Back

Arun Bairagi

Serious Thinker • 1y

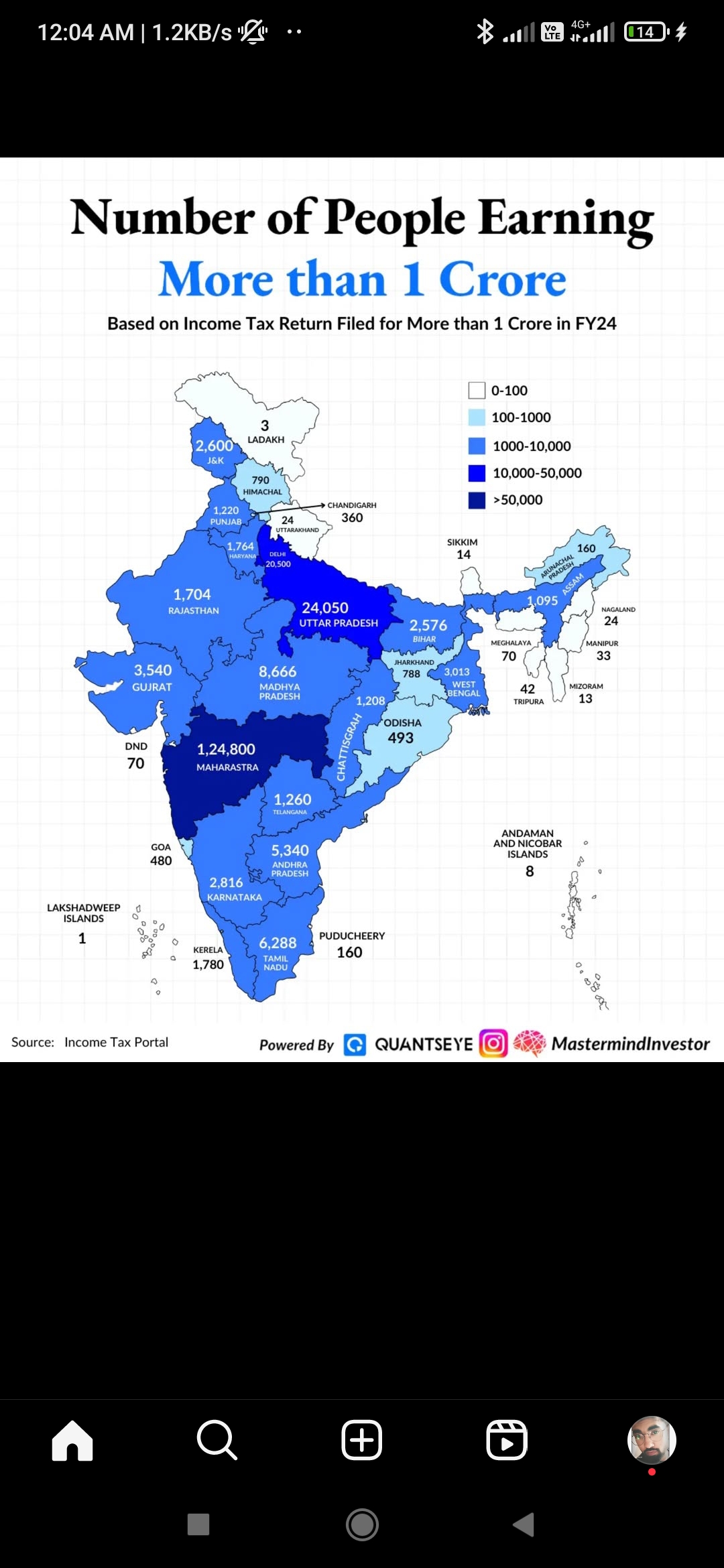

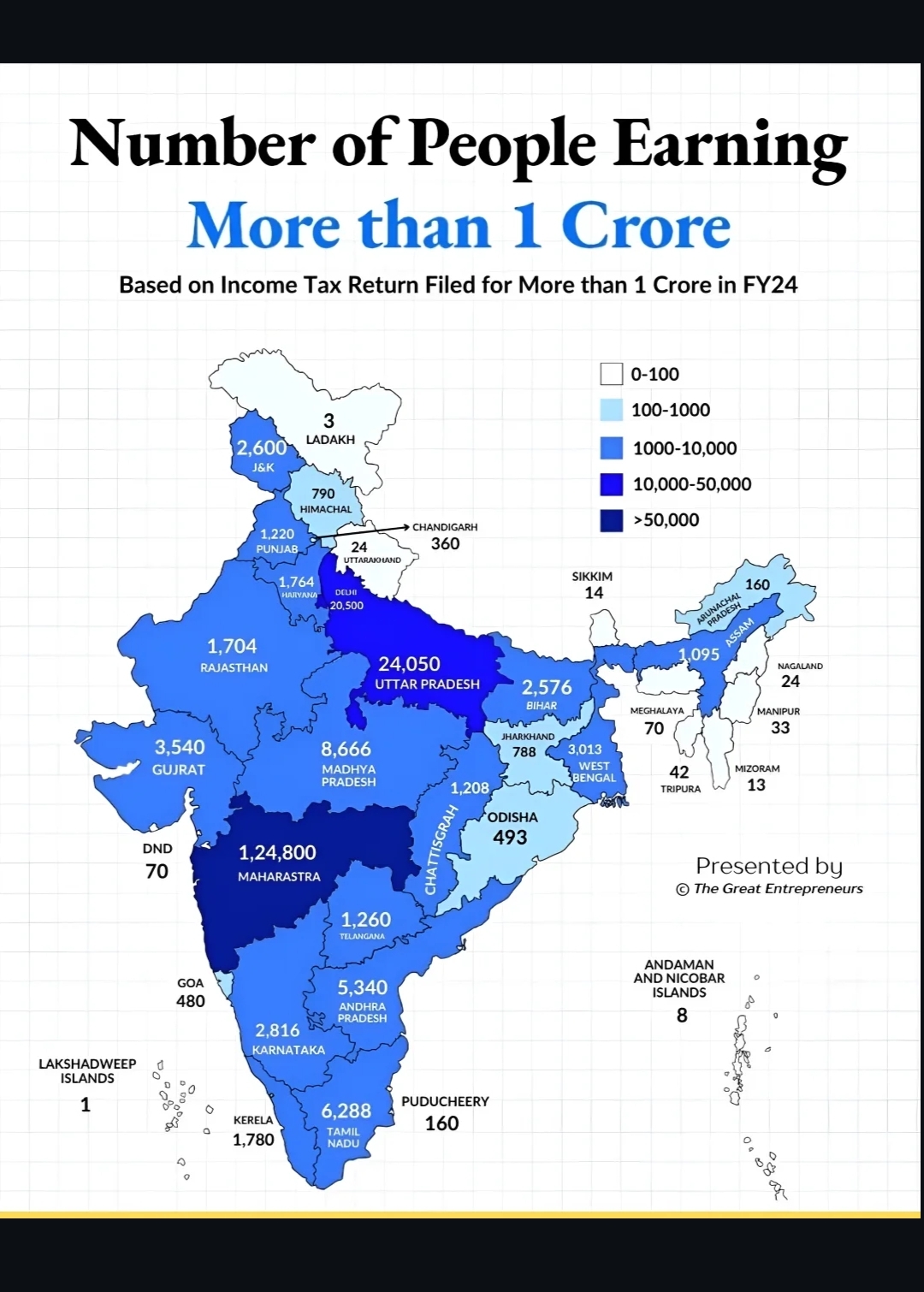

Number of people earning more than 1 crore per year in India, according to the Income tax department.

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 7m

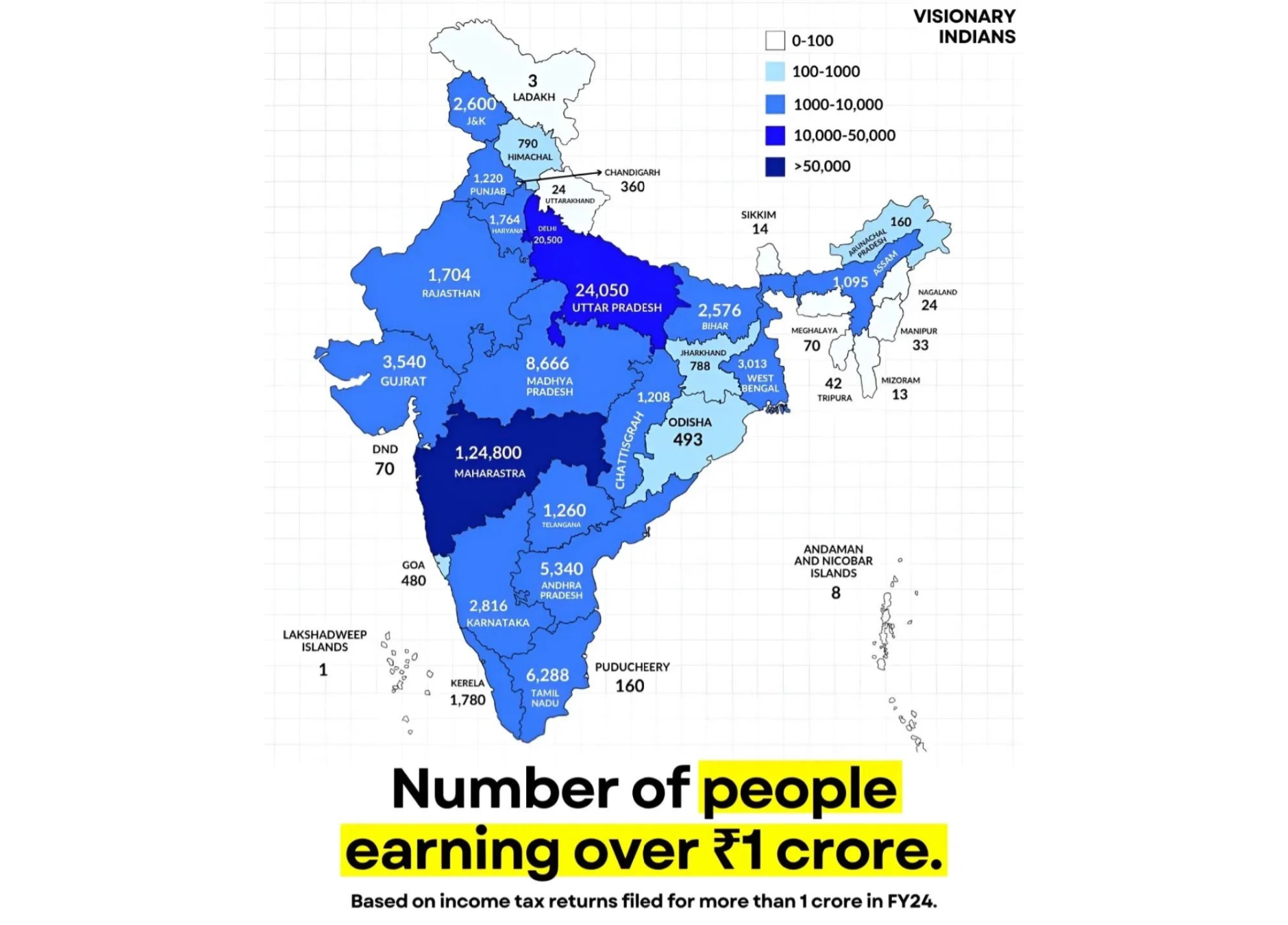

How Many Indians Actually Earn Over ₹1 Crore a Year? The Number Might Shock You. 💬 With a population of over 140 crore, you'd expect lakhs of crore plus earners in India. But the real number is surprisingly low. What does this say about income ineq

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreMohd Rihan

Student| Passionate ... • 11m

Zomato Finances of this year::: Revenue: 5405 cr Expenses: 5533 cr Loss:128 cr Non operating income (invested in FD, IPO and from other places): 252 cr Income- Loss=124 cr After tax: 59 cr Means, Zomato is earning from interest and FD's than actual

See More

Ashutosh Mishra

Chartered Accountant • 1y

Direct Tax collections for FY 2024-25 as of 17 September, 2024 Net Collections, YOY comparison Corporate Tax : ₹4.53 lakh crore, up 10.5% Personal Income Tax : ₹5.15 lakh crore, up 18.8% STT : ₹26,154 crore, up 96% Other Taxes : ₹1,812 crore, up

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)