Back

Samaksh Singh

Content Writer • 11m

India Union Budget 2025 Highlights 🚀 Taxation Reforms: ✅ Income tax exemption limit raised to ₹12 lakh (up from ₹7 lakh) ✅ Revised tax slabs for incomes above ₹12 lakh to simplify structure and reduce burden 🌾 Agriculture Boost: ✅ New 6-year mission to enhance pulse production ✅ Support for cotton farmers to improve yields and competitiveness 🏡 Middle-Class Support: ✅ Reduced customs duties on essential items like cancer drugs and furniture ✅ Measures to facilitate the purchase of second homes 💡 Innovation & Startups: ✅ ₹20,000 crore allocated for private sector-driven R&D ✅ Support for startups to foster innovation ⚡ Infrastructure & Energy: ✅ Capital expenditure set at ₹11.21 trillion to drive growth ✅ Mission to develop 100 GW of nuclear power by 2047 👷 Gig Economy Support: ✅ Identity cards for gig workers to improve access to healthcare and welfare The Budget 2025 aims to simplify taxes, support farmers, health. #UnionBudget2025 #EconomicGrowth #IndiaBudget #Finance

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreK Shreenathan Nedunghadi

An professional with... • 1y

The Union Budget for 2025-26, presented by Finance Minister Nirmala Sitharaman, introduces significant reforms aimed at stimulating economic growth and providing relief to the middle class. Key highlights include: Income Tax Reforms: Revised Tax Slab

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreSanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

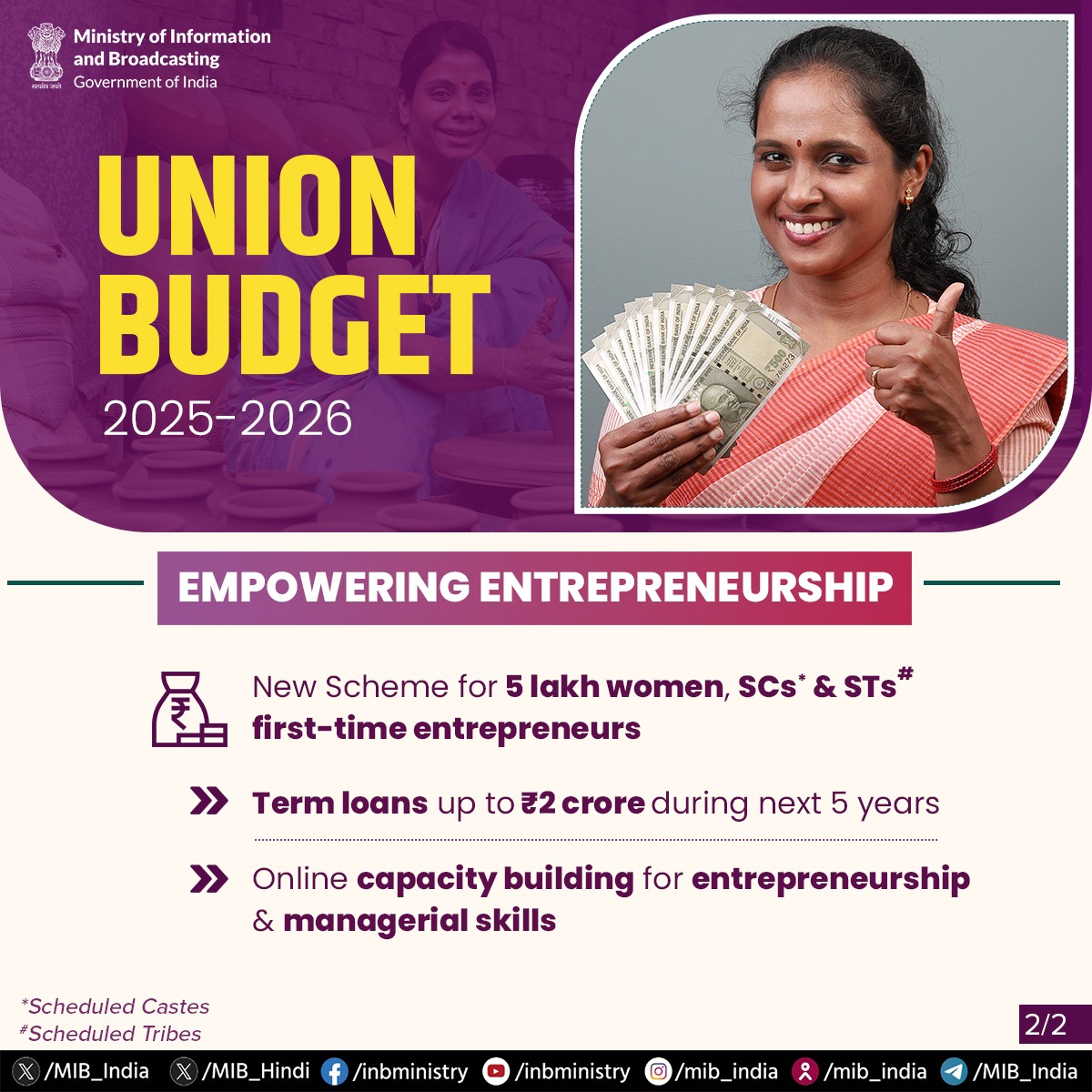

Setting up New Funds with an additional ₹10,000 crore, in addition to existing government contributions of ₹10,000 crore. For 5 lakh first-time entrepreneurs, including women, Scheduled Castes and Scheduled Tribes to be launched #UnionBudget2025

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreMohammed Zuber Ahamad

Founder @Techzipe | ... • 7m

BIG WIN for Startups in India! 🇮🇳 The Govt is offering ₹0 Income Tax for 3 Years to eligible startups! 🙌 ✅ Boost for innovation ✅ Support for entrepreneurs ✅ Massive growth opportunity If you’re building the future, this is your moment. 🔥 #Start

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)