Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

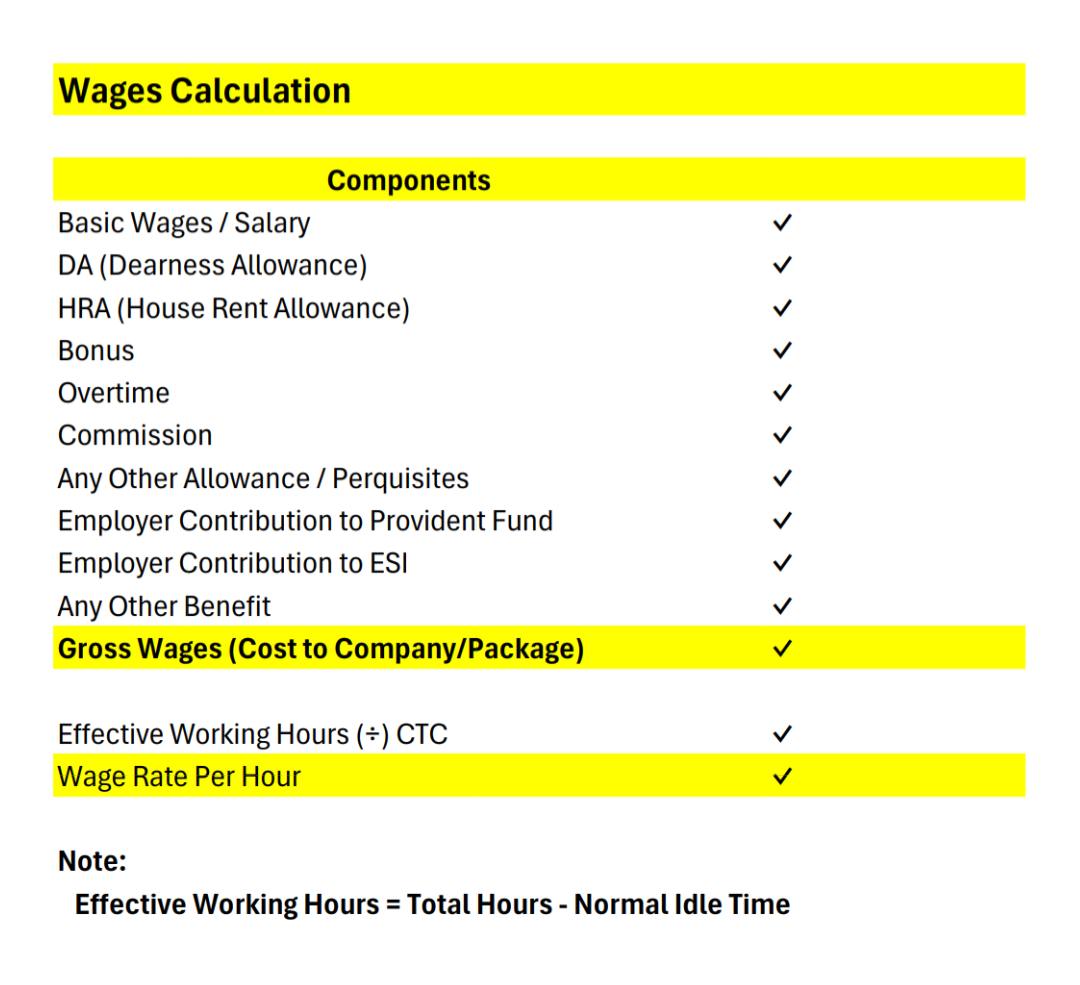

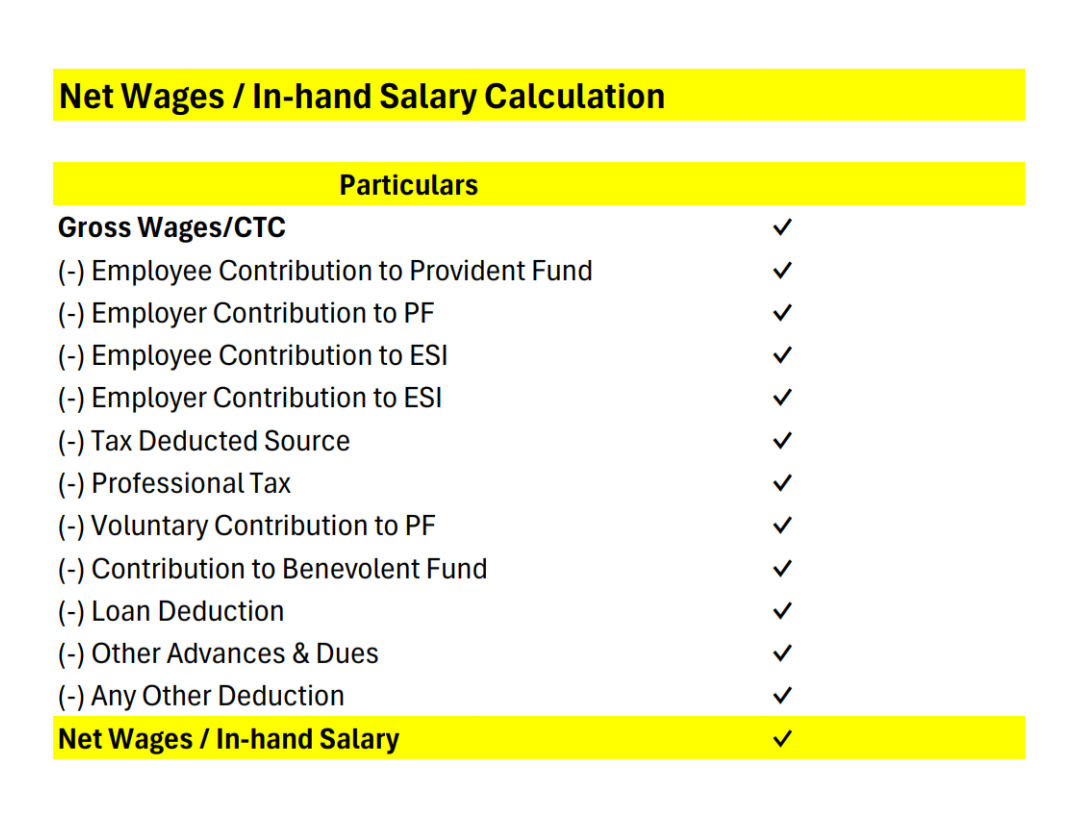

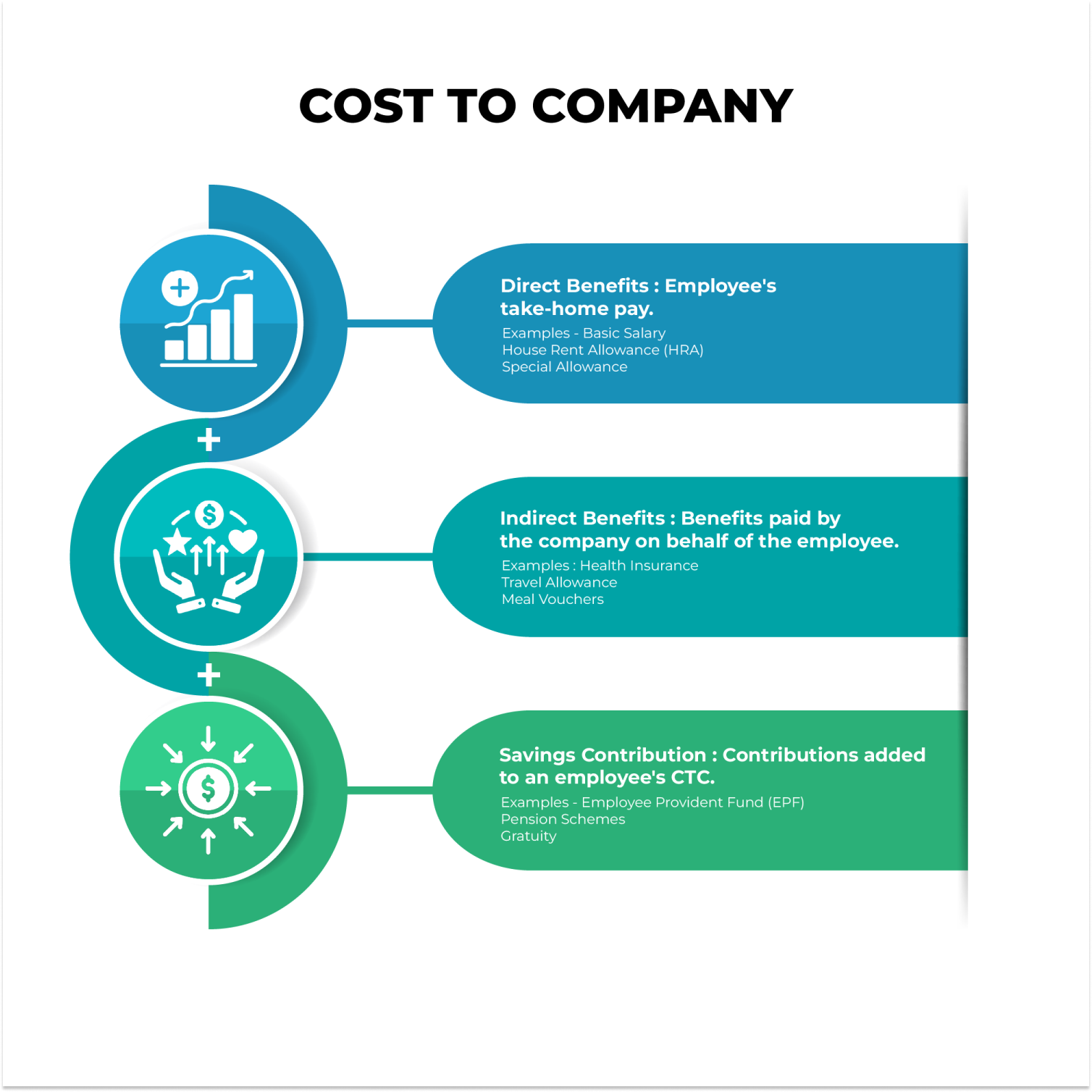

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent Allowance (HRA) + Bonuses, Overtime, Commission + Perquisites/Allowances + Employer’s contribution to Provident Fund (PF) & ESI + Any other benefit offered This is often seen as the Gross Wages or Salary Package. CTC = Sum of All Earnings + Employer Contributions 2️⃣ In-Hand Salary (Net Wages): This is the actual amount received by the employee after deductions: – Employee’s contribution to PF & ESI – Income Tax (TDS) – Professional Tax – Loan/Advance deductions – Any other voluntary deductions In-Hand Salary = CTC – All Deductions Note: Effective Working Hours = Total Hours – Idle Time Wage Rate per Hour = CTC ÷ Effective Working Hours Understanding this helps both employers and employees plan finances better and ensure clarity. Well, If you're hiring interns, your cost is practically zero - so feel free to skip this post and relax.😂

Replies (4)

More like this

Recommendations from Medial

CA Abhishek Singhal

Har Har MAHADEV • 9m

If you're an employee, you've got an in-hand salary hike today! This is because of Nirmala Sitharaman's tax cut for the new regime. April 2025 is the first month you see it in action. Your company would've cut lower TDS in accordance with the new sl

See MoreAnonymous

Hey I am on Medial • 1y

NaukariBharat - job portal for Bharat(uneducated and daily wages worker ) NaukariBharat helps company in finding security gaurd,watch men or daily wages worker How our portal works: So the main problem is our daily wages workers from tier 3 cities m

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)