Back

Poosarla Sai Karthik

Tech guy with a busi... • 4m

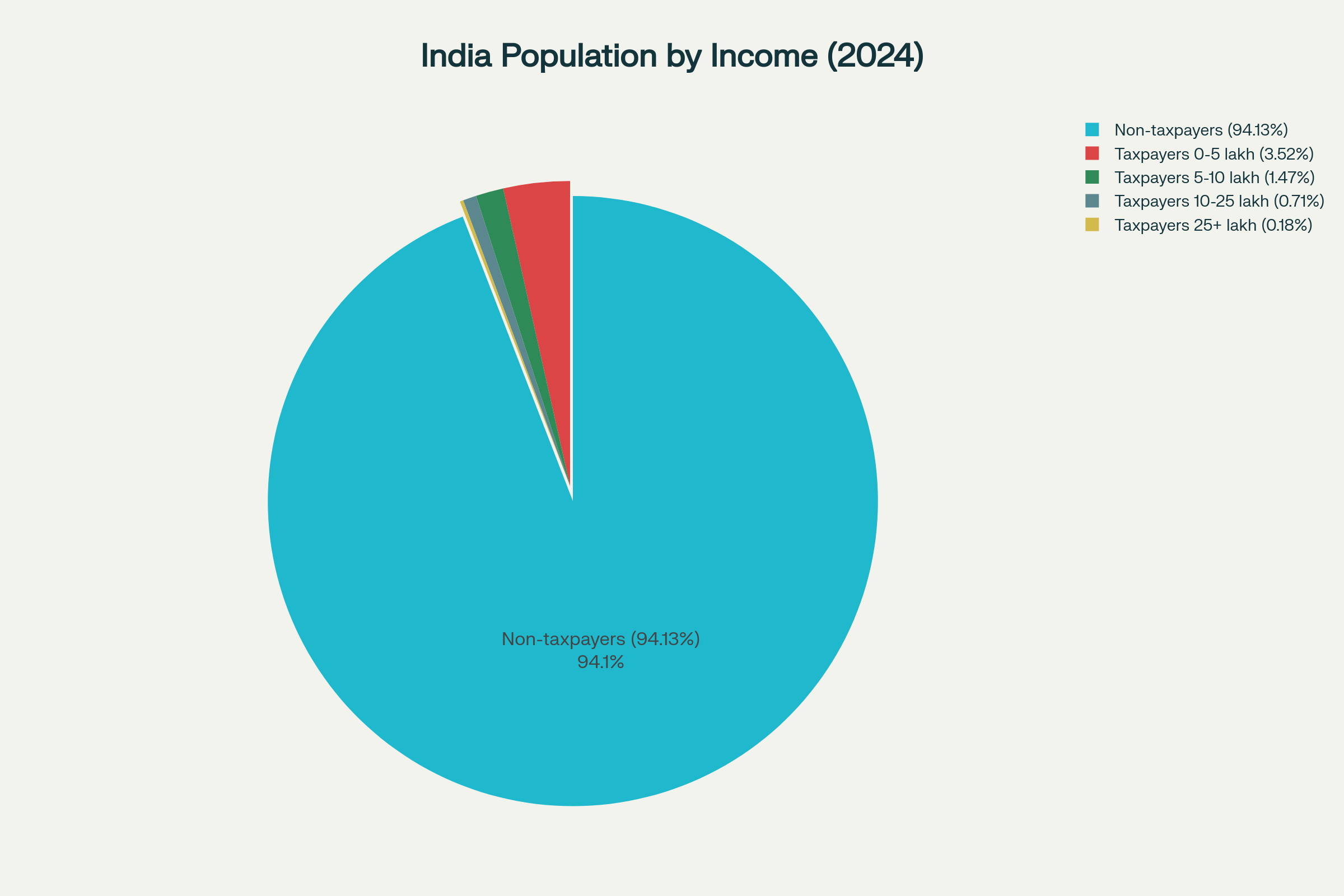

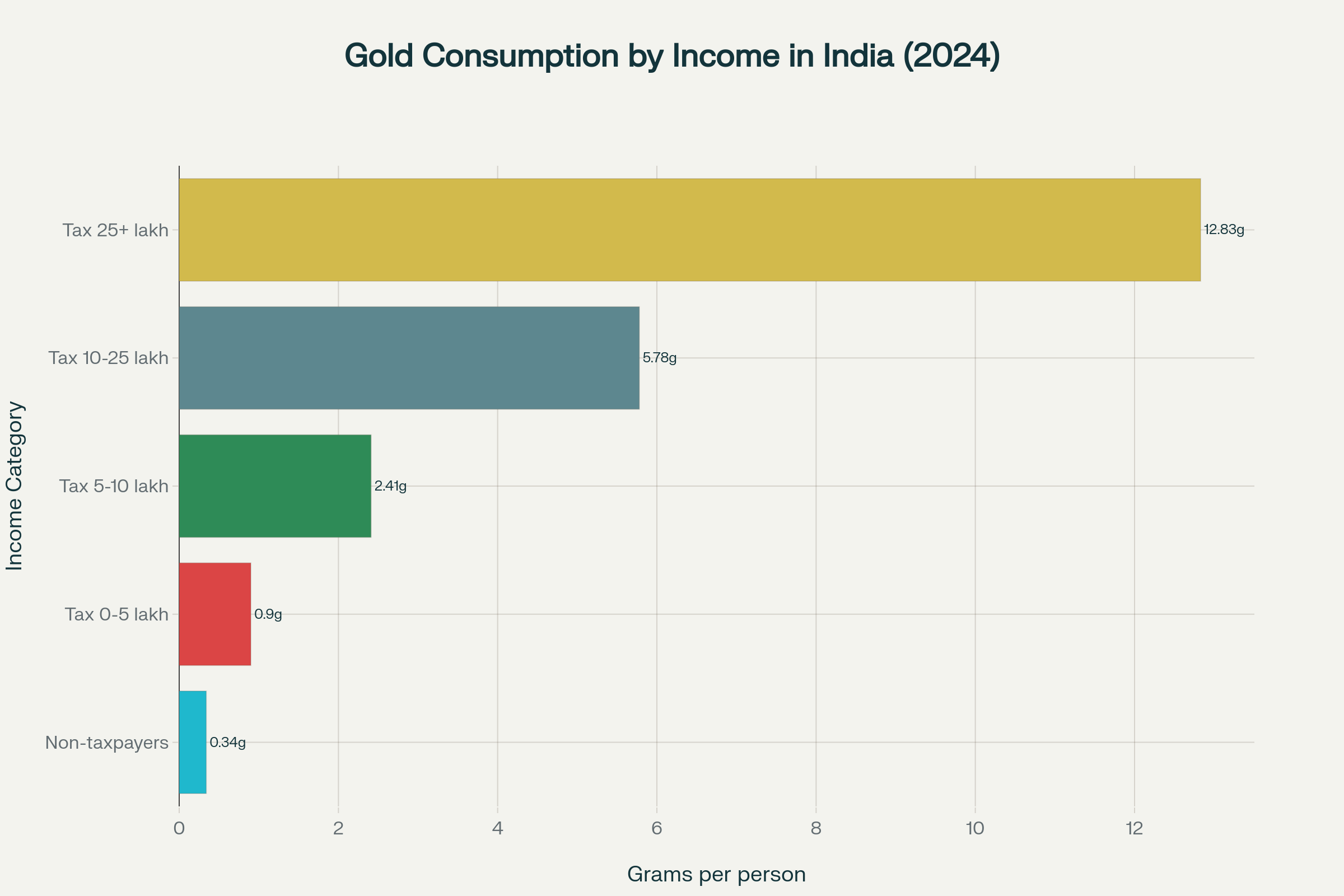

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here is how the numbers reveal India’s special relationship with gold > Gold is universal in India. Even among the 94 percent of people who do not pay tax, gold is an everyday asset for tradition and savings alike. > Huge appetite. In 2024, India bought 802.8 tonnes of gold, worth ₹6.25 lakh crores, spending 2.1 percent of national income. Weddings spark nearly half of this, and investment accounts for 30 percent of demand. > Across the income spectrum Average non-taxpayer: 0.34 grams per year Top taxpayers earning 25 lakh and above: 12.8 grams per year Still, lower-income rural groups drive over half of total gold buying > Middle-class magic. Those earning 10 to 25 lakh spend the highest share of income, three percent, on gold, balancing culture with conscious investing. > Gold is more than wealth. For every Indian, rich or poor, gold represents security, trust, and celebration. Look at the chart below Gold buying increases dramatically with income, but cultural love makes gold universal in India * Annual gold consumption varies dramatically by income level, with the highest earners consuming nearly 38 times more gold per person than non-taxpayers * Takeaway: No matter your background, gold stands at the heart of India’s culture, economy, and resilience, making every purchase a story of tradition and trust.

Replies (1)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See Morefinancialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MorePrem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreAshutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)