Back

Ashutosh Mishra

Chartered Accountant • 1y

Income Tax season is here: Dont forget to claim House Rent Allowance (HRA) deduction given by your company so that you can save a substantial amount of tax.

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

AVOID this mistake WHILE taking deduction of interest (saving +fixed deposit)in your ITR🔴🔴🔴🔴🔴 Since ITR Season is around, highlighting common confusion ➡️For Individual & HUF - We can take a max deduction of 10,000 on interest from a savings a

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

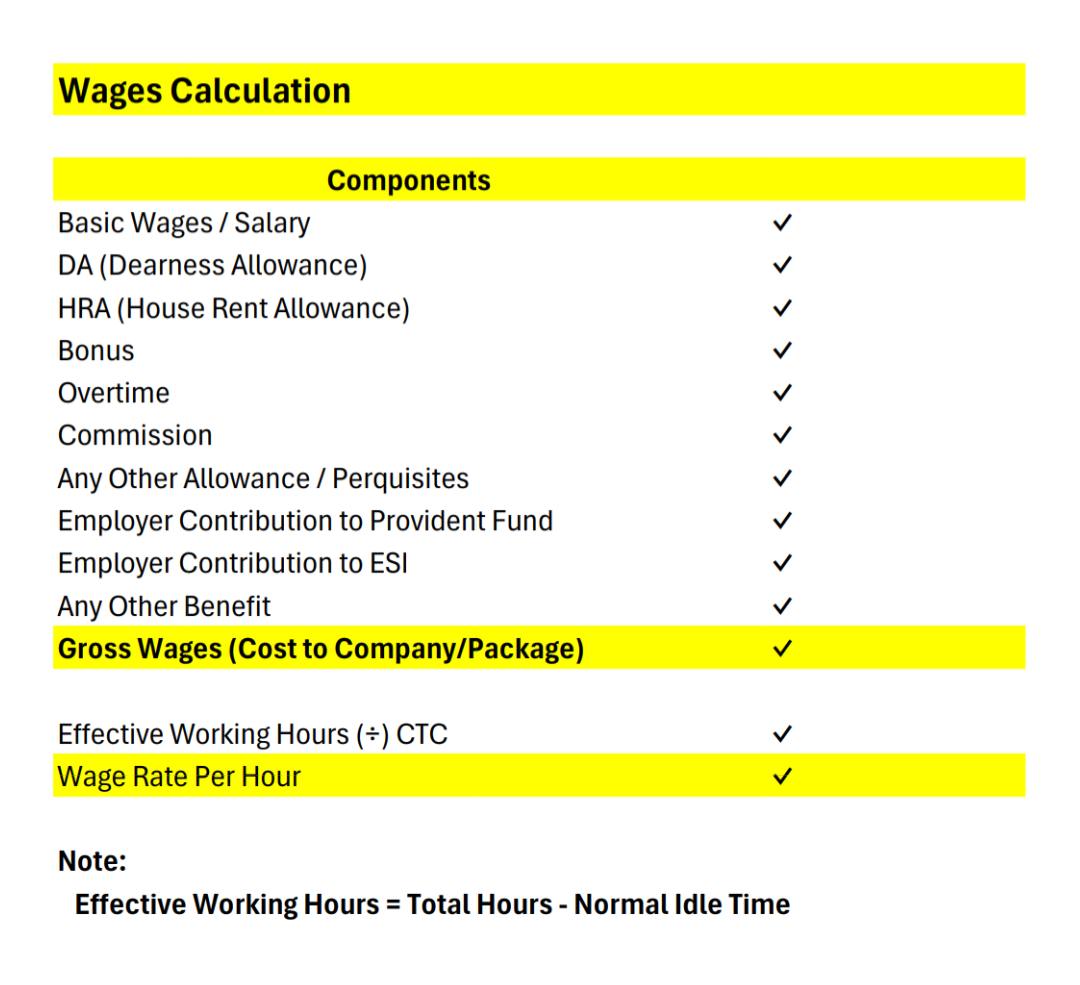

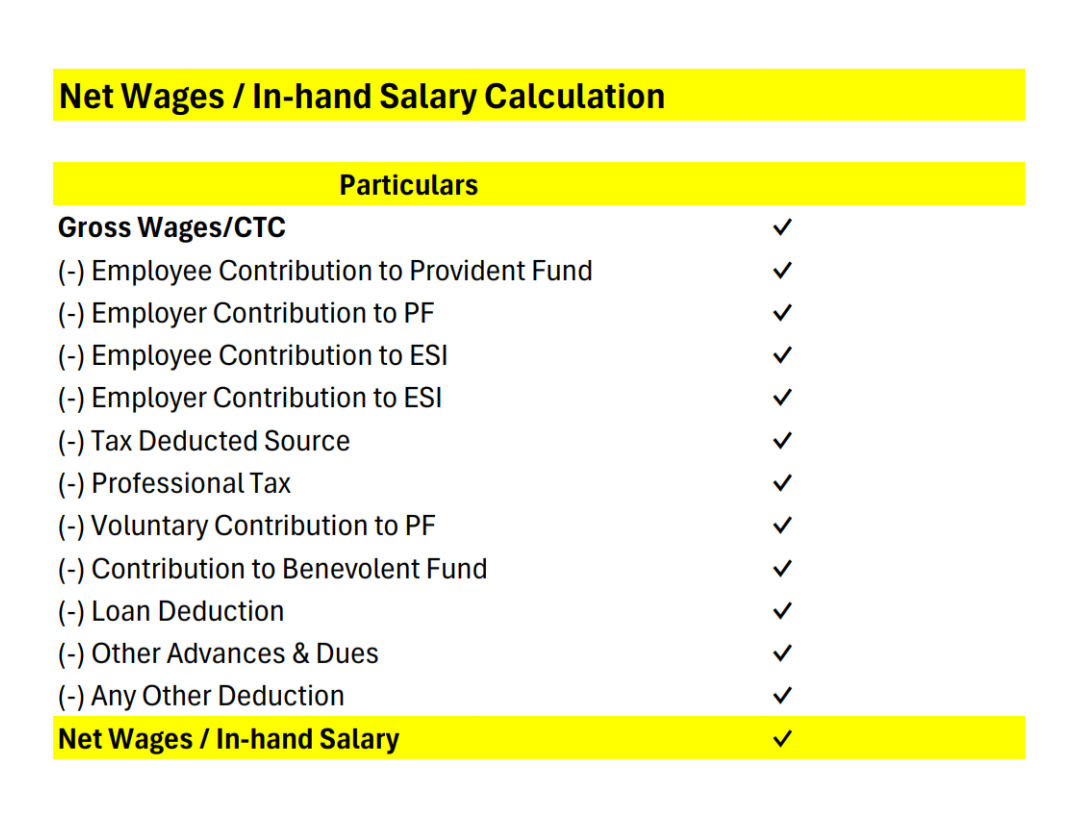

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

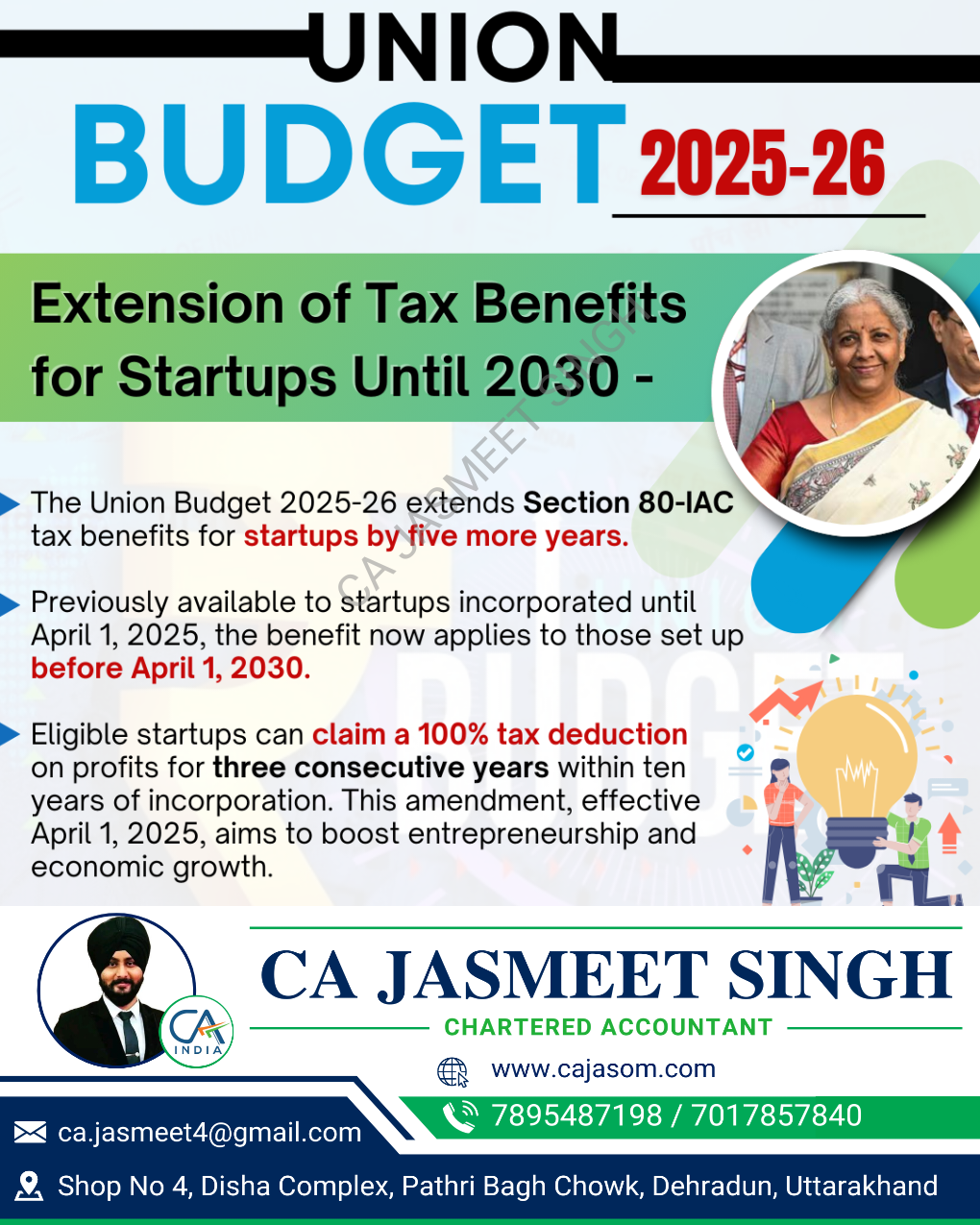

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

Sandip Kaur

Hey I am on Medial • 1y

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 12m

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)