Back

Dinakar

Nobody • 1y

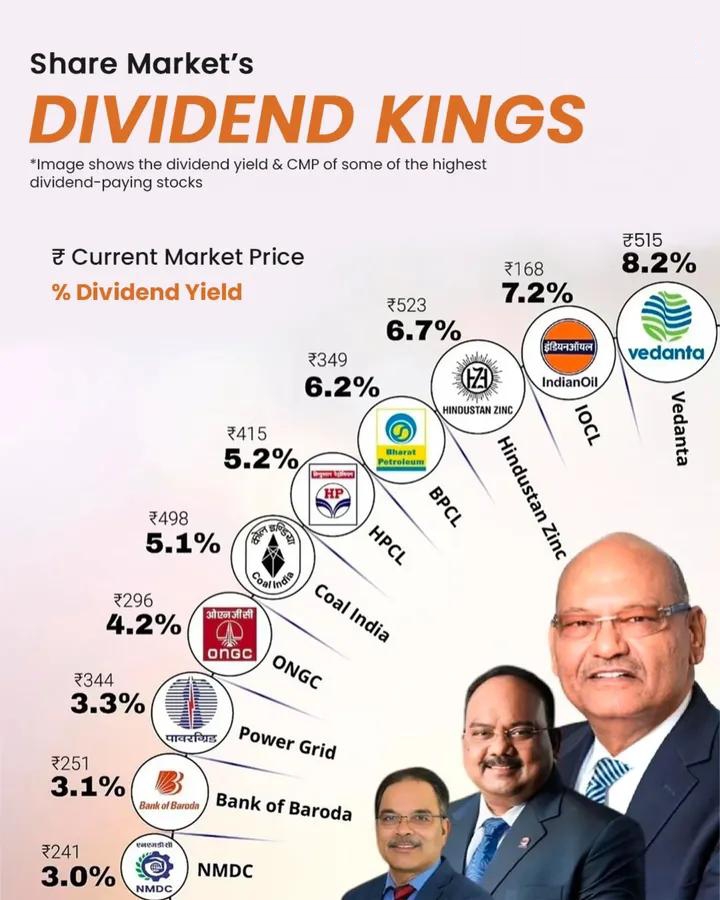

What are dividends? Dividends are a sum of money that is paid by the company to their share holders out of it's profits. Tax on dividends - Dividends are part of our taxable income according to our tax bracket. Earlier, the companies used to pay DDT, before it was distributed. But now shareholders pay it according to their respective tax bracket. Dividend yield = Dividend amount/Current stock price × 100 How to get dividends? First the company declares that they are distributing dividends to their share holders, this date is the dividend declaration date. You must have bought the shares before the ex-dividend date. The ex-dividend date will be declared by the company so keep an eye out for it. Then comes the record date which will be approximately 30-40 days of dividend declaration. The company's registrar checks who all are eligible to receive dividends. Then finally comes the dividend payout date, we'll recieve the dividend on our bank a/c which is linked to our demat a/c.

Replies (2)

More like this

Recommendations from Medial

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Dividends When a company makes a profit, it can choose to share a portion of the profit with its shareholders as a reward for their investment. This "reward" given by the company to it's shareholders is called a dividend Di

See MoreRohan Saha

Founder - Burn Inves... • 9m

I’ve noticed a lot of people make this mistake they invest in a company just because it offers good dividends, without looking at anything else. But that’s not really a smart approach. The dividends you get are based on how much you invest. So if yo

See MoreMehul Fanawala

•

The Clueless Company • 1y

When the income tax return filing date is near, the income tax department goes into full marketing mode to remind taxpayers to file on time. Guess what? Even they have targets and quotas like our marketing and sales teams! 🎯 Imagine the tax offic

See More

AASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)