Back

King 11

Hey I am on Medial • 1y

i have designed a gold valuation software for banking in vb 6.0 all personal the can use in banking sector and personal loan department exice department and income tax department

More like this

Recommendations from Medial

vijay gondliya

Hey I am on Medial • 1y

we have diamond and jewelry business we see with time gold loan and banking system is good to make money we want to start nidhi company for gold loan or nbfc for business expansion anybody come and investment with us 100 % profitable business patel

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

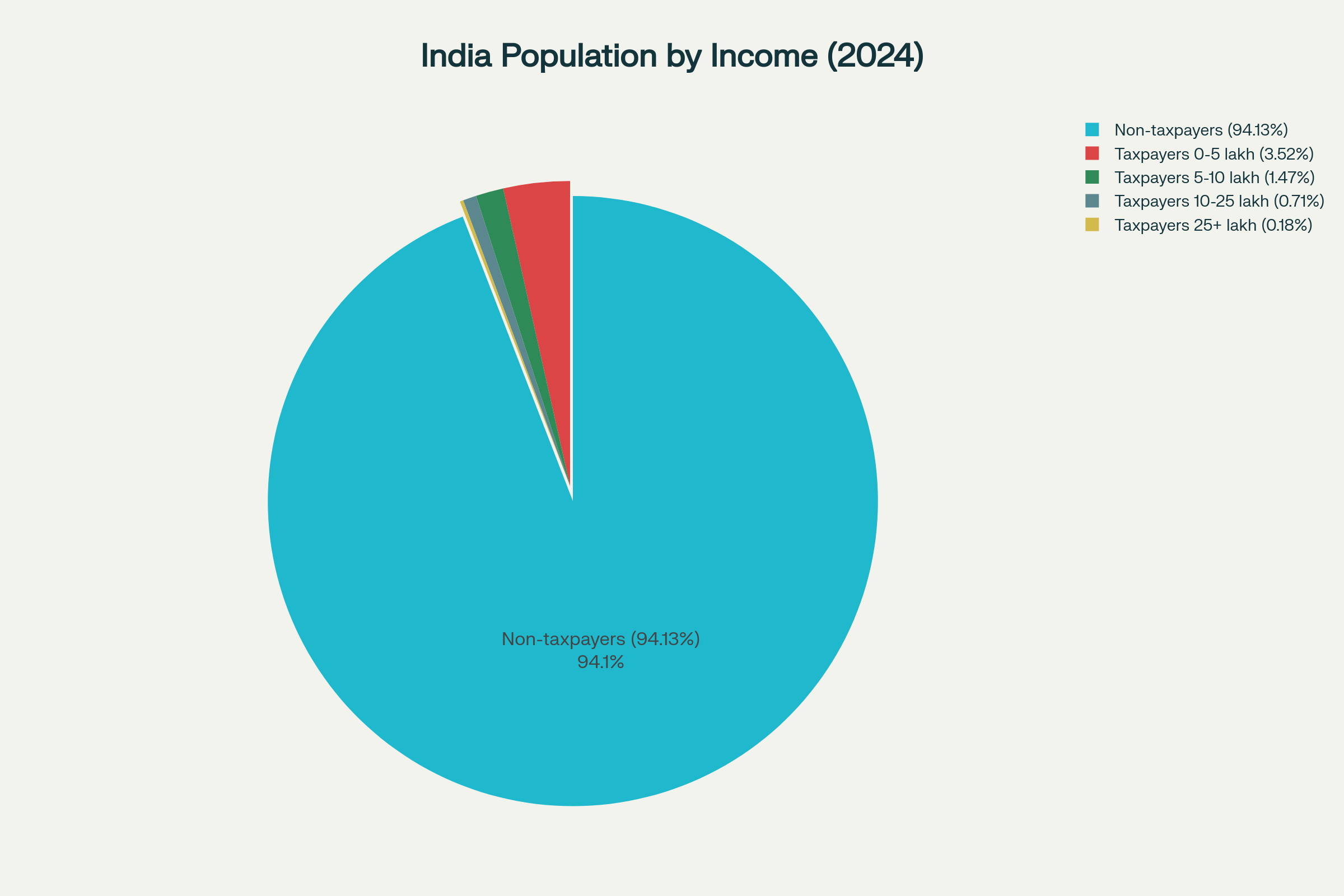

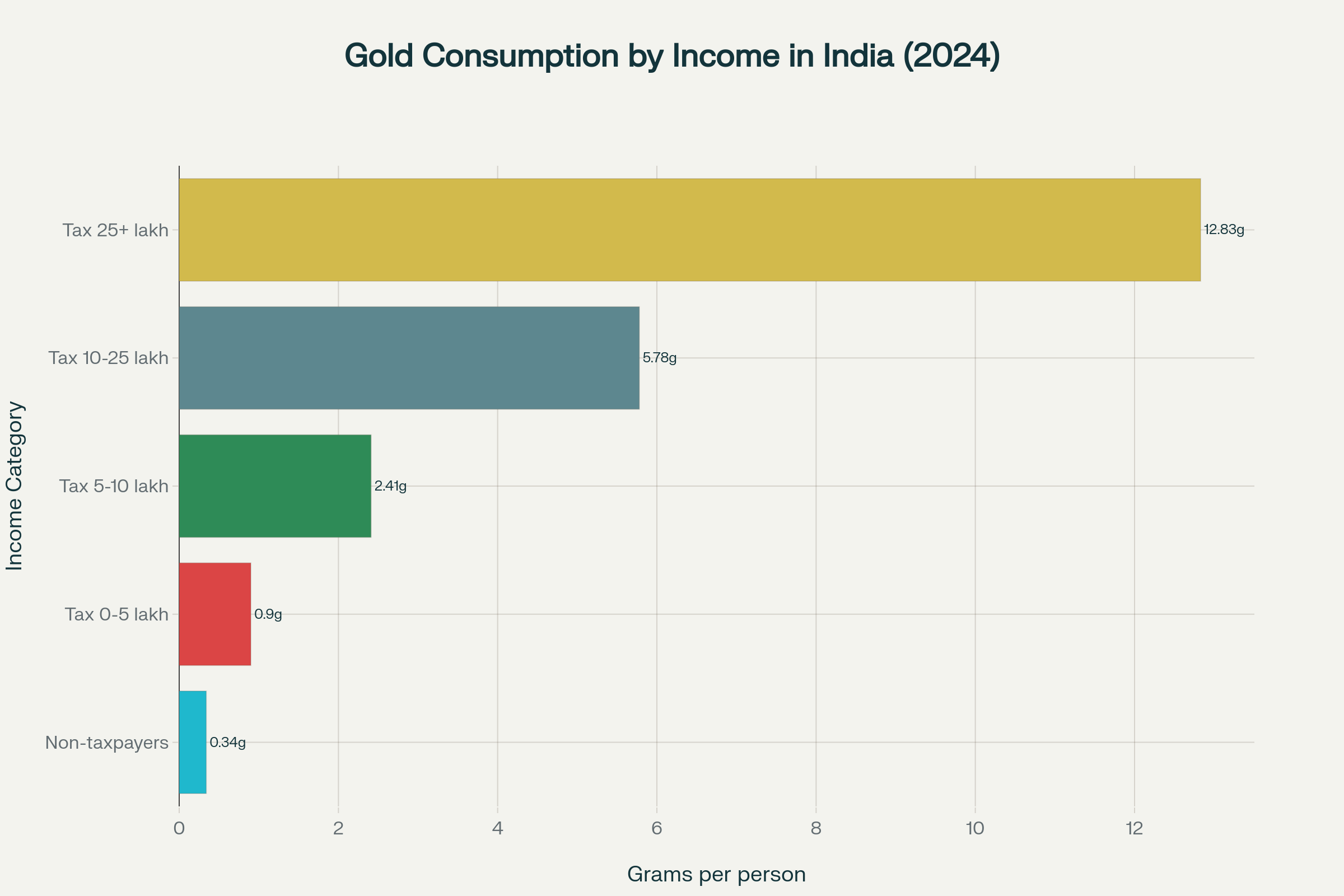

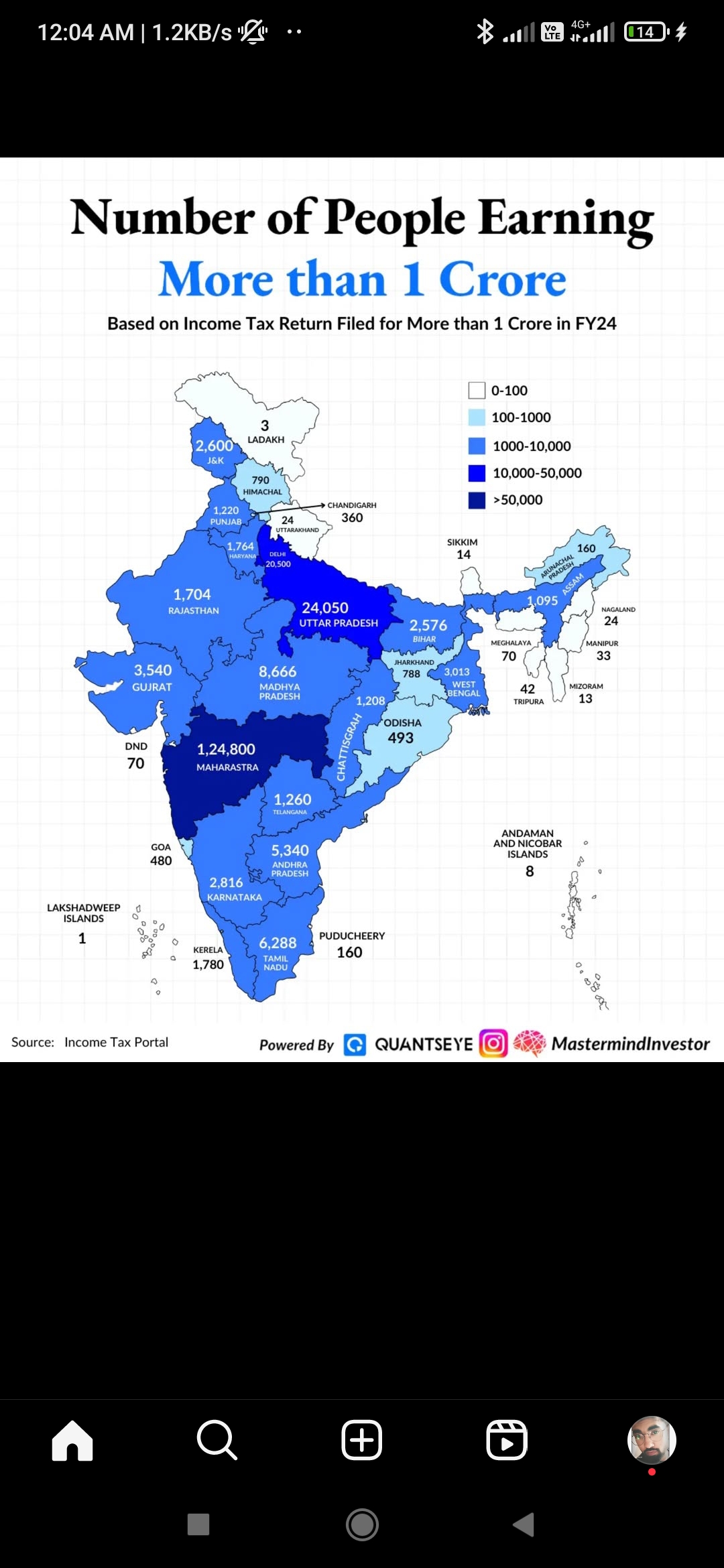

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here

See More

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreAshutosh Mishra

Chartered Accountant • 1y

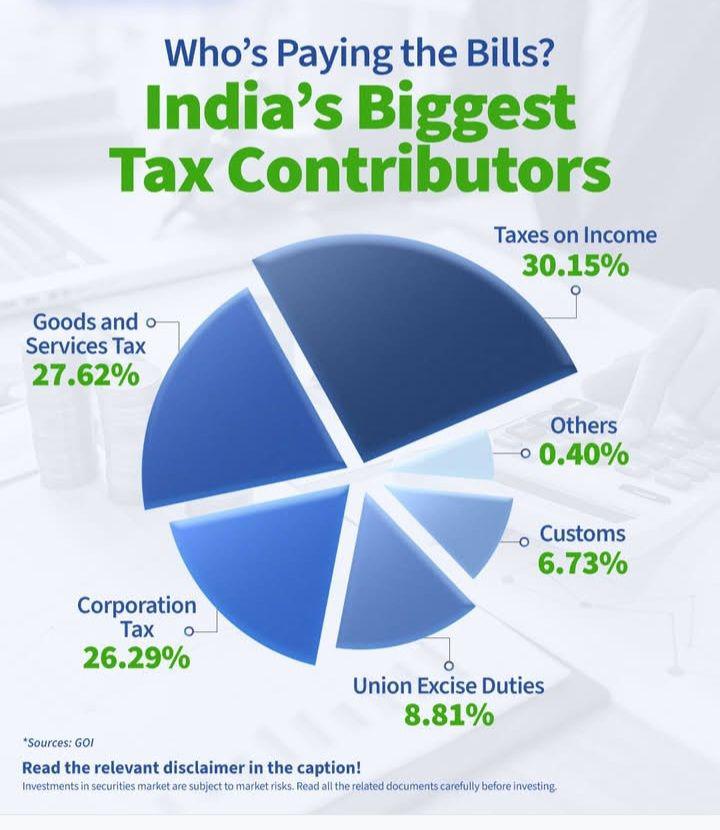

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MorePrem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)