Back

Sai Vishnu

Income Tax & GST Con... • 11m

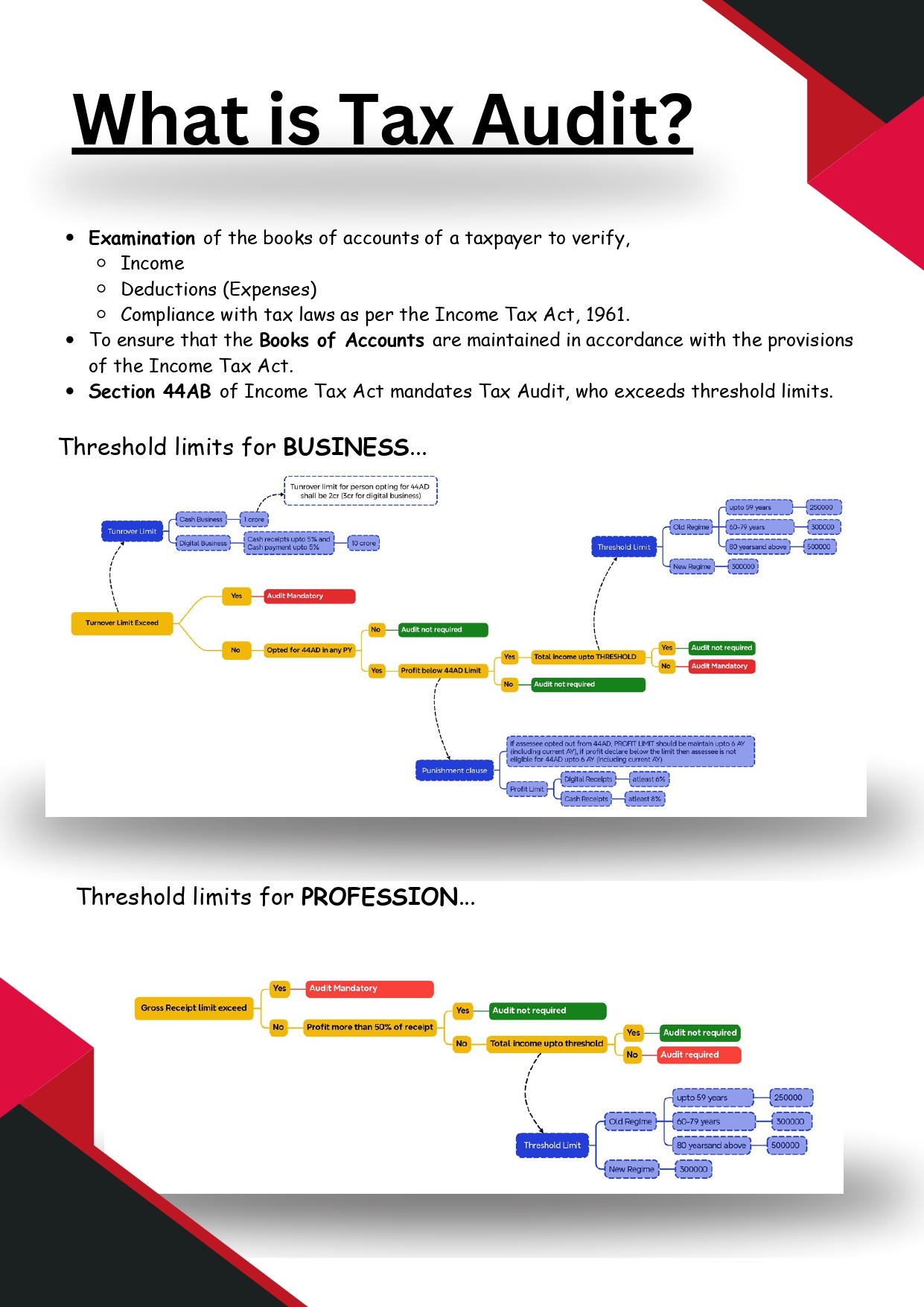

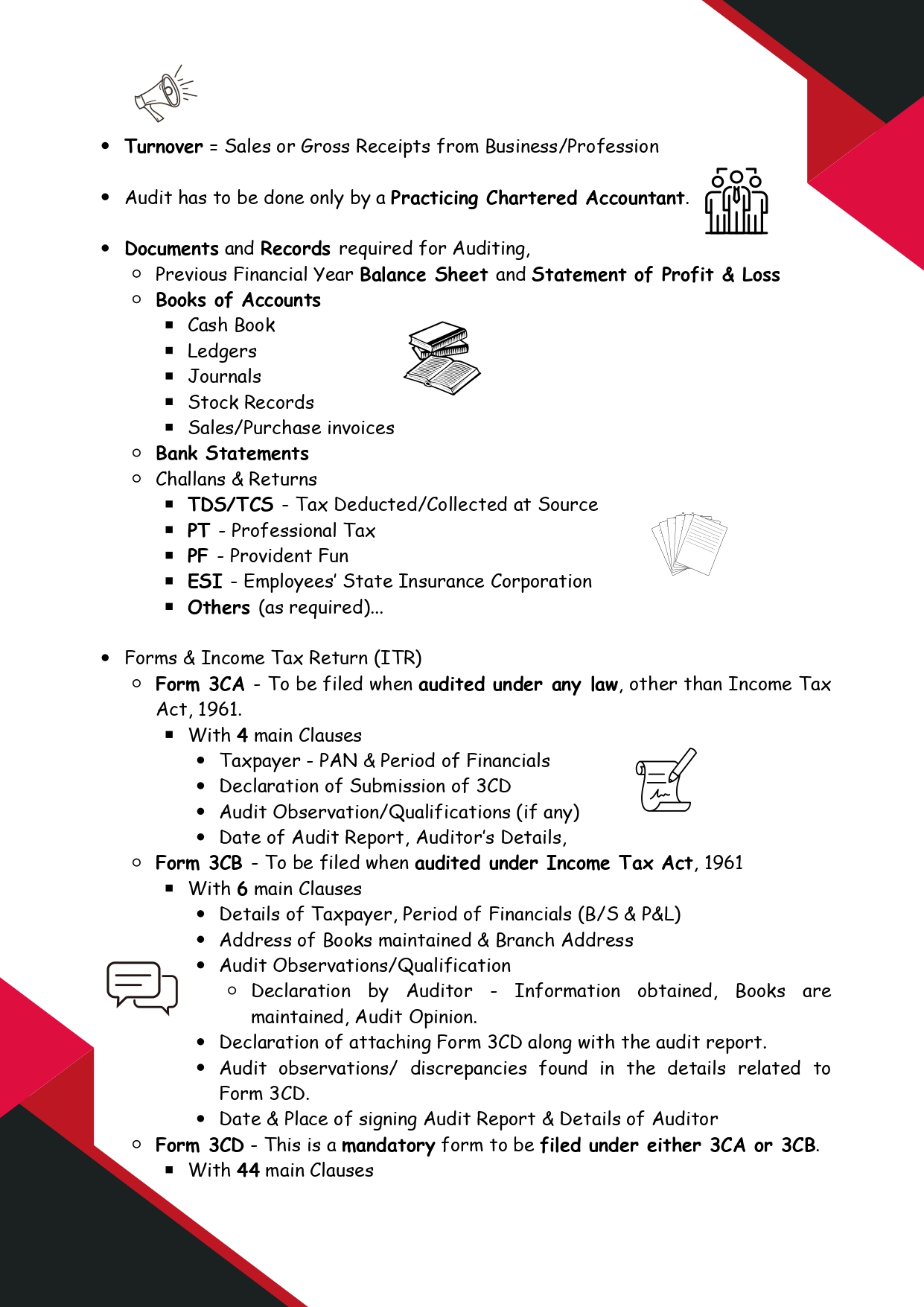

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Proper maintenance of records 📌 Who Needs a Tax Audit? 💼 Businesses & Professionals exceeding threshold limits under Section 44AB must get their accounts audited. 📝 Key Highlights: 📊 Turnover limits for businesses & professionals 📑 Mandatory forms – 3CA, 3CB, 3CD, 3CE ⏳ Due date – 30th September every year ⚠️ Penalty – 0.5% of turnover or ₹1,50,000 (whichever is lower) 💡 Why is Tax Audit Important? ✔ Ensures transparency & compliance ✔ Prevents tax evasion ✔ Reduces tax risks 📢 Aspiring CAs & Finance Enthusiasts – SAVE THIS POST! 🔖 Let's make finance simple and accessible! 🚀 Tag a friend who should know this! #TaxAudit #Finance #IncomeTax #CA #Audit #Taxation 👉🏻 #SecretsOnFinance

More like this

Recommendations from Medial

CA Dipika Pathak

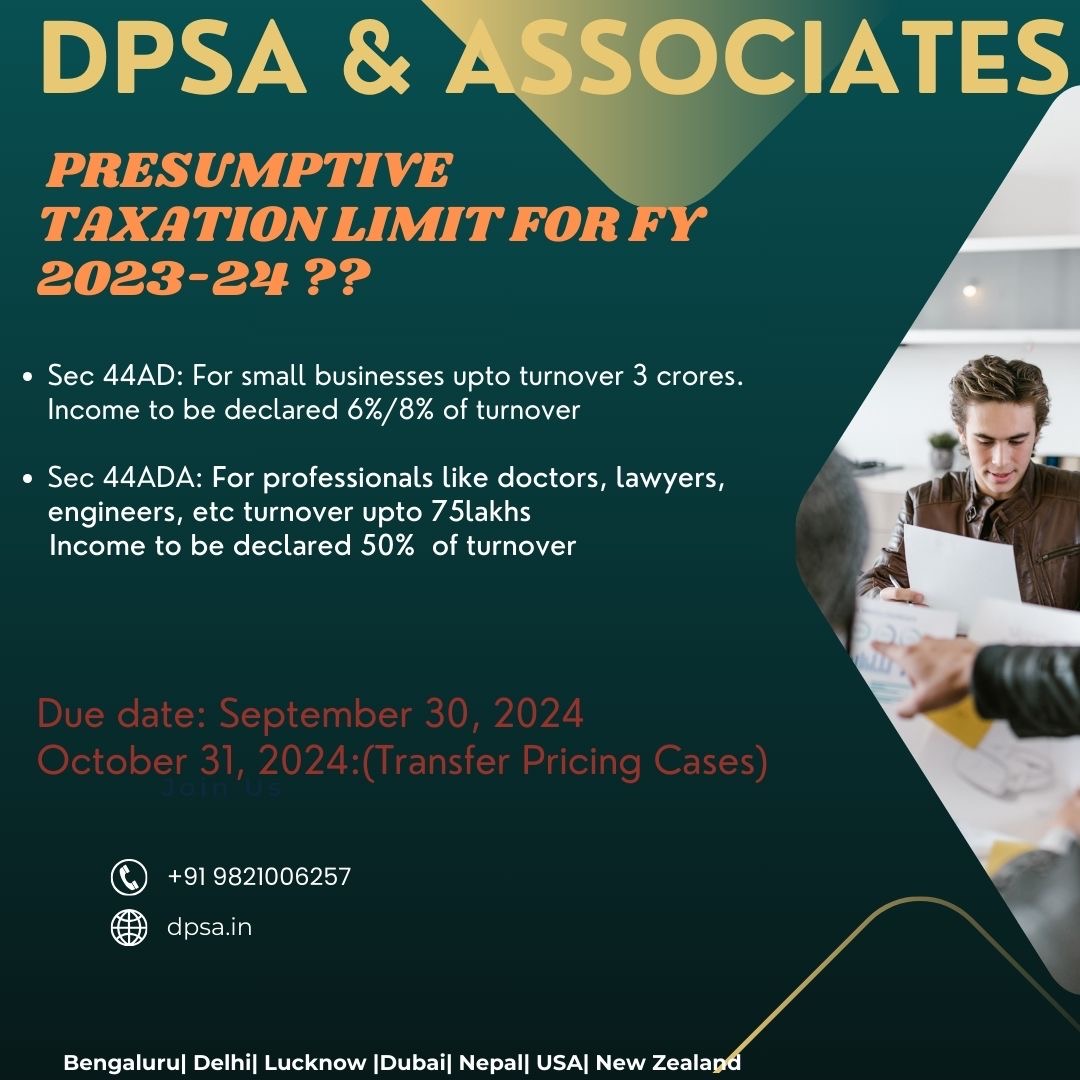

Partner at D P S A &... • 1y

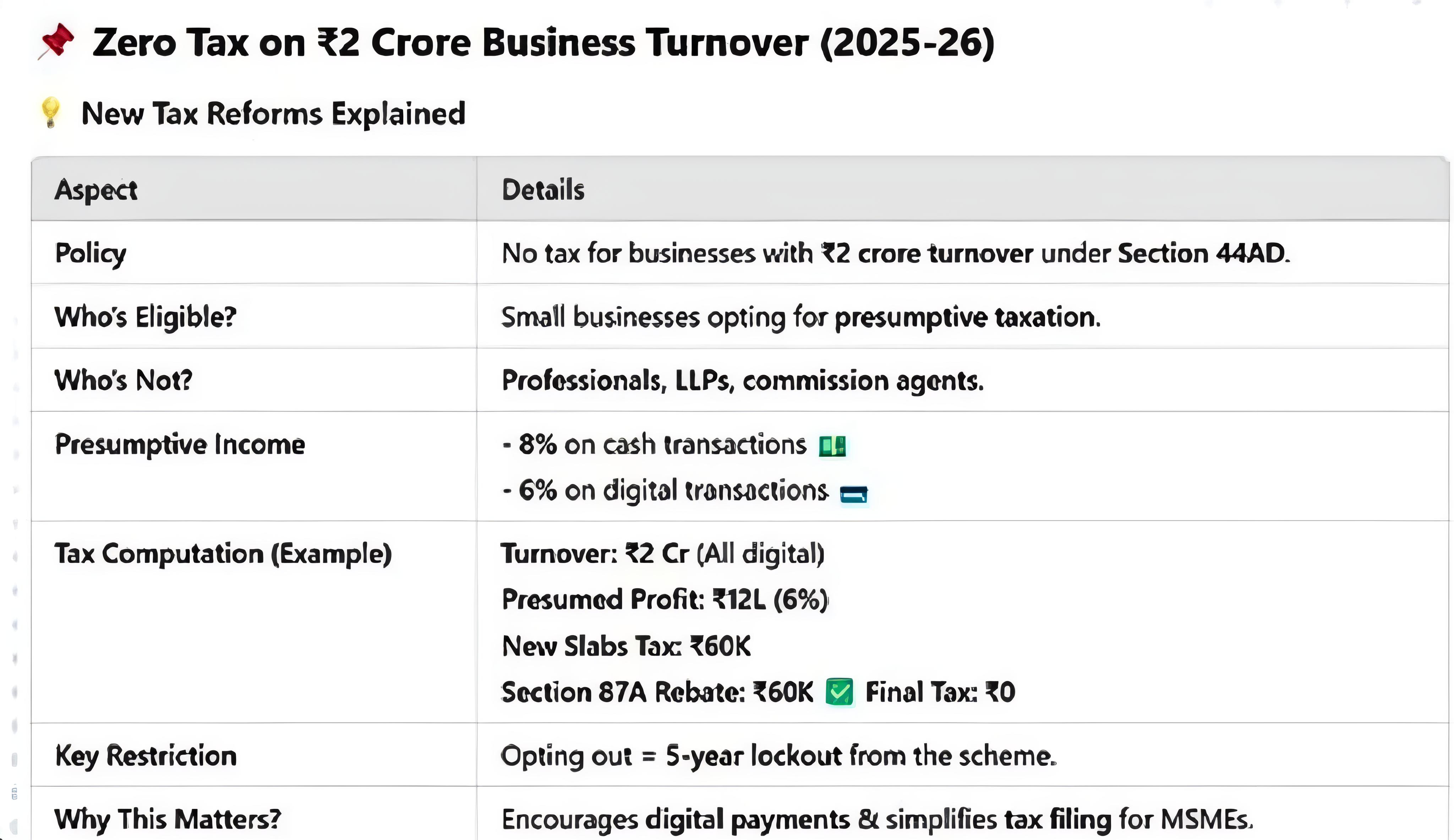

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

CA Kakul Gupta

Chartered Accountant... • 10m

The Government of India has revised the investment and turnover limits for MSME classification. As per the latest notification, the new limits are: Investment criteria ✅ Micro Enterprises: Up to ₹2.5 crore (earlier ₹1 crore) ✅ Small Enterprises

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

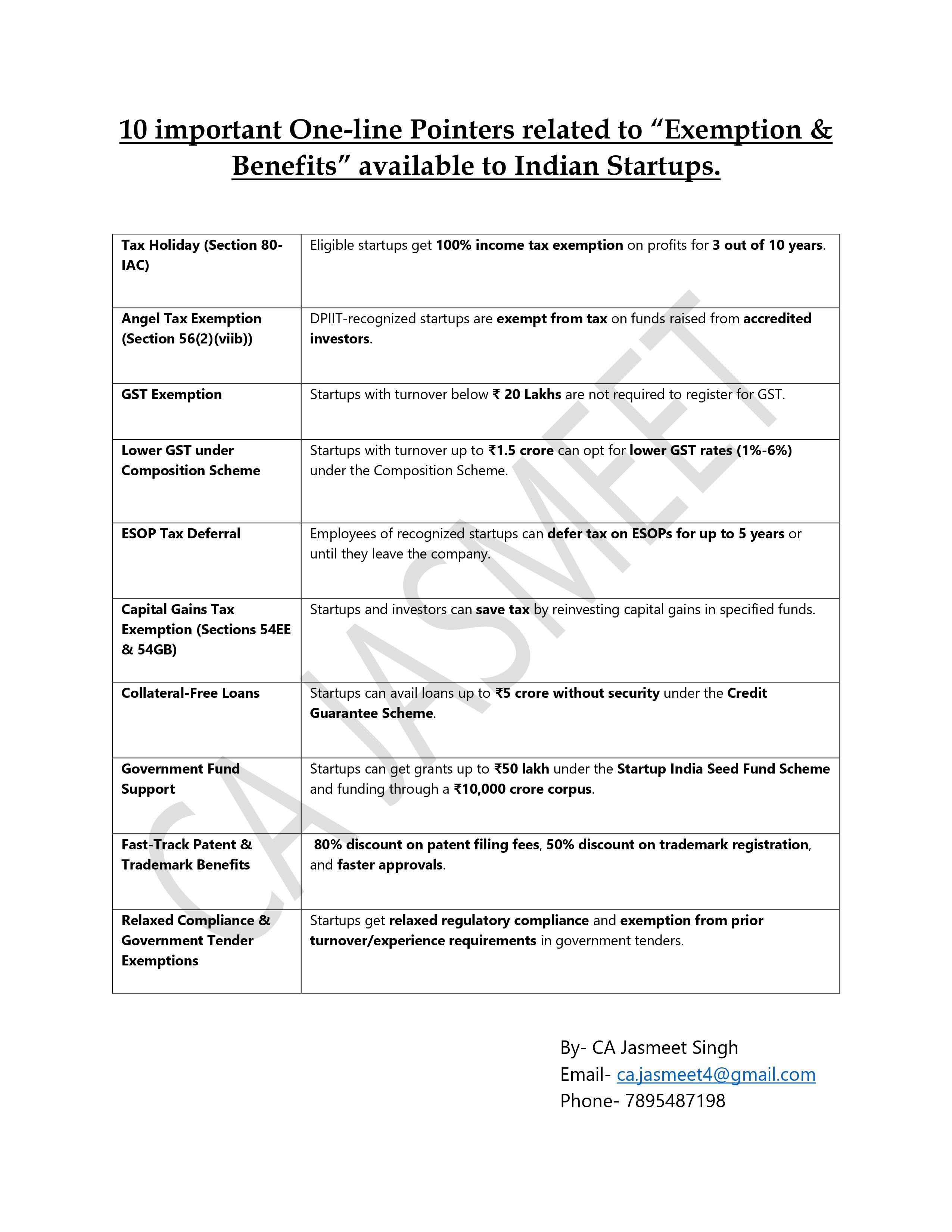

In God We Trust, The... • 1y

🌟 Big News for Startups! 🚀💼 Did you know Indian startups get amazing tax breaks, funding support, and compliance relaxations? 🏦📊 From 100% tax exemptions to collateral-free loans, here are 10 key benefits every entrepreneur must know! 💡✅ 🔥 C

See More

CA Jasmeet Singh

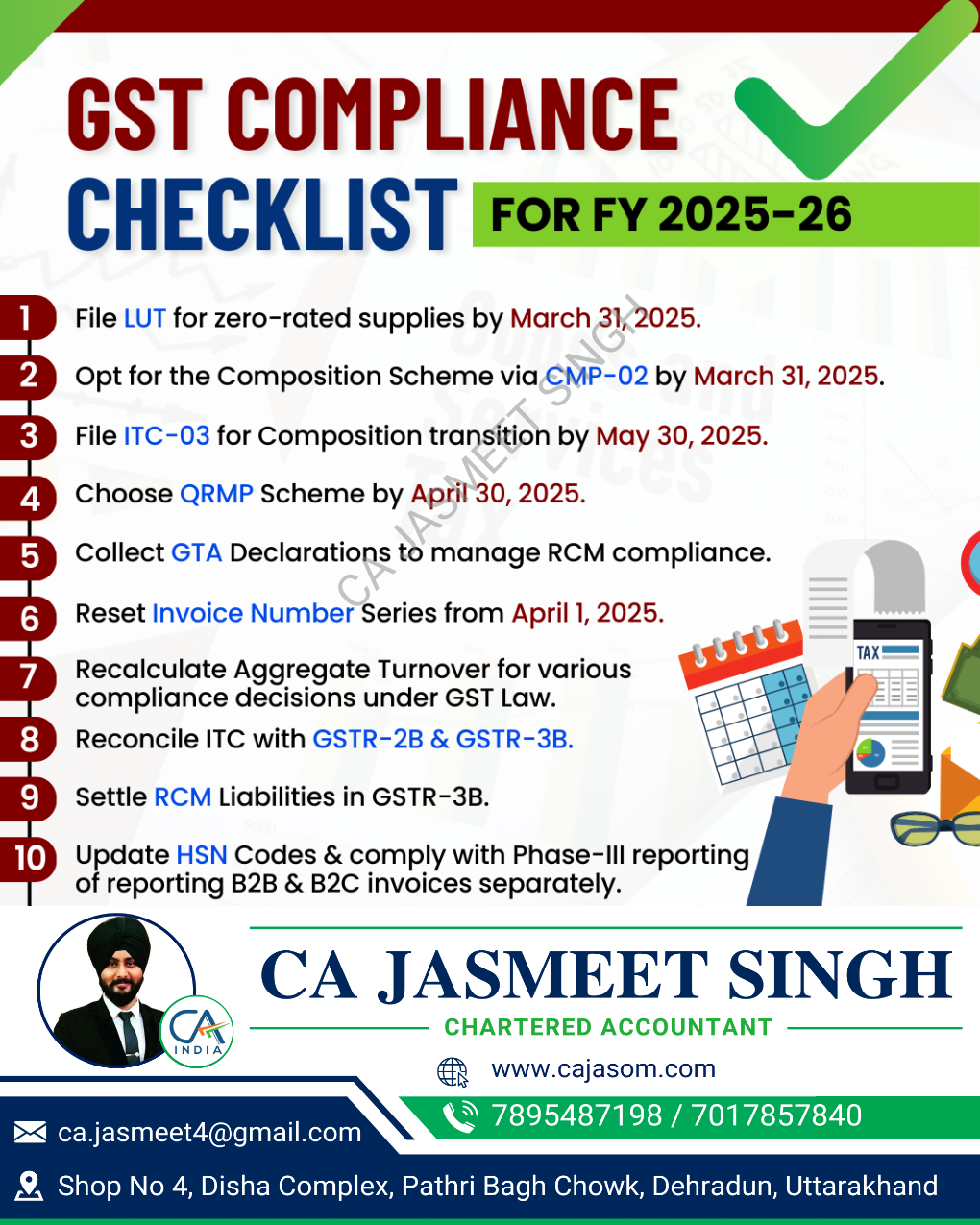

In God We Trust, The... • 11m

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

CA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreSheikh Ayan

Founder of VistaSec:... • 11m

🔍 Top Log Monitoring Tools for Cybersecurity 🔍 Protecting your digital assets starts with real-time log monitoring! Here are the top log monitoring tools every cybersecurity professional should know: ✅ Splunk – Advanced analytics, real-time monit

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)