Back

Om Pandey

An engineer • 1y

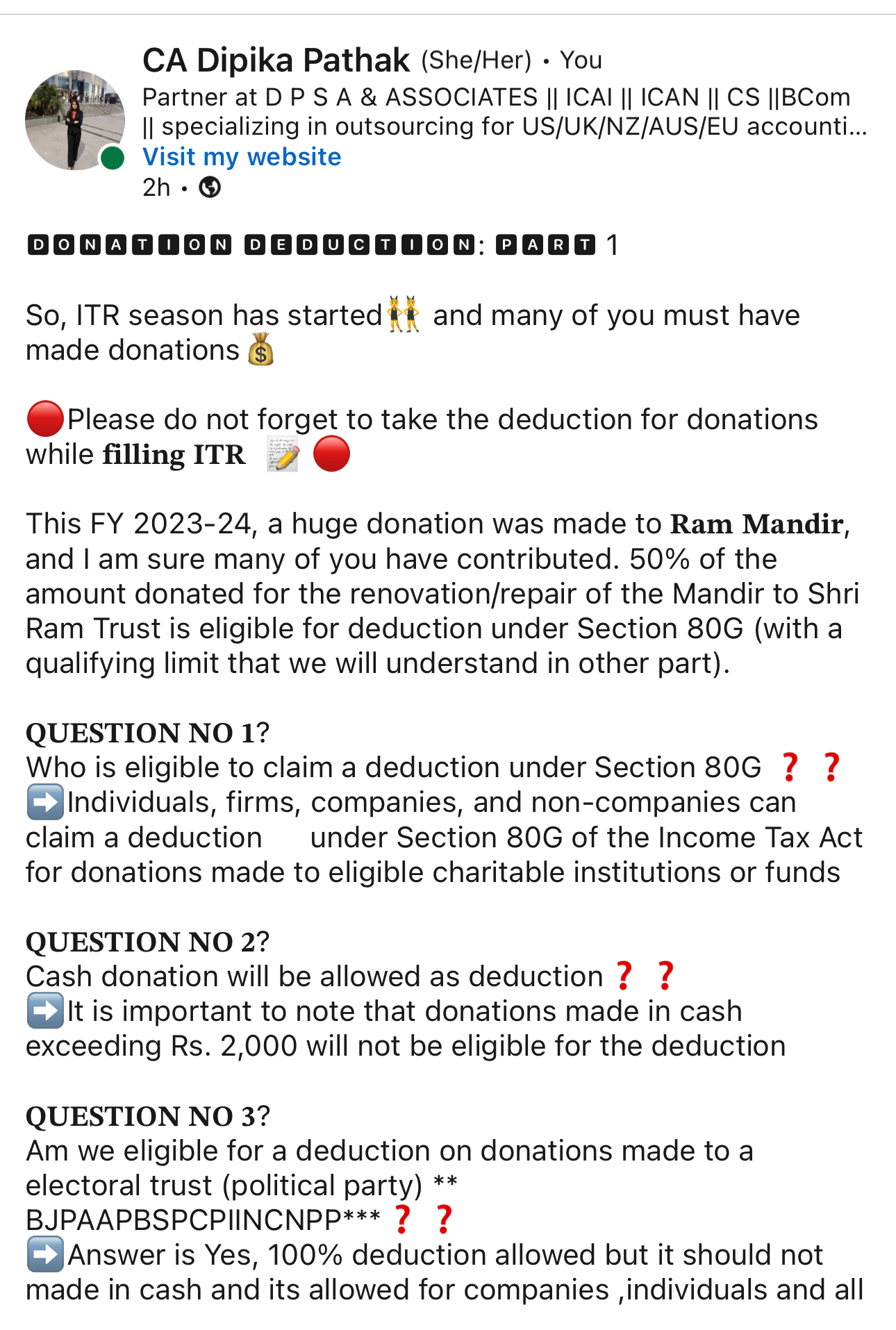

Filing Your ITR? Save on Taxes with Us! If you're planning to file your Income Tax Return (ITR), here's some good news: My organization is 80G certified! This means you can claim tax exemptions for donations made to us under Section 80G of the Indian Income Tax Act. Support a meaningful cause while reducing your tax liability. It’s a simple way to make a positive impact and save money at the same time. Feel free to contact me for more details or to make a donation. Let’s work together for a better tomorrow!

More like this

Recommendations from Medial

theresa jeevan

Your Curly Haird mal... • 1y

Deadpool’s Tax Tips—Let’s Make It Simple! 💸 Salary below ₹12.75L? Go with the new tax regime—less pain, less paperwork. Easy peasy. 🥳 💰 Salary above ₹12L? If your exemptions (HRA, 80C, 80D, home loan, etc.) are more than ₹5L, old tax regime coul

See More

theresa jeevan

Your Curly Haird mal... • 1y

🚨 Tax Saving Alert: Only 2 Months Left! 🚨 Hi there! 👋 Here’s a quick guide to help you maximize your savings: 🔹 80C - Save up to ₹1.5L PPF, ELSS (higher returns), NSC, LIC, Tax-Saving FDs (5 yrs). 🔹 80D - Health is Wealth Save ₹25K (self/fami

See More

Anonymous

Hey I am on Medial • 1y

“I have been earning around 10 LPA (lakhs per annum), but a significant portion of my income is being deducted as taxes. I’m unsure about what steps to take. Could you please provide some tips on how I can minimize my tax liability and save more mone

See MoreShubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)