Back

Kimiko

Startups | AI | info... • 9m

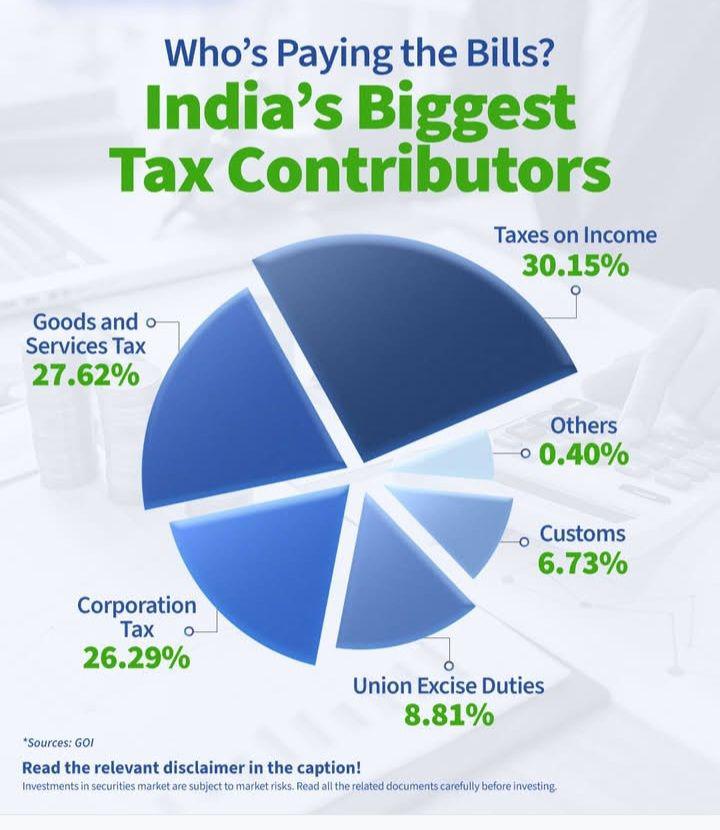

India's Biggest Tax Contributors... Personal income tax is still India's biggest tax contributiors, accounts for more than 30% of total tax collections

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MorePrem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreSameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

You still have to pay taxes if your income is below 12Lakhs.💀 Let’s talk about a crucial detail in the recent Indian Union Budget that many people are overlooking. If you’re already aware, great! But if not, this is essential to know—otherwise, you

See More

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

If your income is 12L, You pay 0 for the first 4L. From 4L - 8L i.e. next 4L, you pay 5% = 20,000. From 8L - 12 i.e. another 4L, you pay 10% = 40,000. Total Tax Payable= 60,000. Standard Deduction -75,000. So NO TAX FOR INCOME UP TO 12L. Get it?

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)