Back

Shubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Trading: ITR-3 3. Salary + Capital Gains + F&O Trading: ITR-3 (or ITR-4 if opting for presumptive taxation) 4. Only Intraday Trading: ITR-3 5. Only F&O Trading: ITR-3 (or ITR-4 if opting for presumptive taxation) 6. Salary + F&O Trading: ITR-3 (or ITR-4 if opting for presumptive taxation) 7. Salary + Intraday Trading: ITR-3 Choosing the correct ITR form is crucial for accurate reporting. In case of any clarification you can connect with us anytime. Thanks Shubham 8826624959

Replies (1)

More like this

Recommendations from Medial

Linkrcap Studio

A digital news platf... • 22d

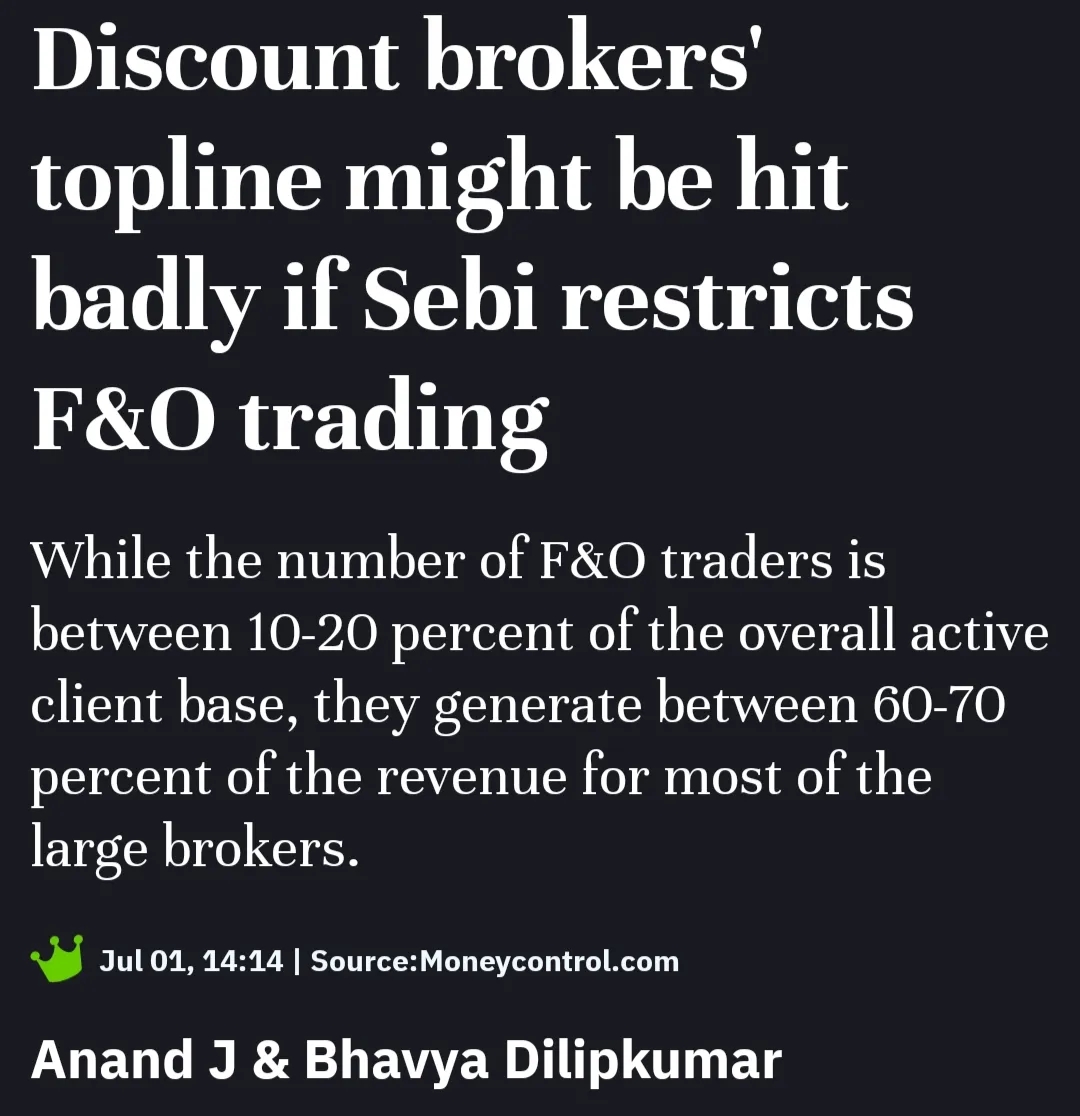

Shares of online brokerage platform Groww remain under pressure for the second straight trading session after the finance minister Nirmala Sitharaman proposed hiking securities transacation tax (STT) on F&O derivatives during her ninth Budget speech

See More

Shuvodip Ray

•

Arizona State University • 7m

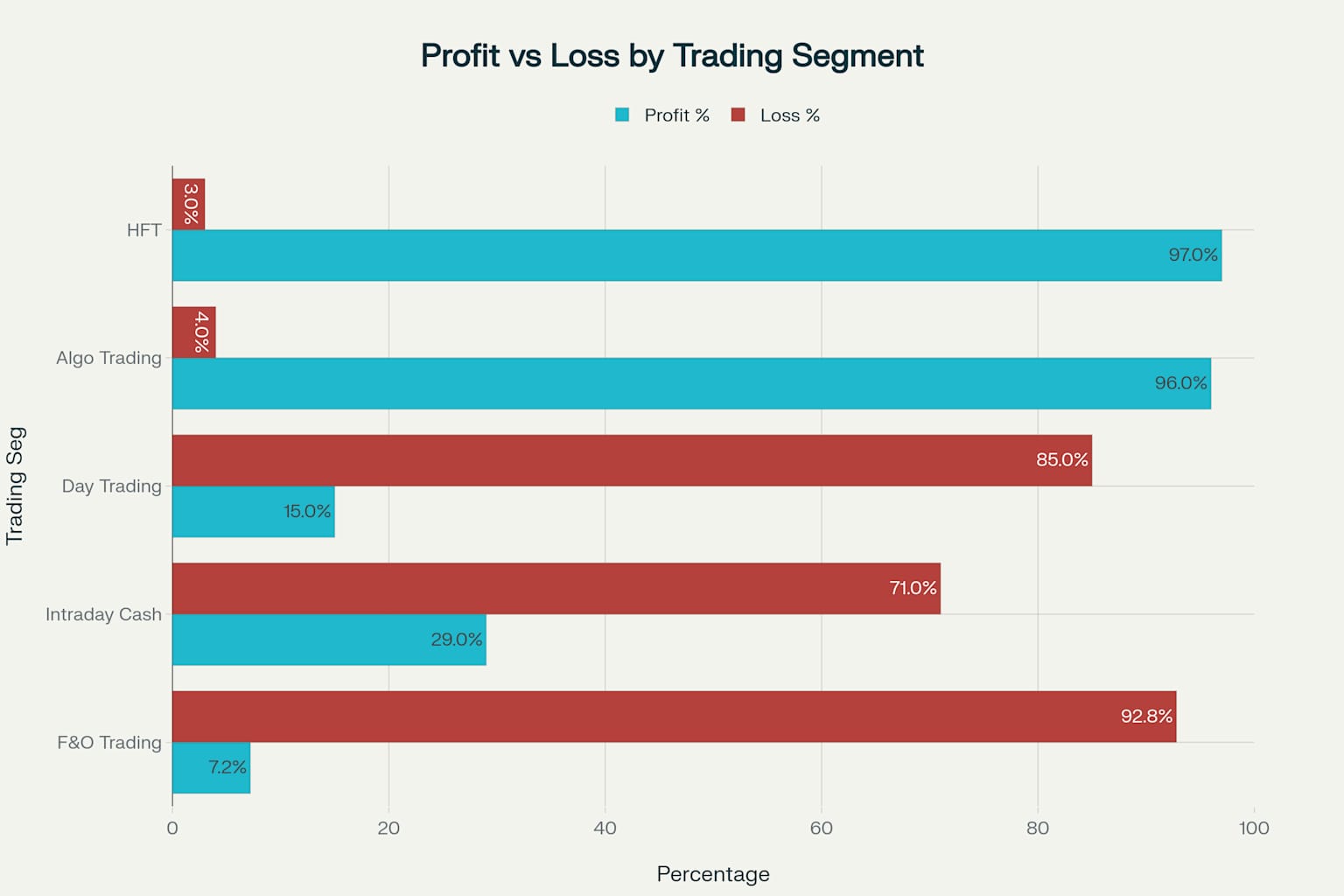

📈Over 90% of retail traders in India lose money, especially in futures & options (F&O) and day trading. >> Who Actually Makes Money? ✅Institutional Traders: Banks, hedge funds, and big firms using algorithms and high-frequency trading. ✅Algorithmic

See More

CA Dipika Pathak

Partner at D P S A &... • 1y

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)