Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

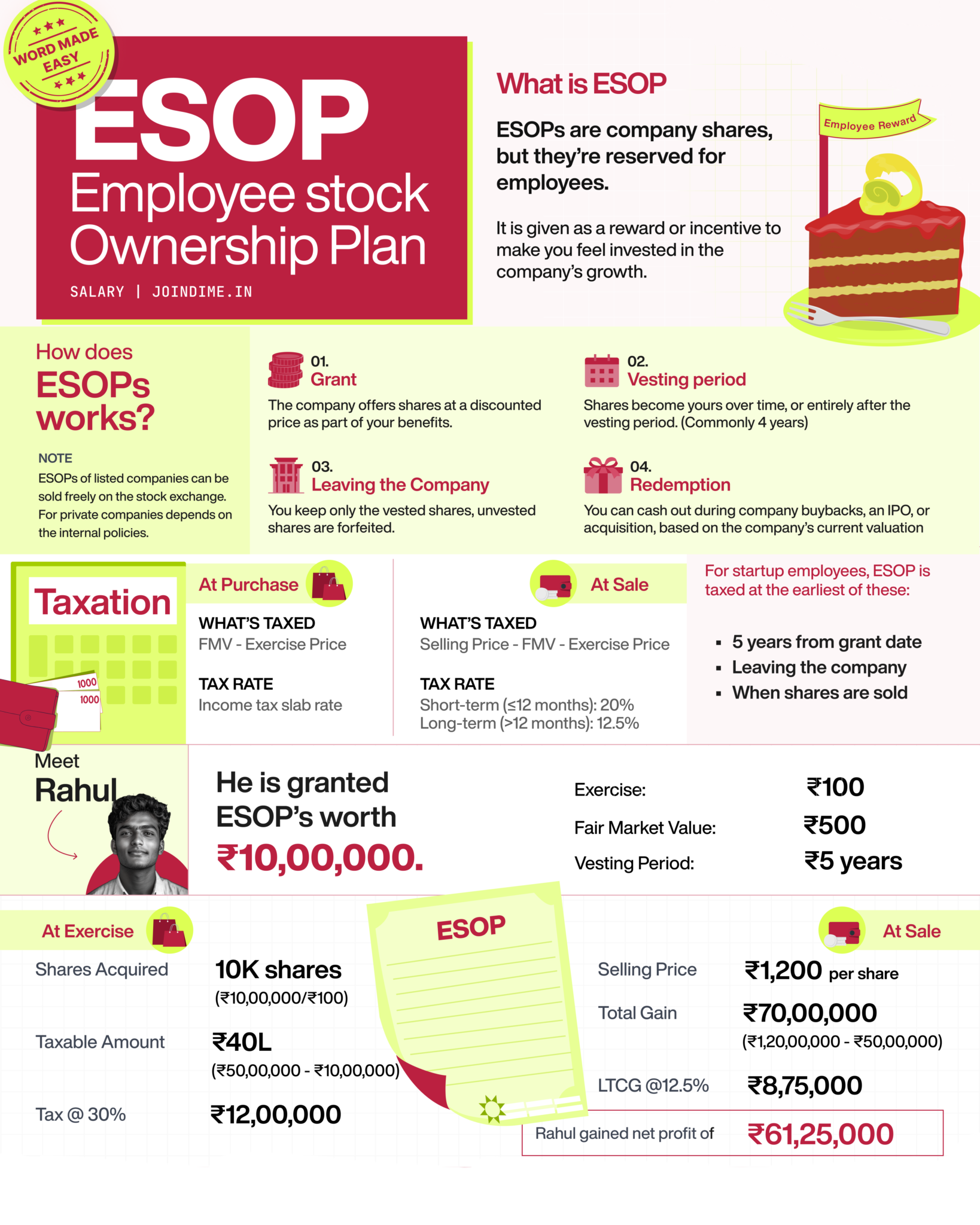

What is an ESOP from a Company’s Perspective?🚀 An Employee Stock Ownership Plan (ESOP) is a tool companies use to attract, retain, and motivate talent by offering them ownership in the business. You’re not just giving away shares, you’re building a team that’s emotionally and financially invested in the company’s long-term growth. ⁉️ Why Do Companies Offer ESOPs? 1. Attract Top Talent Startups often can’t compete with big companies on salary. ESOPs offer a chance for long-term wealth, making your offer more appealing. 2. Retention & Loyalty With a 4-5 year vesting period, ESOPs encourage employees to stay longer and see the company grow. 3. Boosts Performance When employees are shareholders, they think like owners. This leads to better decision-making, higher productivity, and accountability. 4. Cash Flow Friendly You’re offering shares, not cash-so it's easier on your startup’s runway. 5. Align Interests Everyone is working toward the same goal: building company value. ⁉️ How It Works for the Company 1. Create an ESOP Pool Typically 5-15% of total equity is set aside as an “ESOP Pool” from the company’s cap table. 2. Grant Shares to Employees You grant stock options (not shares yet) to employees at a fixed price (exercise price). These are not real shares until exercised. 3. Vesting Schedule Commonly 4 years with a 1-year cliff. This means the first chunk vests after 12 months, then monthly or quarterly after that. 4. Exercise & Sale Once vested, employees can buy (exercise) their options at the exercise price. When a liquidity event (buyback, acquisition, or IPO) happens, they can sell and realize gains. 5. Dilution Management ESOP grants dilute founder and existing shareholder equity-so planning the pool size and grants carefully is critical. ✅️ Taxation (For Company) ESOPs themselves are not an immediate cost to the company. However, the company must report ESOPs in financials and may face accounting expenses (IndAS 102). When employees exercise and sell, tax liability lies with them, not the company. ✅️ Example: Let’s say you offer a star developer 10,000 ESOPs at ₹100. 5 years later, your company’s valuation grows, and the shares are worth ₹1,200 each. They exercise and sell during an IPO. They’ve made a huge gain, and you’ve kept a valuable team member who helped build that success.

Replies (3)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

I have got many DMs regarding ESOPs So Let me Clear up here. 1. Are ESOPs free for employees? ESOPs are granted for free, meaning the employee doesn't pay to receive the options. However, to own the shares, the employee must pay the exercise price

See More

Vishnu dubey

CEO of @EliteSS | In... • 1y

"ESOPs (Employee Stock Ownership Plans) empower employees by giving them a stake in the company’s success. 💼✨ They foster loyalty, boost motivation, and create wealth for employees while aligning their goals with the company’s growth. A win-win for

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get

See More

Ashish Singh

Finding my self 😶�... • 10m

Big Move by Paytm CEO! Vijay Shekhar Sharma, founder & CEO of Paytm, has voluntarily given up 21 million ESOPs worth over ₹1,800 crore. These ESOPs were granted under the 2019 One 97 Employee Stock Option Scheme. This decision follows SEBI’s show-c

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)