Back

Vikas Acharya

•

Medial • 1y

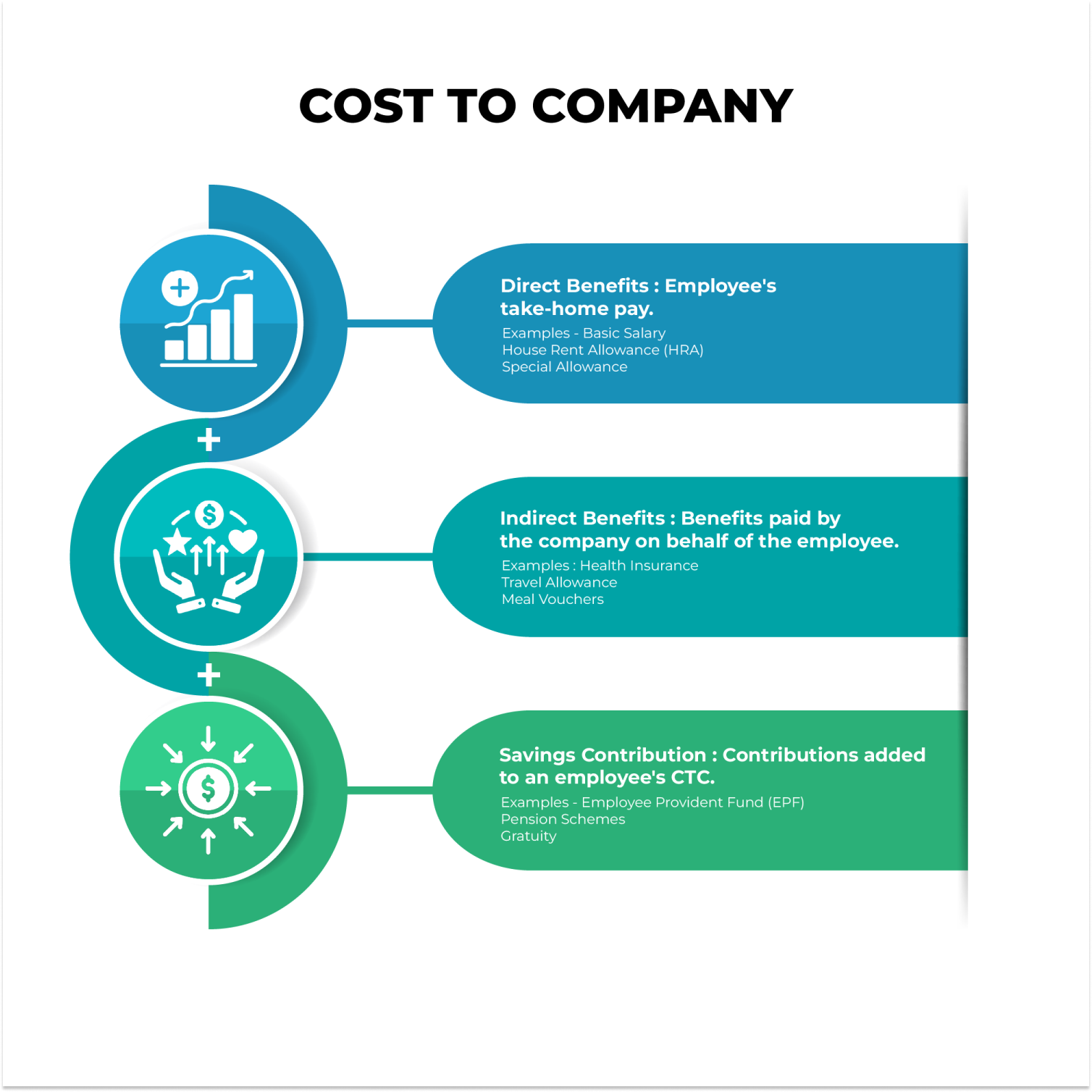

CTC stands for Cost-to-Company, and it's a human resources metric that represents the total amount of money a company spends on an employee in a year. This includes the employee's salary, benefits, taxes, and other costs. CTC is different from an employee's take-home pay, which is the amount they receive after taxes and deductions are applied. CTC is often included in job postings and offer letters to show the total compensation an employee will receive.

Replies (3)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

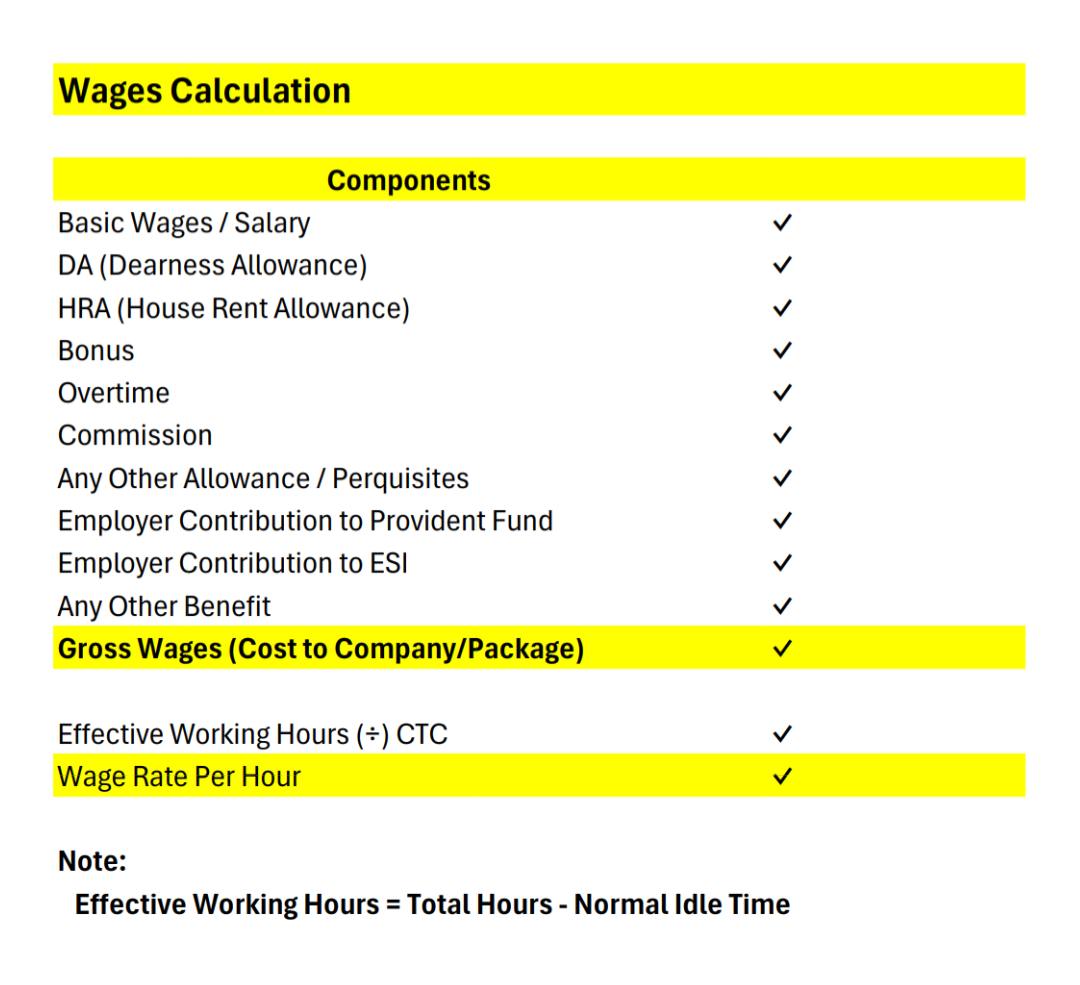

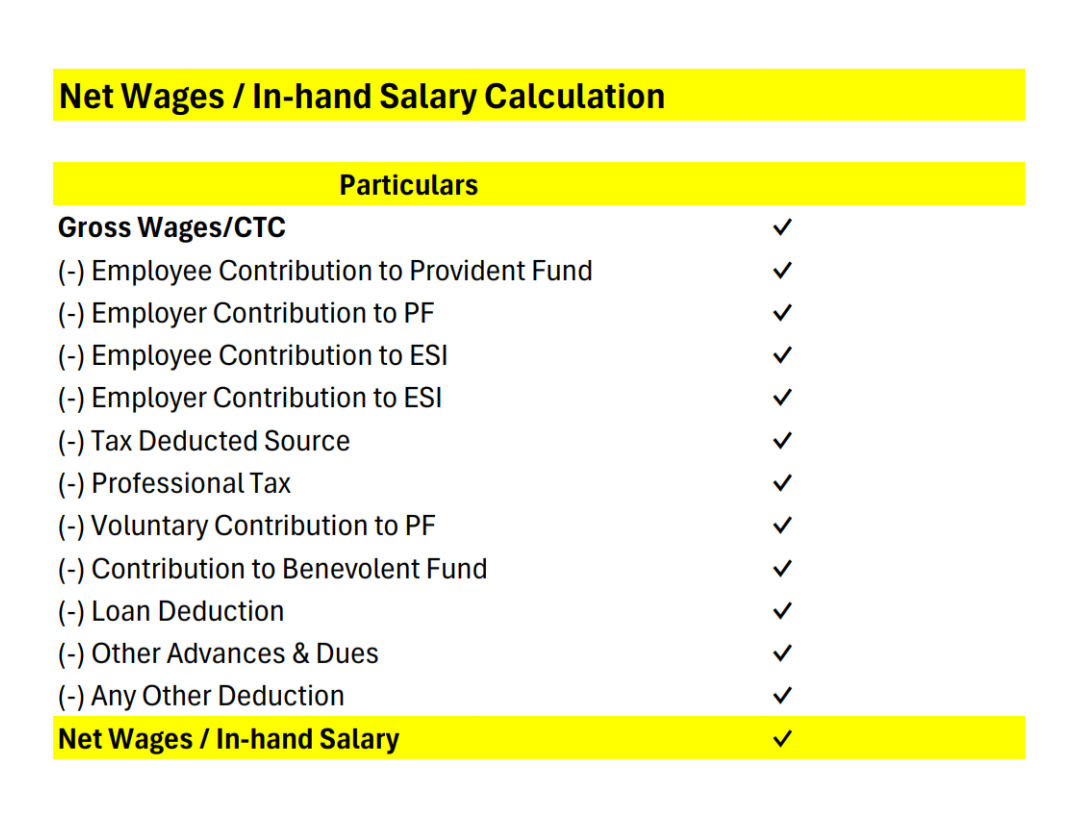

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Taxation: Salary vs. Income Hey there! Let’s talk about something essential in finance—taxation—and the difference between salary and income. First off, your salary is the fixed amount you earn from your employer, usually detailed in

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

I have got many DMs regarding ESOPs So Let me Clear up here. 1. Are ESOPs free for employees? ESOPs are granted for free, meaning the employee doesn't pay to receive the options. However, to own the shares, the employee must pay the exercise price

See More

PRATHAM

Experimenting On lea... • 1y

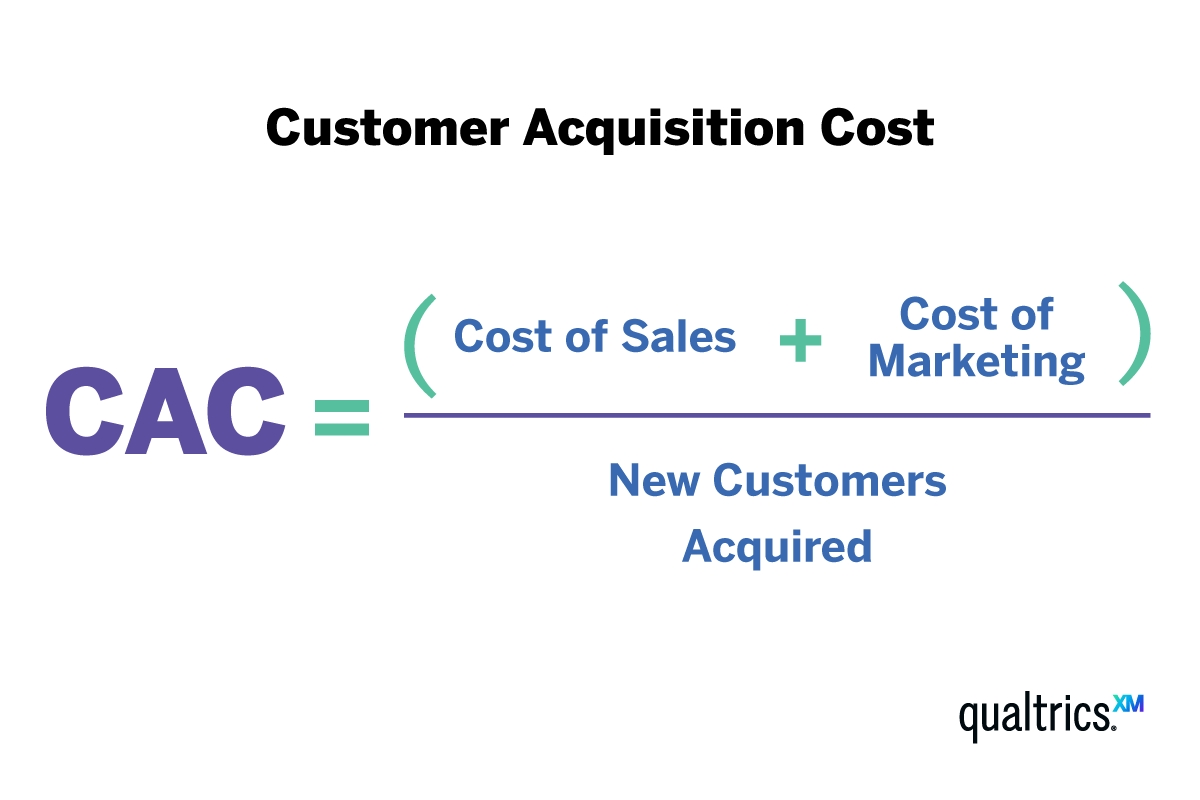

WTF is CAC (Customer Acquisition Cost)❓🤔👀 Let me explain this, Customer Acquisition Cost (CAC) is a key business metric that represents the total cost of acquiring a new customer. So, This includes all the costs associated with sales and marketing

See More

Rohan Kute

Business | infograph... • 10m

What do you think? Can this become the next unicorn? This startup, Zikilove, offers a unique concept called relationship insurance. Couples are required to pay an annual premium for five years. If they get married after this period, they receive 10

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)