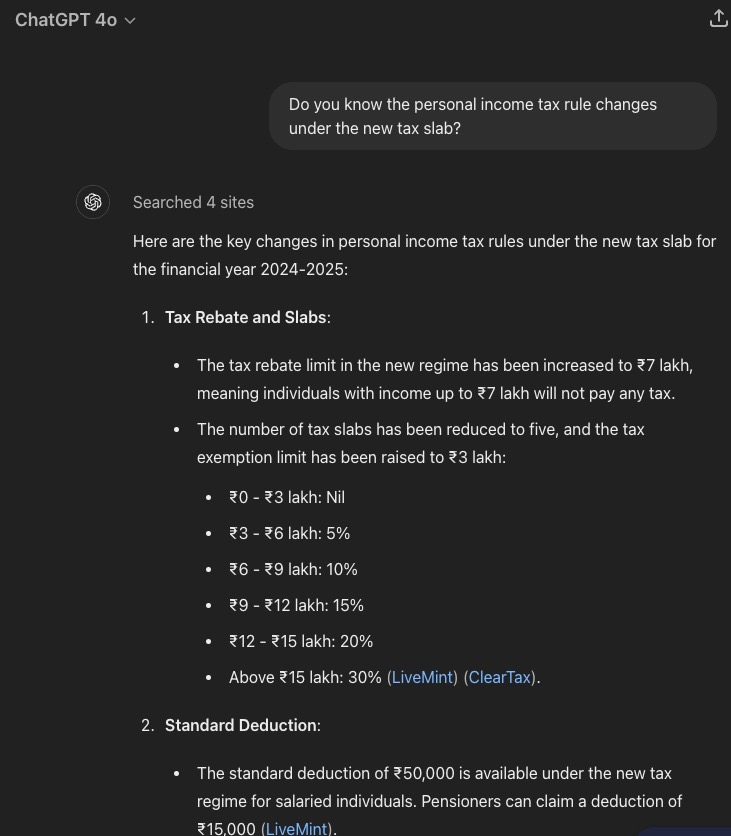

Why some people are saying that "this is the power of meme"?? context: budget announcement 2025 by FM (income tax exemption limit)

Replies (1)

More like this

Recommendations from Medial

calculus

Your Bottom Line Our... • 9m

📢 Income Tax Filing Awareness – Don’t Miss the Deadline! ✔️ Filing your Income Tax Return (ITR) is mandatory if your annual income exceeds the exemption limit. ✔️ It helps you avoid penalties, claim refunds, and build a strong financial record. ✔️

See MoreMuttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

India's Budget 2025-26: Sectoral Impacts Finance Minister Nirmala Sitharaman presented the annual budget focusing on increasing middle-class spending, promoting inclusive development, and encouraging private investment. Consumer goods and automaker

See More

B Yashwanth

Customer success ent... • 1y

Just invest 10 sec in below 👇 calculator to calculate your tax as per new regime 2025 Tax Calculator comparison as per budget 2025! https://tax.pythontrader.in/ Calculate ur tax as per new proposed slab rates .. just enter your income in this ..

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreAmbalal Prajapati

Let's work together • 1y

https://www.businesstoday.in/latest/corporate/story/godrej-family-begins-formal-division-of-group-to-start-divestments-soon-report-426069-2024-04-19 their sonnwill get exemption from heavy capitals gain u/s 47(iii) of Income tax act 1962 Informatio

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)