Back

Sairaj Kadam

Student & Financial ... • 1y

Understanding Taxation: Salary vs. Income Hey there! Let’s talk about something essential in finance—taxation—and the difference between salary and income. First off, your salary is the fixed amount you earn from your employer, usually detailed in your employment contract. For example, if you have an annual salary of $50,000, that’s the base amount you receive before any taxes or deductions. Now, income is a broader term. It includes not just your salary but also any bonuses, investment income, rental income, freelance earnings, and more. So, if your salary is $50,000 and you earn an additional $15,000 from investments and side jobs, your total income would be $65,000. Remember, taxes are calculated on your total income, not just your salary. This distinction is crucial for understanding your financial situation and tax obligations. Curious to learn more about how taxation works and how to manage it? Let’s chat! Drop your questions below!

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 9m

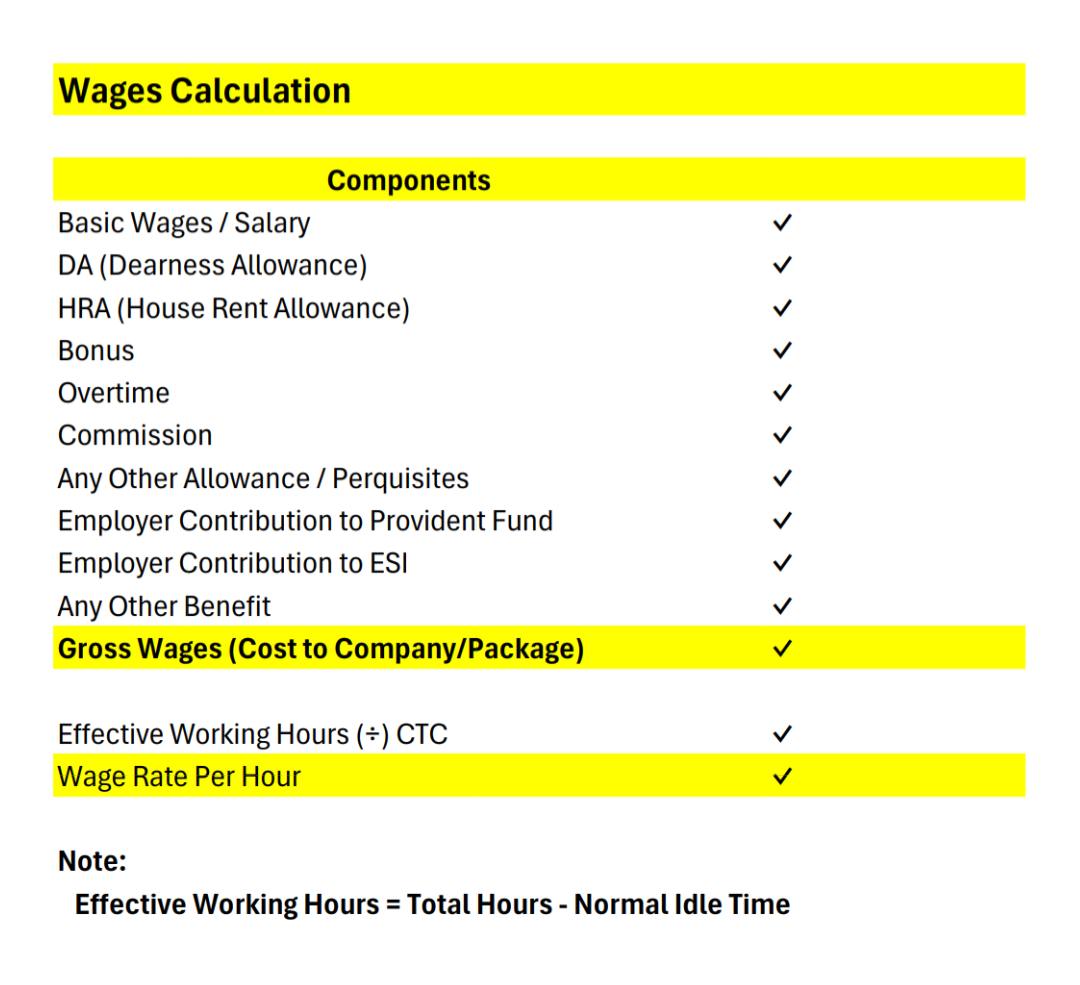

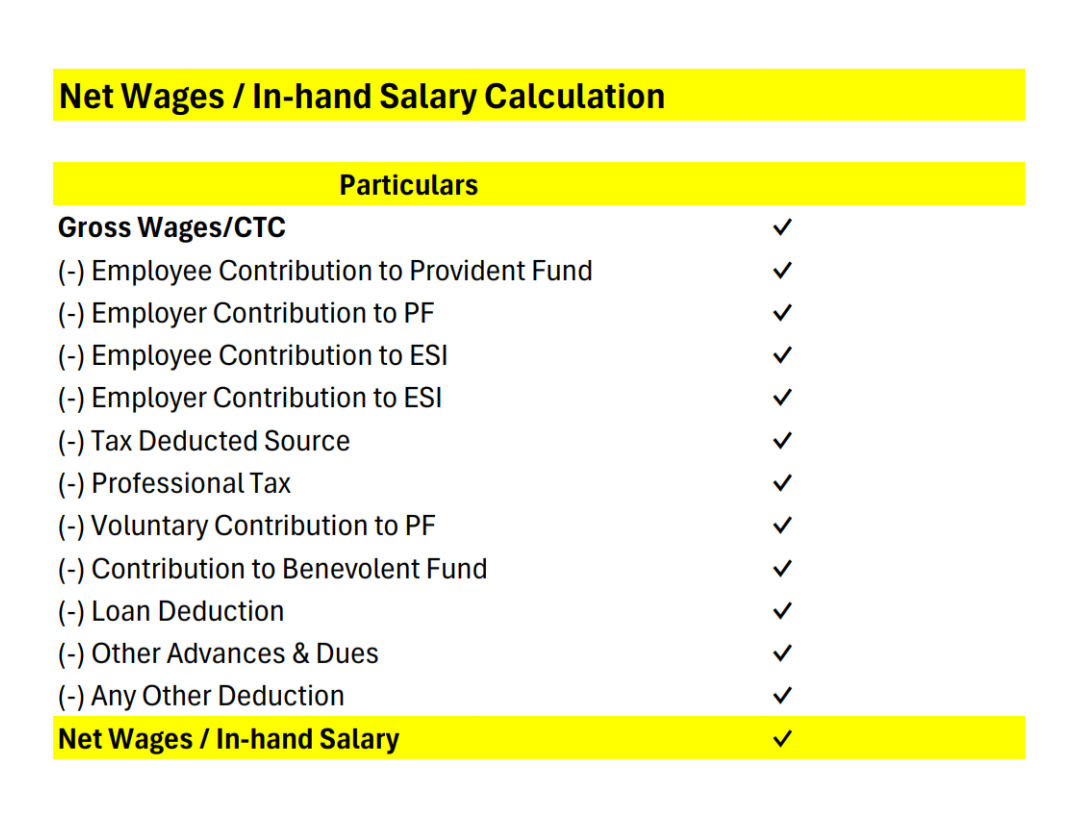

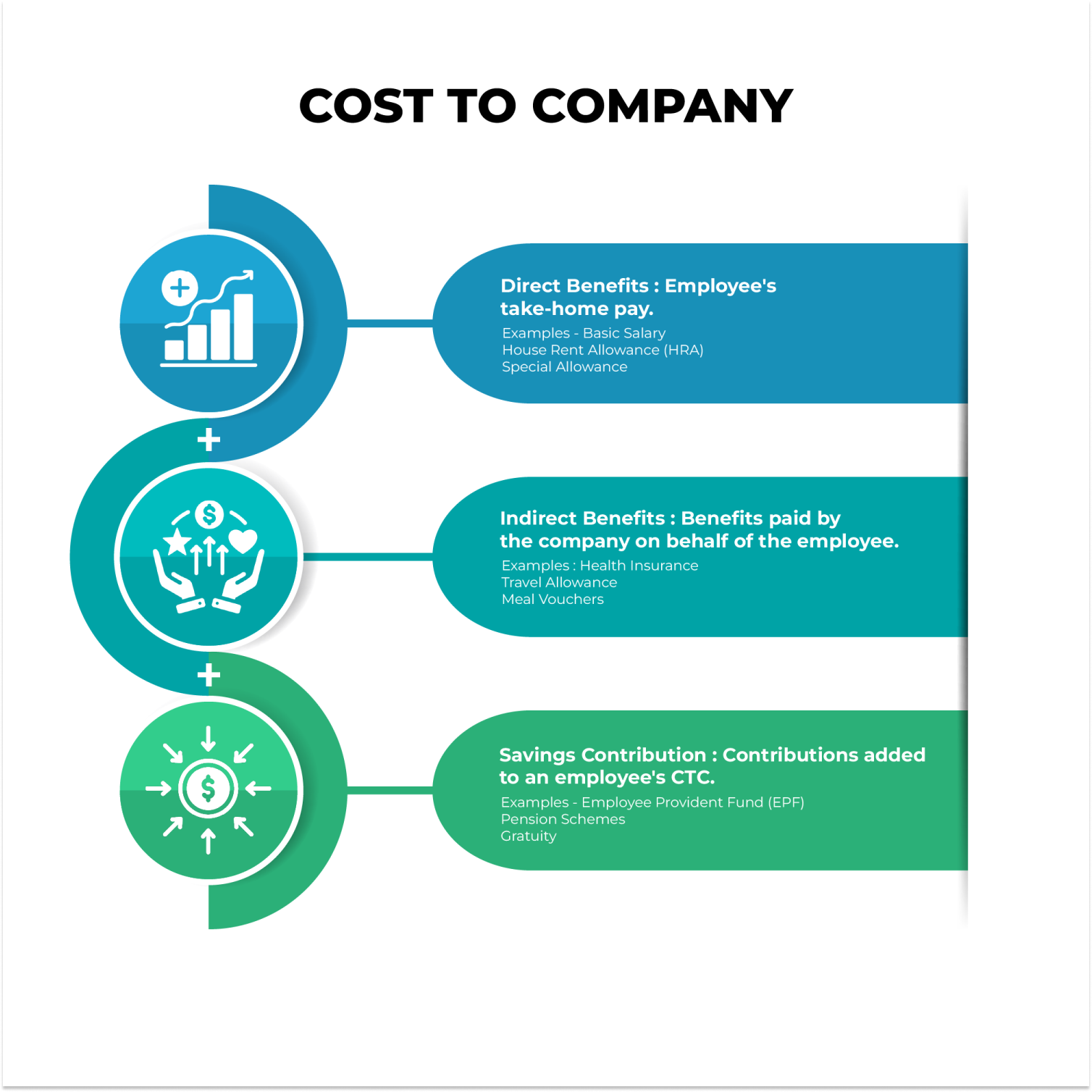

How to Calculate Employee Cost to Company (CTC) & Understand In-Hand Salary. 🤔 1️⃣ Cost to Company (CTC): CTC represents the total amount a company spends on an employee annually. It includes: + Basic Salary + Dearness Allowance (DA) + House Rent

See More

Shubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See MoreHavish Gupta

Figuring Out • 2y

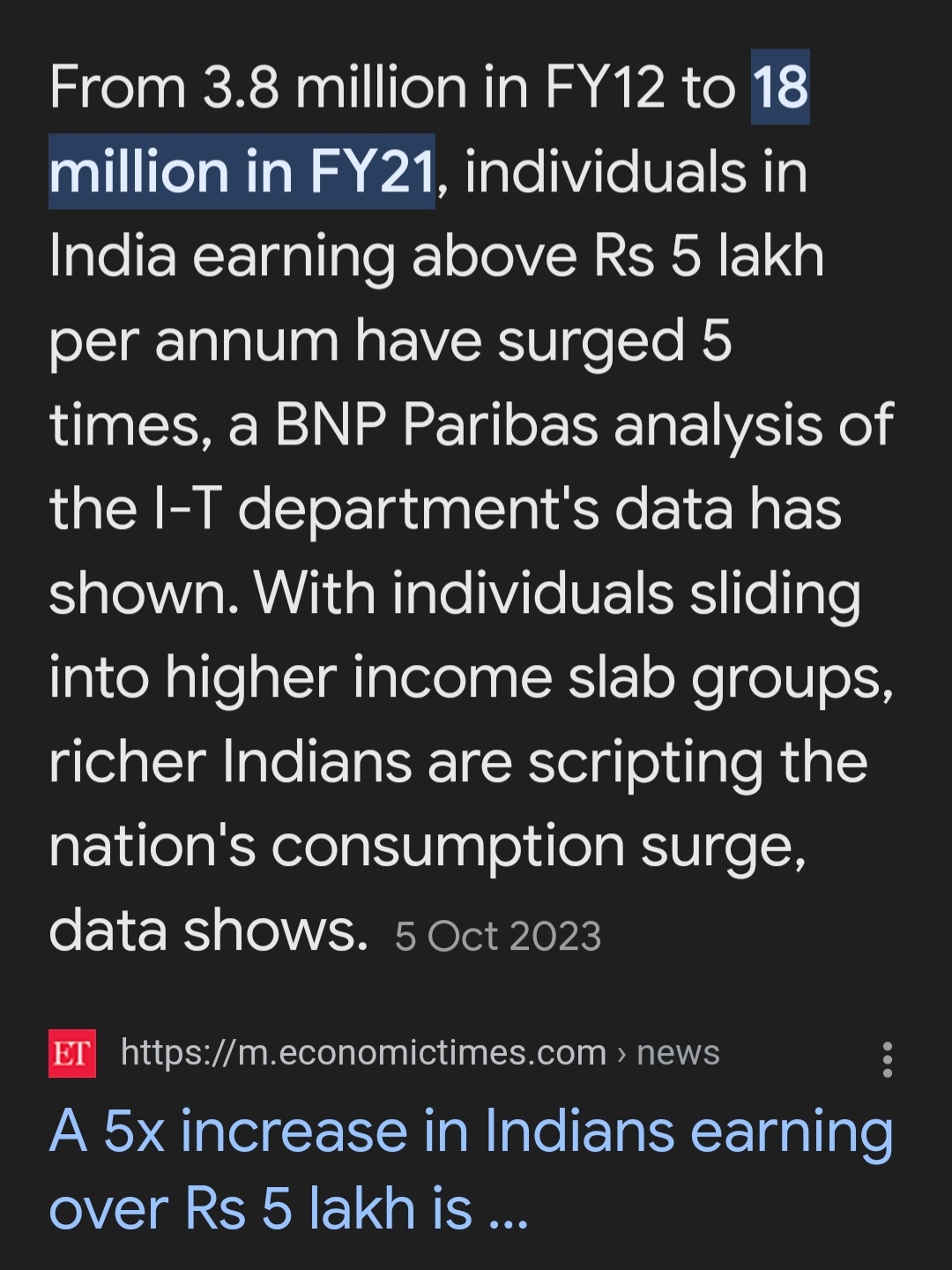

Many of you have know that only less than 5% population in india, pays taxes. But there is reason for it. According to this economic times report, only 1.8 crore people earn more than 5 lakhs annually (~2%). And if you earn less than 5 lakhs, you leg

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)