Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

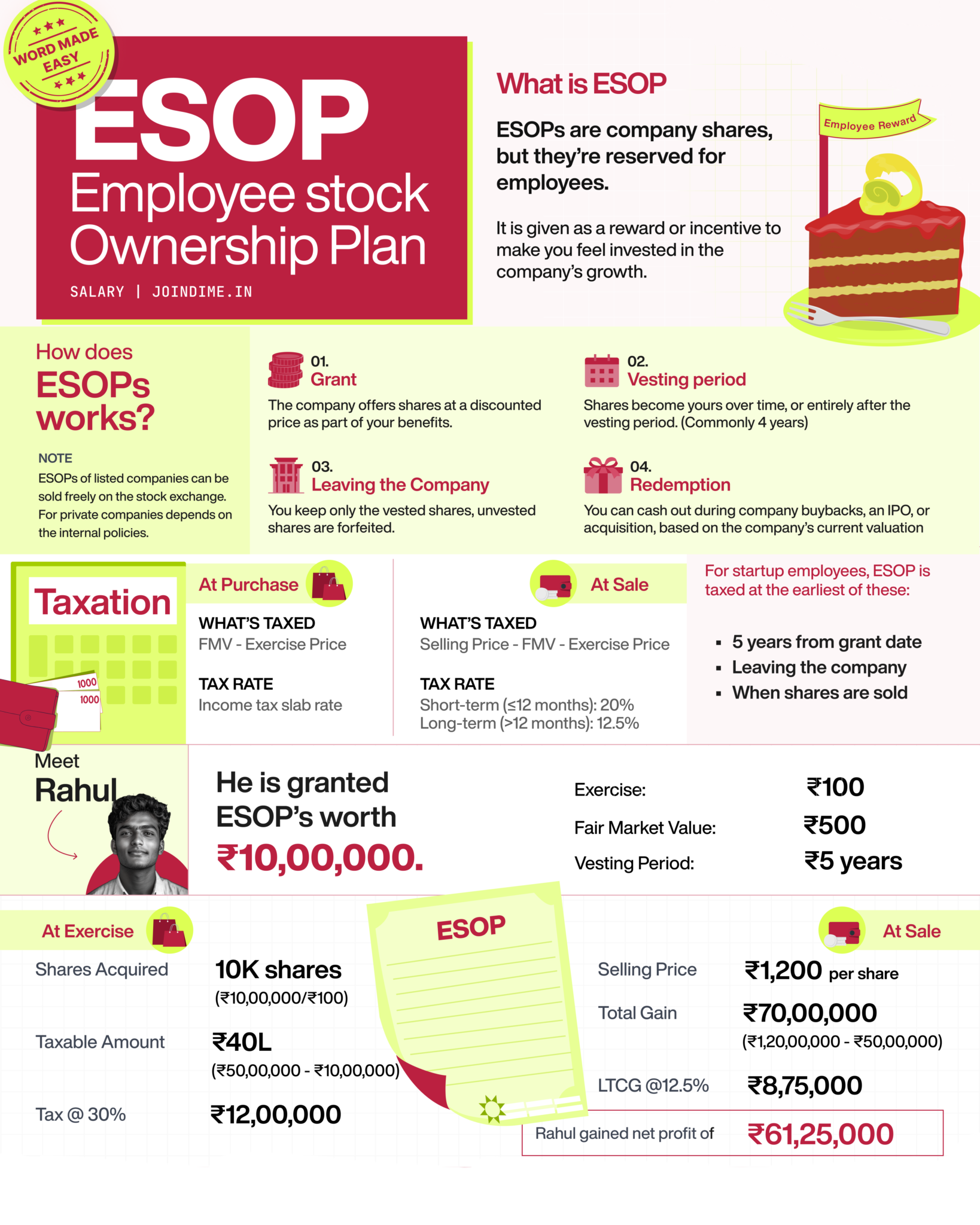

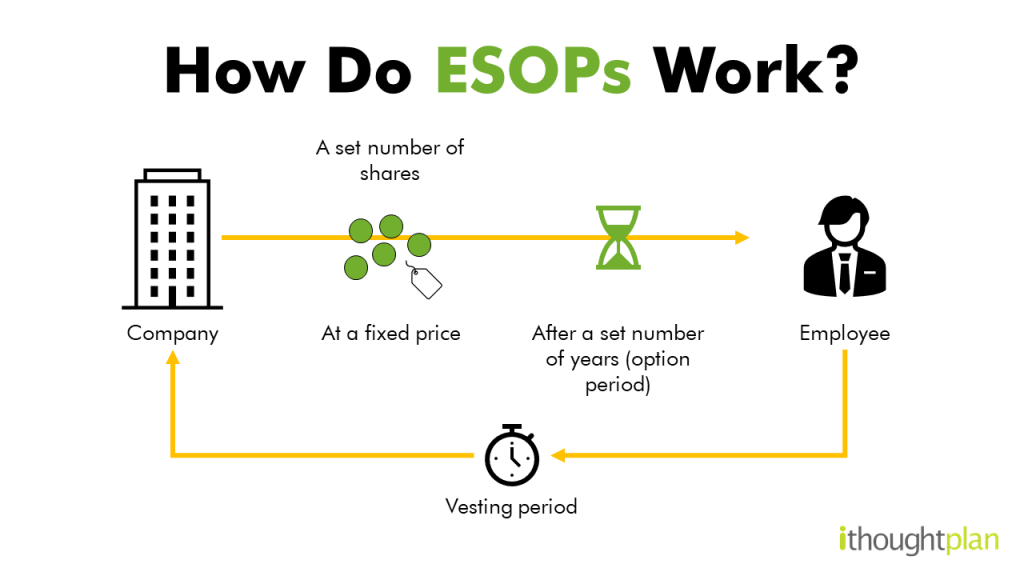

What is an ESOP (Employee Stock Ownership Plan)? ----- Explained. (Employee Perspective) Imagine your company gives you a chance to own a piece of the business. That’s what an ESOP is company shares reserved for employees like you. You don’t get them all at once, and you don’t get them for free, but you get them at a much lower price than the public would pay. ⁉️ How ESOP Works in 4 Simple Steps 1. Grant Your company says: “We’re giving you 10,000 shares at ₹100 each. You’ll earn the right to own them over time.” 2. Vesting Period This is like a waiting period. Shares become yours gradually, often over 4 to 5 years. For example, if you stay 5 years, you get to keep 100% of them. 3. Leaving the Company If you leave early, you only keep the shares that have vested. The rest are forfeited. 4. Redemption (Selling Your Shares) After they’re vested, you can sell your shares-maybe when the company goes public (IPO), buys them back, or gets acquired. ⁉️ Taxxxes (Yes, There Are Two Stages)👀 1. At Exercise When you buy the shares You pay tax on the difference between the market price and the price you pay (this is called “perquisite tax”). 2. At Sale When you sell the shares You pay tax on the profit (sale price minus market value at the time you exercised the shares). ✅️ If you held them for >1 year: Taxed at 12.5% ✅️ If <1 year: Taxed at 20% Example: Rahul's ESOP Journey He’s given 10,000 shares at ₹100 each After 5 years, the shares are worth ₹500 (market value) He buys all 10,000 shares at ₹100 = ₹10,00,000 Since market value is ₹500, the taxable amount is ₹40,00,000 and he pays ₹12,00,000 tax 2 years later, he sells them at ₹1,200 per share Profit = ₹1.2 Cr - ₹50L = ₹70L Capital gains tax @12.5% = ₹8.75L Net Profit = ₹61.25L

Replies (9)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

What is an ESOP from a Company’s Perspective?🚀 An Employee Stock Ownership Plan (ESOP) is a tool companies use to attract, retain, and motivate talent by offering them ownership in the business. You’re not just giving away shares, you’re building

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

I have got many DMs regarding ESOPs So Let me Clear up here. 1. Are ESOPs free for employees? ESOPs are granted for free, meaning the employee doesn't pay to receive the options. However, to own the shares, the employee must pay the exercise price

See More

gray man

I'm just a normal gu... • 9m

After a muted IPO and listing, EV major Ather Energy ended its first trading session 7.22% below its listing price at INR 302.50 on the BSE. Compared to its IPO price of INR 321, the company’s shares crashed 5.76%. Earlier today, the shares of the E

See More

financialnews

Founder And CEO Of F... • 1y

Waaree Energies shares make strong debut, list at ₹2,500 on NSE, up 66.3% over IPO price . . Shares of Waaree Energies made a strong on the bourses on Monday, October 28, listing at ₹2,500 on NSE, a premium of 66.33 percent to the issue price of ₹1,5

See Morefinancialnews

Founder And CEO Of F... • 1y

Swiggy shares list at ₹420 on NSE, opening 7.7% above IPO price in a highly anticipated debut Swiggy's IPO debuted at ₹420 on NSE, up 7.7% from its issue price. The IPO was oversubscribed 3.59 times, attracting significant interest from institutiona

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)