Back

Prem Siddhapura

Unicorn is coming so... • 1y

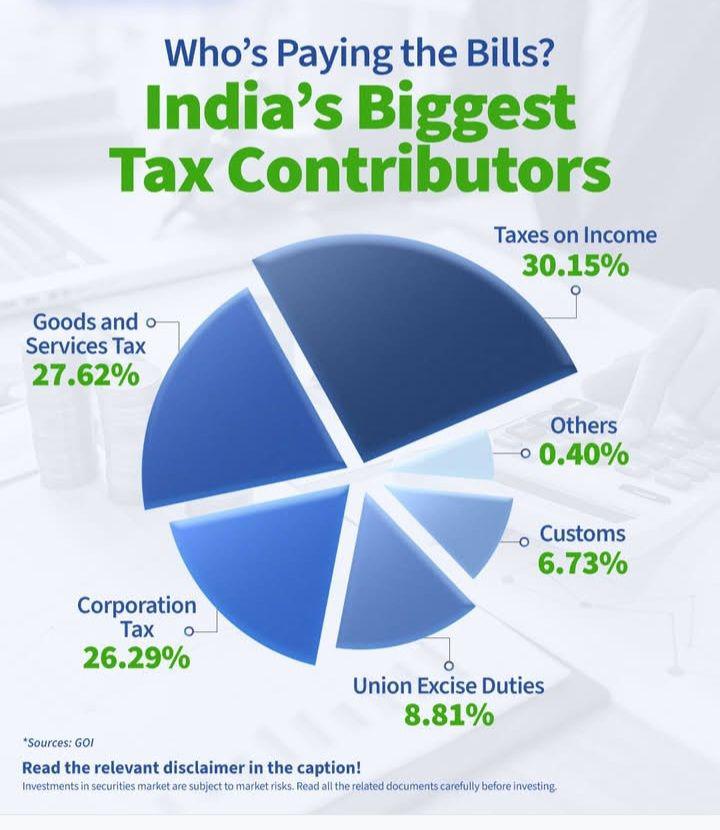

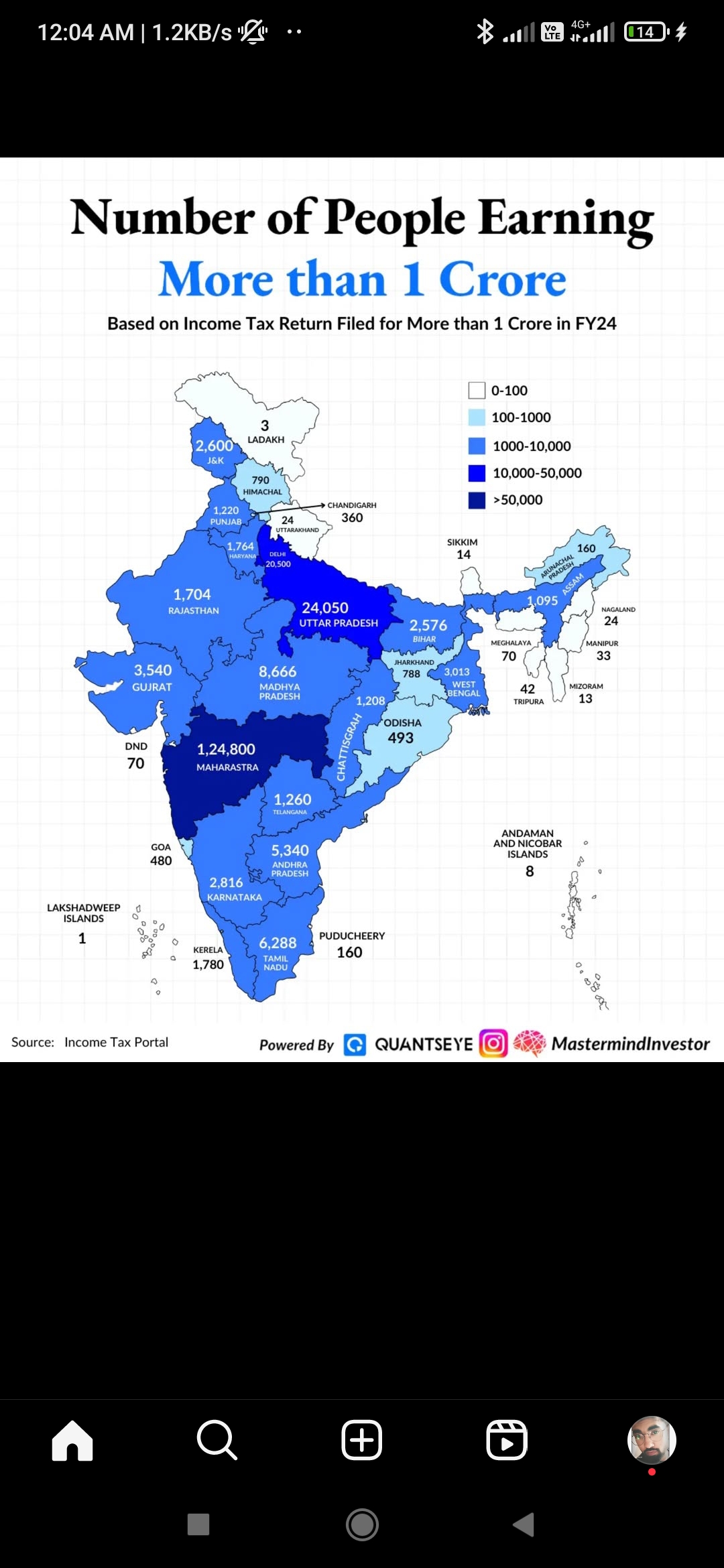

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰 Securities transaction tax receipts skyrocketed, nearly doubling to ₹15,923 crore—thanks to market activity. 😆 Refunds issued by the government grew by 53% year-over-year to ₹2.91 lakh crore. The fiscal year's direct tax target stands at ₹22.07 lakh crore. ‼️ With corporate tax collections performing below expectations, the finance ministry is counting on personal income tax growth to fill the gap. While corporate tax collections are budgeted at ₹10.2 lakh crore—a projected 12% increase—the Centre expects personal income tax collections to exceed estimates by ₹1.3 lakh crore. The net personal income tax target for this year is ₹1.87 lakh crore, a 13.6% boost from ₹1.64 lakh crore in FY 2023-24. 🏦

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreSameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See Morefinancialnews

Founder And CEO Of F... • 1y

Stocks to Watch: Tech Mahindra, HDFC Bank, Kotak Bank, Jio Financial Tech Mahindra reported a significant rise in consolidated net profit, which more than doubled to ₹1,250 crore in the July-September quarter of FY2024-25. This jump was primarily dr

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)