Back

CA Dipika Pathak

Partner at D P S A &... • 1y

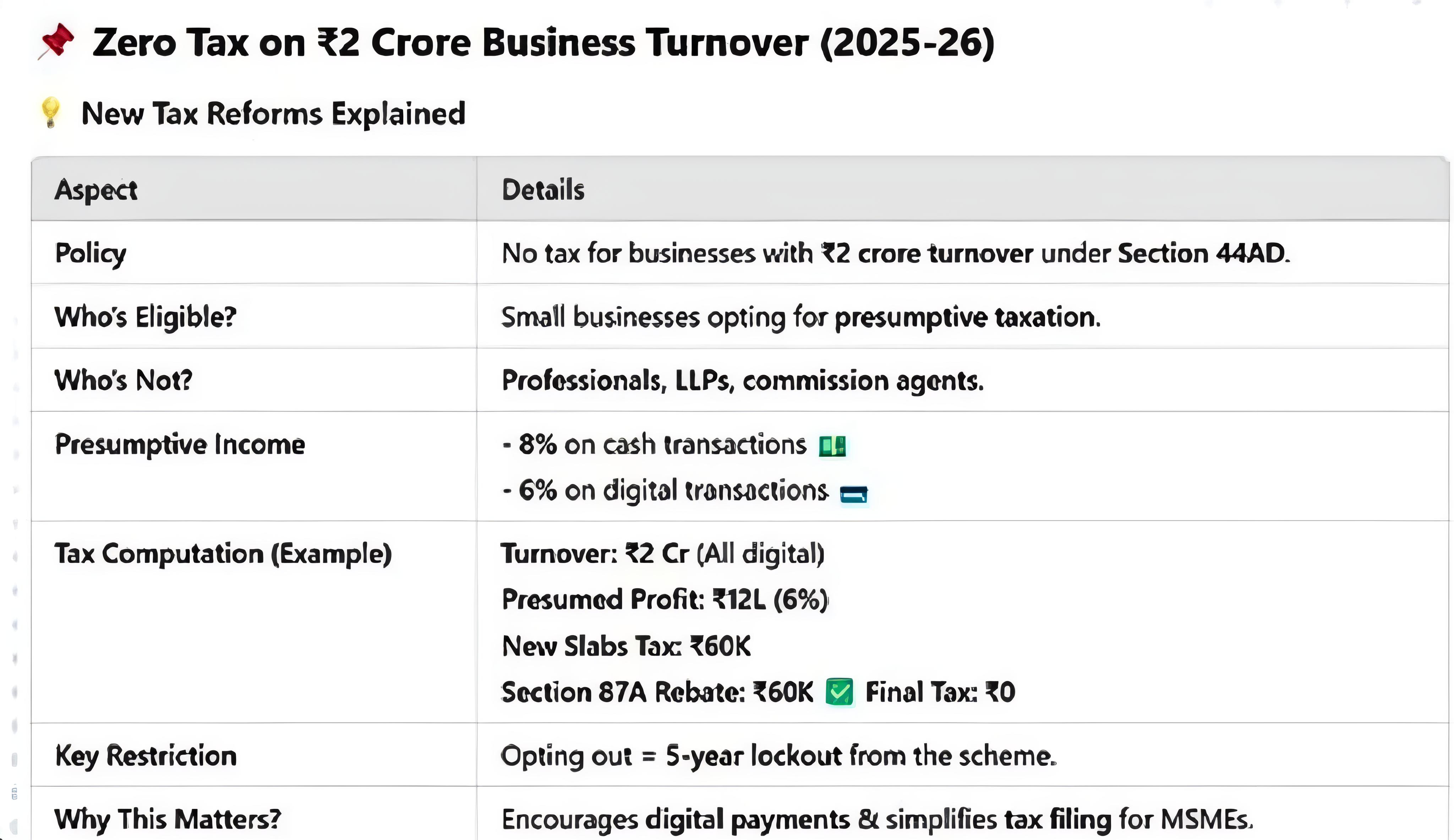

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sales, turnover or gross receipts exceed Rs.1 crore in the FY ➡️If cash transactions are up to 5% of total gross receipts and payments, the threshold limit of turnover for tax audit is Rs.10 crores

Replies (1)

More like this

Recommendations from Medial

Sai Vishnu

Income Tax & GST Con... • 11m

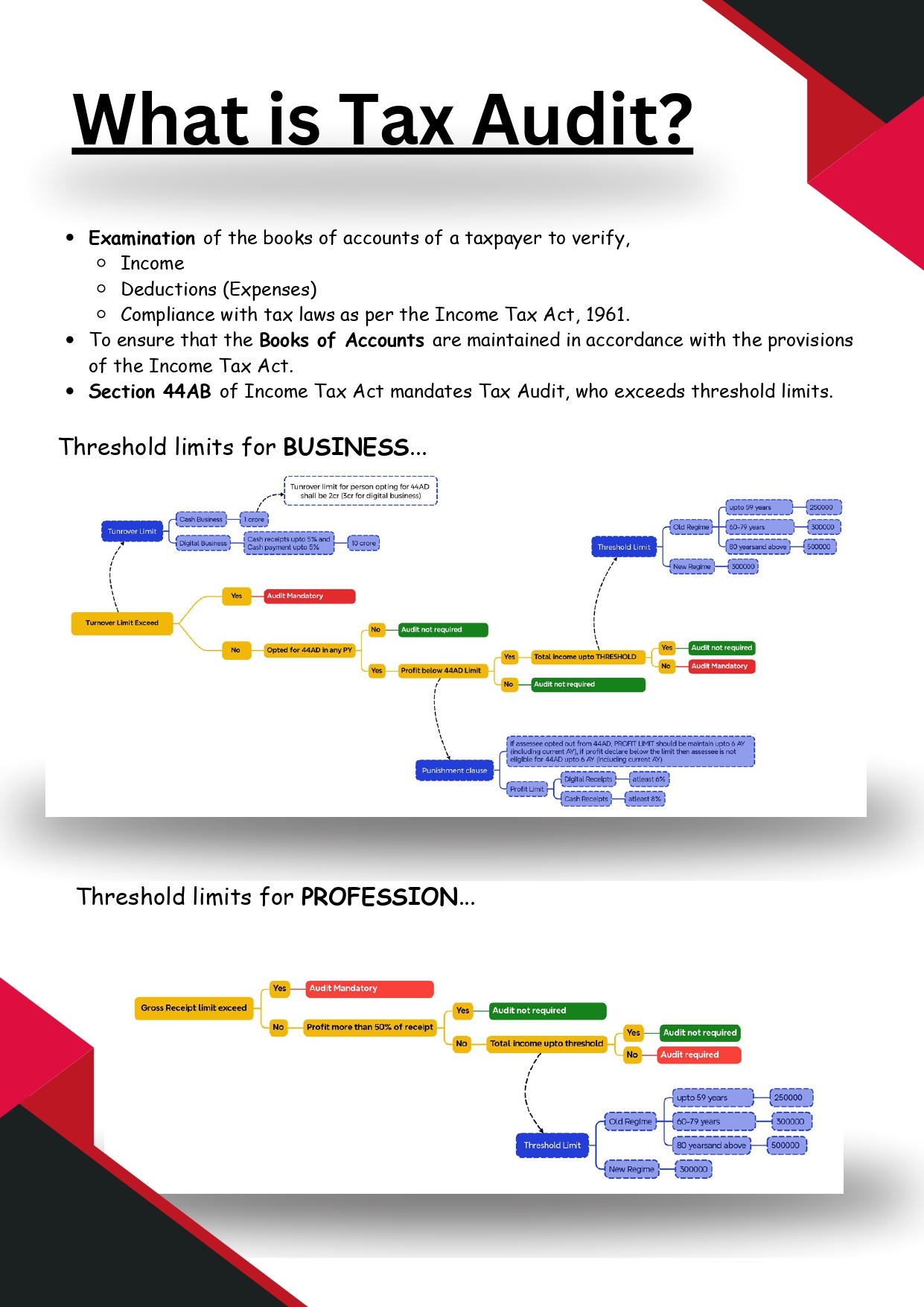

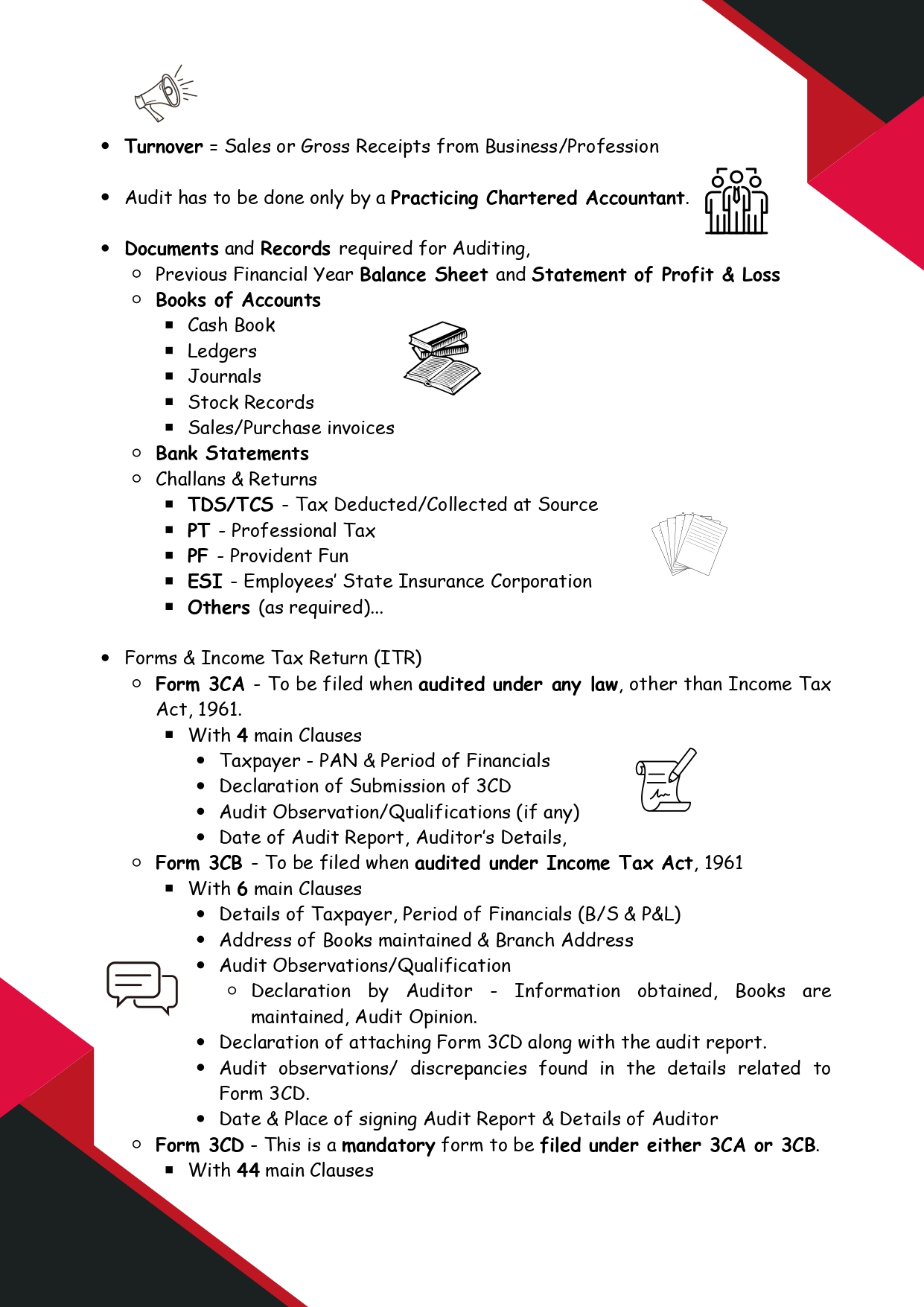

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)