Back

Anonymous

Hey I am on Medial • 1y

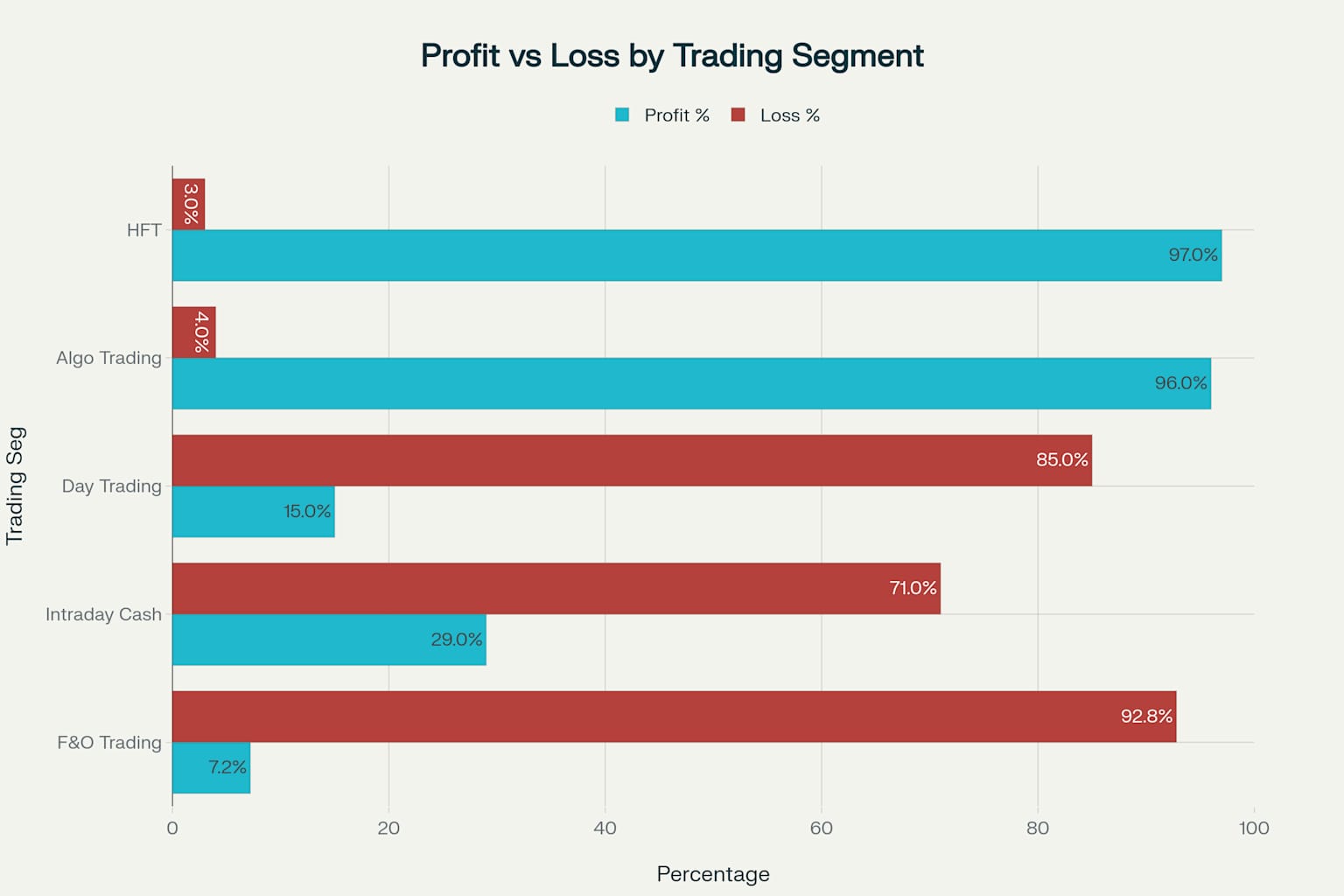

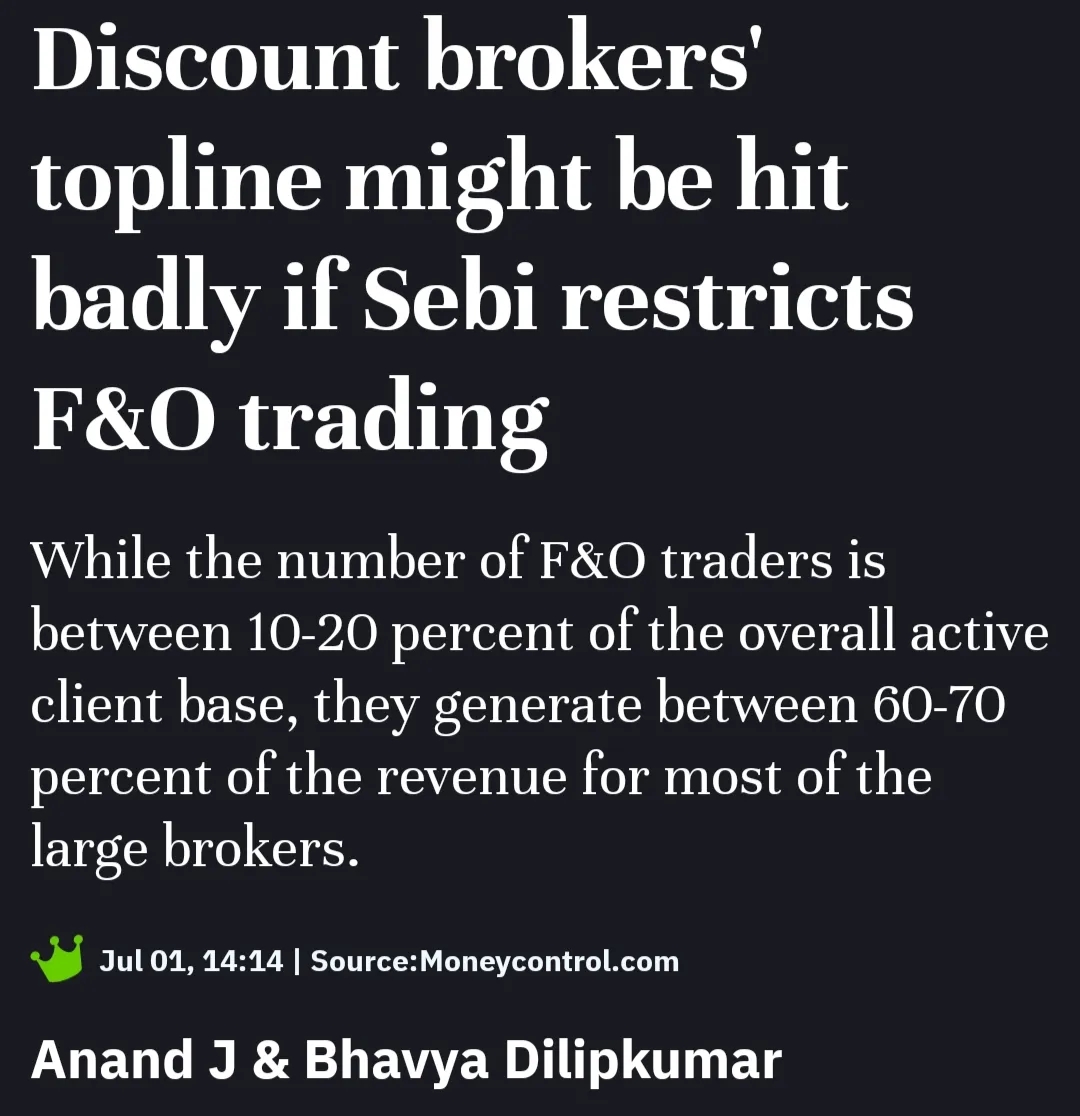

What are your thoughts 🤔 on SEBI's new regulations for Futures & Options (F&O) trading. On October 1, 2024, SEBI announced new rules for futures and options (F&O) trading, effective from November 20, 2024. Key changes include: (1) Upfront Premium Payments: Option buyers must pay premiums upfront (2) Intraday Monitoring: Position limits will be monitored throughout the day starting April 1, 2025 (3) Weekly Expiry Limit: Only one index per exchange will have weekly expiries (4) Additional Margin Requirements: An extra 2% extreme loss margin for short options on expiry day (5) Increased Contract Size: Minimum trading size raised from ₹5 lakh to ₹15 lakh Do you believe these regulations will ultimately benefit retail investors, or do they primarily restrict their opportunities in the market?

Replies (5)

More like this

Recommendations from Medial

Shuvodip Ray

•

Arizona State University • 7m

📈Over 90% of retail traders in India lose money, especially in futures & options (F&O) and day trading. >> Who Actually Makes Money? ✅Institutional Traders: Banks, hedge funds, and big firms using algorithms and high-frequency trading. ✅Algorithmic

See More

VIJAY PANJWANI

Learning is a key to... • 11d

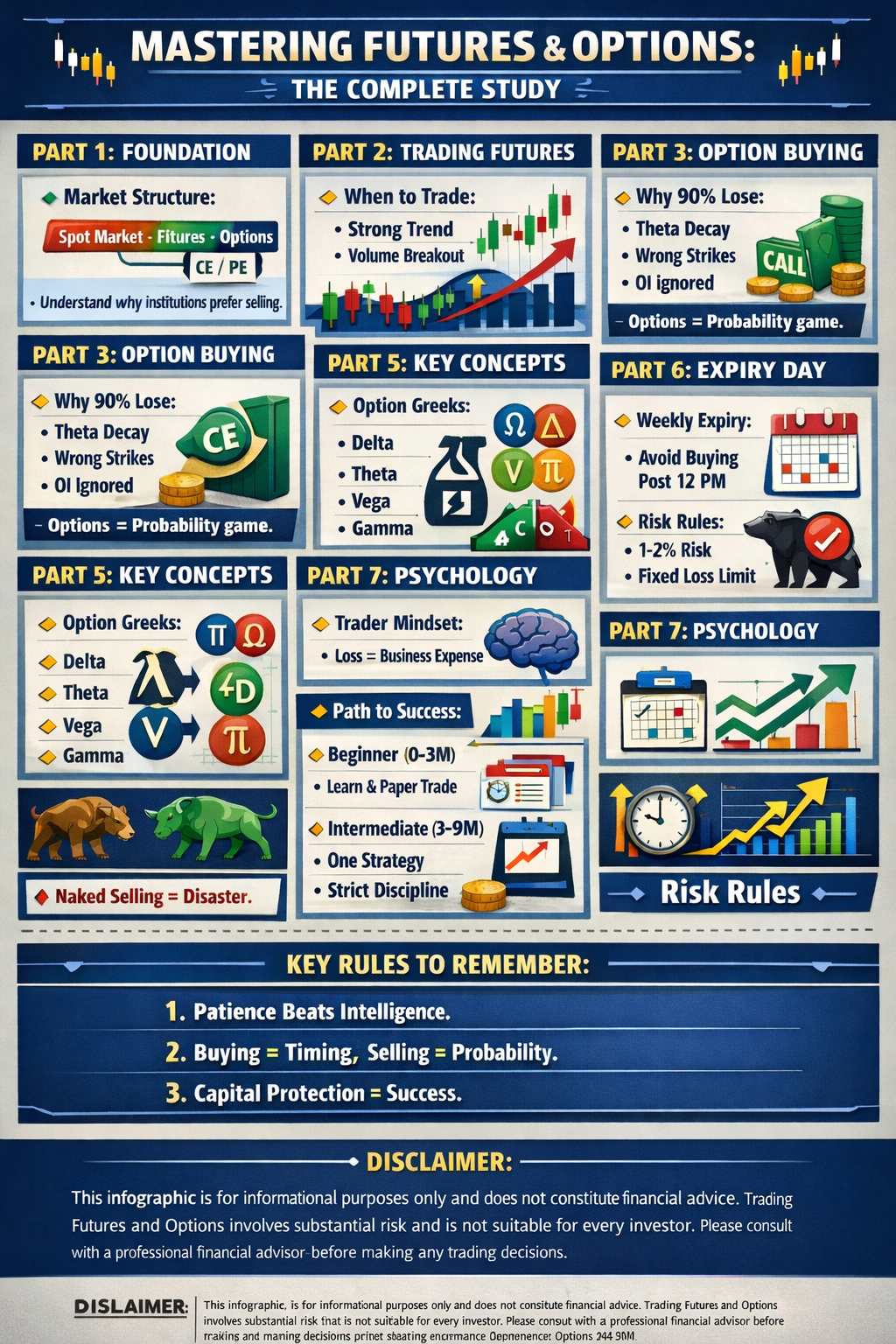

F&O isn’t gambling it’s a game of probability, data & discipline. This infographic breaks down Futures & Options the right way: ✔ When to buy ✔ When to sell ✔ Where most traders lose ✔ How smart money survives Save it. Study it. Trade smarter. ⚠

See More

Ashish Tiwari

Try again, Fail agai... • 7m

Hi, I'm building SM-Arth — Bharat's first platform focused on responsible and informed Futures & Options and Crypto trading. Here's the problem: According to SEBI, 89% of Indian retail traders lose money. Why? Because they trade without education,

See MoreShubham Jain

Partner @ Finshark A... • 1y

ITR Forms for Stock Market Income📈 A lot of people have been asking about which ITR form to use for stock market income. Here's a quick guide to clear up any confusion 👇 1. Salary + Capital Gains: ITR-2 2. Salary + Capital Gains + Intraday Tradi

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)