Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

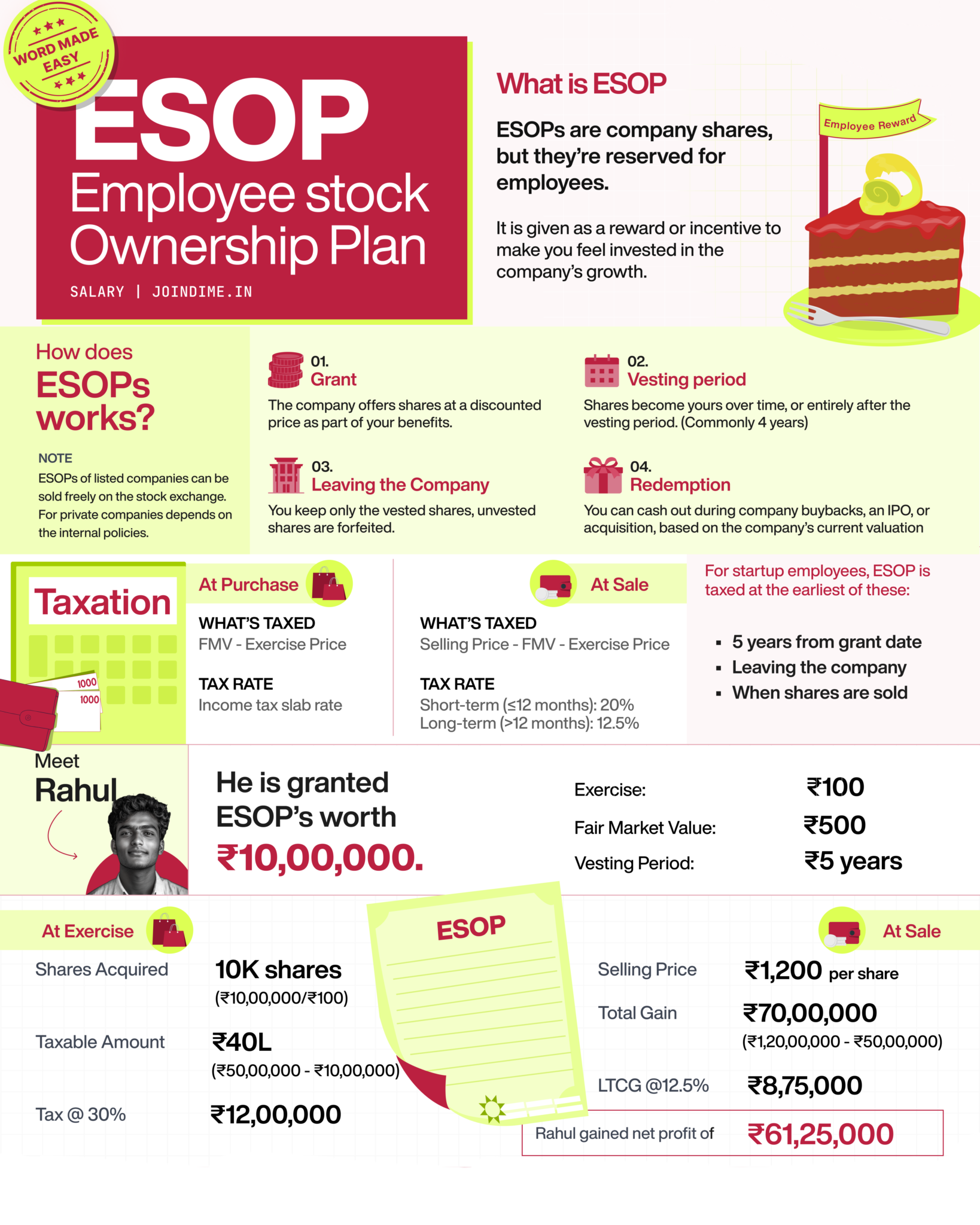

I have got many DMs regarding ESOPs So Let me Clear up here. 1. Are ESOPs free for employees? ESOPs are granted for free, meaning the employee doesn't pay to receive the options. However, to own the shares, the employee must pay the exercise price and applicable taxes. So, they are not free overall. This is biggest myth in the ecosystem. 2. If ESOPs are granted for free, why does the employee need to pay later? Because the grant is just a right to buy shares later, not actual ownership. To convert that right into real shares, the employee has to exercise the options, which involves paying the exercise price. 3. So ESOPs aren’t really free? Correct. They are free to receive but not free to exercise or sell. There are three costs: 1. Exercise price 2. Tax on exercise (perquisite tax) 3. Capital gains tax on selling 4. Why do people in the startup ecosystem say “ESOPs are free”? They mean the grant is free, not the whole process. This is half the truth. It’s often marketing or simplification - sounds attractive, but doesn't reflect the real financial commitment involved during exercise and exit. 5. Is it compulsory for employees to exercise their ESOPs? No. Exercising ESOPs is optional (that's why it is called options) If an employee doesn’t want to pay the exercise cost or sees no value, they can choose not to exercise. However, if they leave the company and don’t exercise within a certain period (usually 90 days), they lose the options. 6. So why are ESOPs still valuable? Even though you pay to exercise and pay taxes, the potential upside is huge if the company grows and its market price increases more than the contract price. Example: Pay ₹10L to buy shares, sell them for ₹1.2Cr later = Make over ₹1Cr profit (even after taxes).

Replies (3)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

What is an ESOP from a Company’s Perspective?🚀 An Employee Stock Ownership Plan (ESOP) is a tool companies use to attract, retain, and motivate talent by offering them ownership in the business. You’re not just giving away shares, you’re building

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

Shubham P

•

Self Improvement • 1y

Most startups raise funding from investors in exchange for company shares, and then use that money to pay salaries to their employees, market the product and all. But what if we skipped the middle step? Instead of raising money and giving away share

See More

Vishnu dubey

CEO of @EliteSS | In... • 1y

"ESOPs (Employee Stock Ownership Plans) empower employees by giving them a stake in the company’s success. 💼✨ They foster loyalty, boost motivation, and create wealth for employees while aligning their goals with the company’s growth. A win-win for

See MoreHavish Gupta

Figuring Out • 2y

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)