Back

Anonymous

Hey I am on Medial • 1y

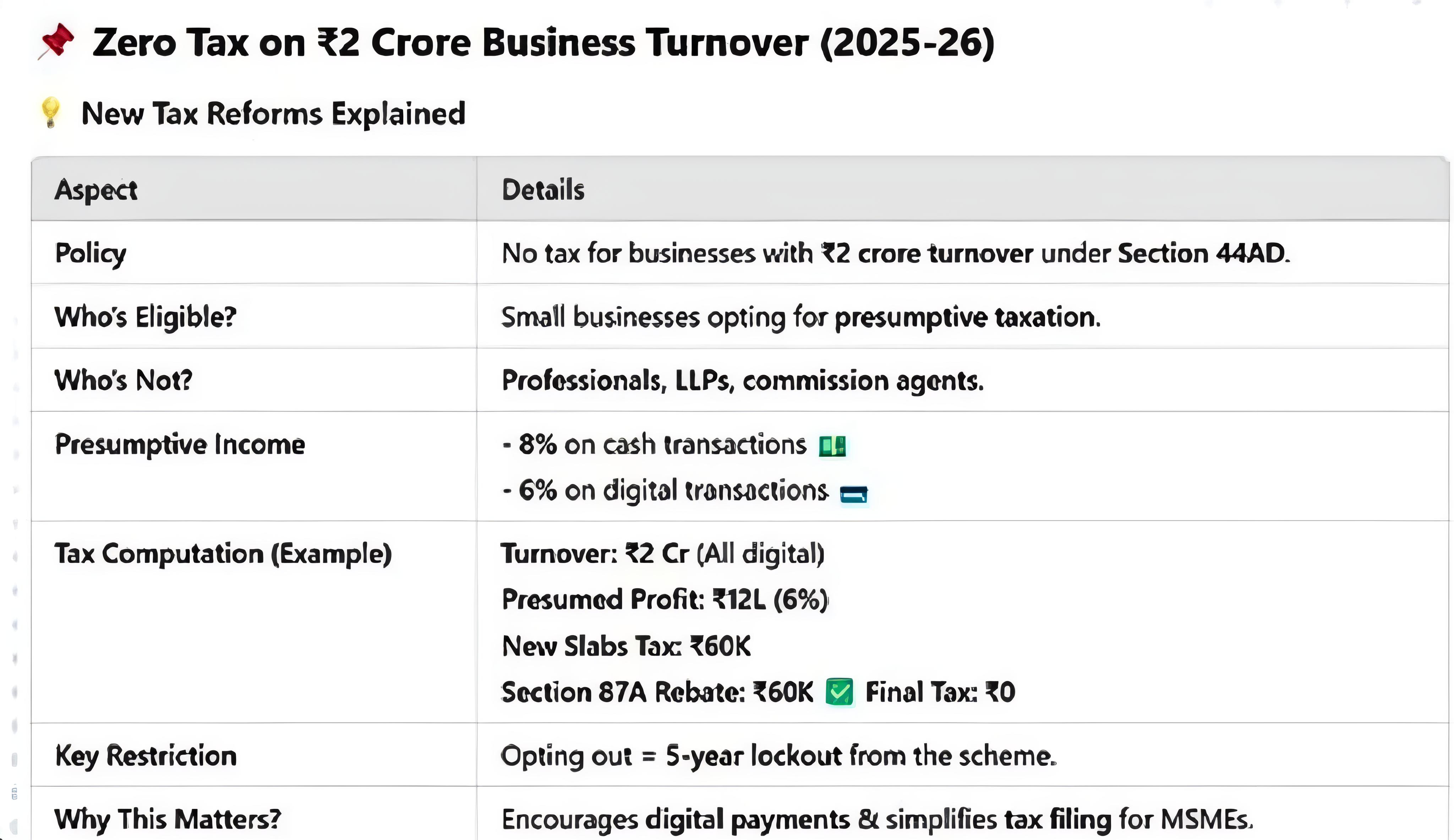

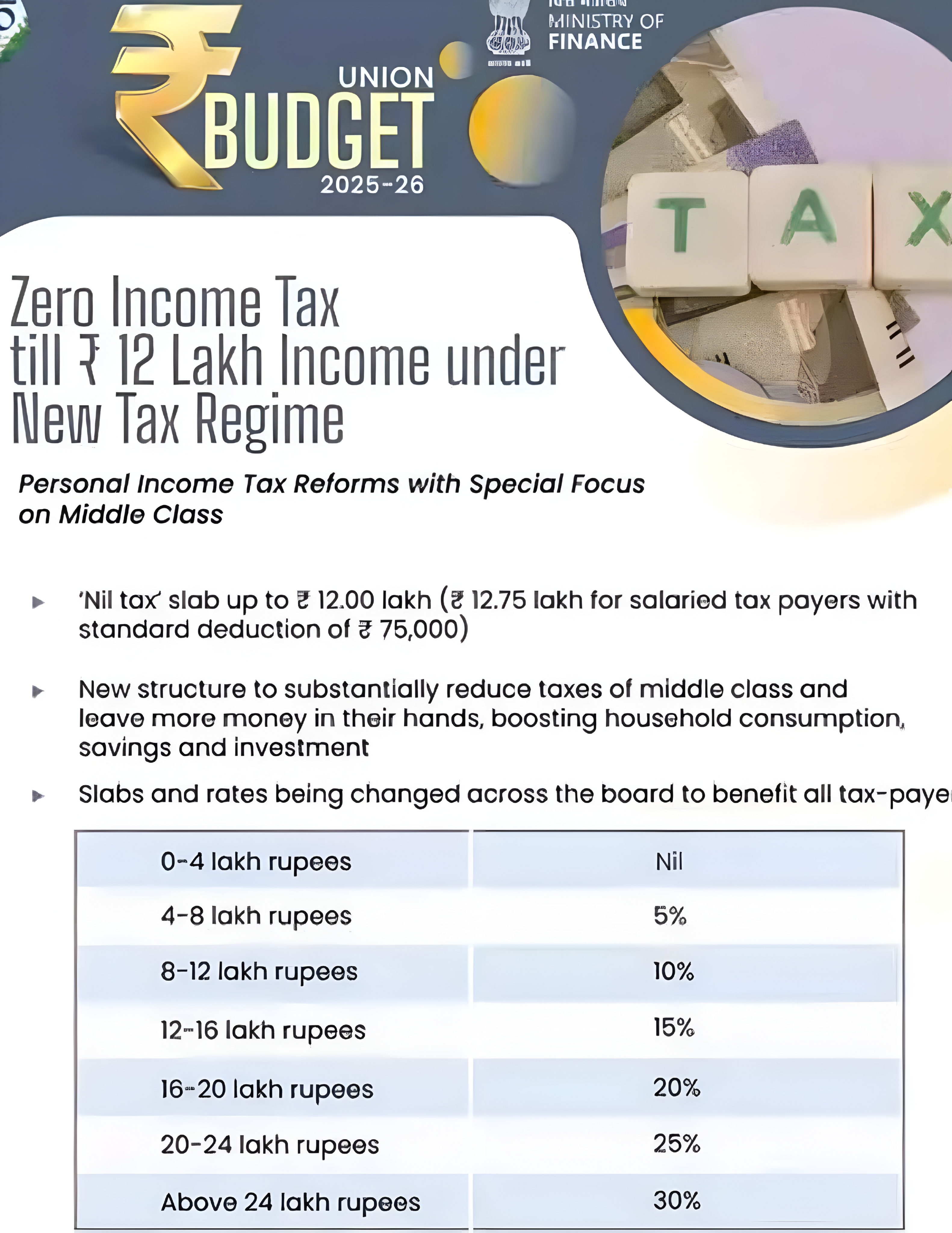

🔥🕉️ BJP announced No Tax On businesses and startups Upto 2 Crores turnover 💰🇮🇳🚀 • Presumptive Taxation ( Section 44AD ) For Small Businesses: Individuals, HUFs, and partnership firms (except LLPs) can opt. 1= Taxable Income Presumed: • 8% of turnover for cash transactions. • 6% of turnover for digital transactions. 2= Simplified Compliance • No need to maintain detailed books of accounts. • No need for tax audit if turnover ≤ ₹2 crore. • Reduces compliance burden for small businesses. 3= Latest Updates • Higher Turnover Limit: Increased from ₹2 crores to ₹3 crores if cash receipts ≤ 5% of total turnover. • Encourages Digital Transactions: More businesses can now benefit if they use digital payments. 4= Tax Payment & Compliance • Advance Tax: Entire tax liability must be paid by March 15 of the financial year. • Fixed Presumed Profit: Even if actual profit is lower, tax is still calculated on 6-8% of turnover. • Cannot Claim Business Deductions: No deductions for rent, depreciation, salaries, etc. 5= Restrictions & Limitations • No Opting In & Out Frequently: Once opted out, cannot re-enter for 5 years. 6= Not Allowed For: • Commission agents, brokerage firms, and agency businesses. • Businesses engaged in hiring, leasing, or plying goods carriages. • No Loss Carry Forward: Business losses cannot be adjusted in future years. 7= Advantage for startup and businesses • Less paperwork & compliance burden for small businesses. • No tax audit required if turnover ≤ ₹2 crores • Lower tax rate (6%) for digital transactions • Encourages digital payments & transparency • High Growth opportunities and easy market entry • Competitive Advantage for competing with giants 🇮🇳💰 What's your take on this ?

Replies (2)

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

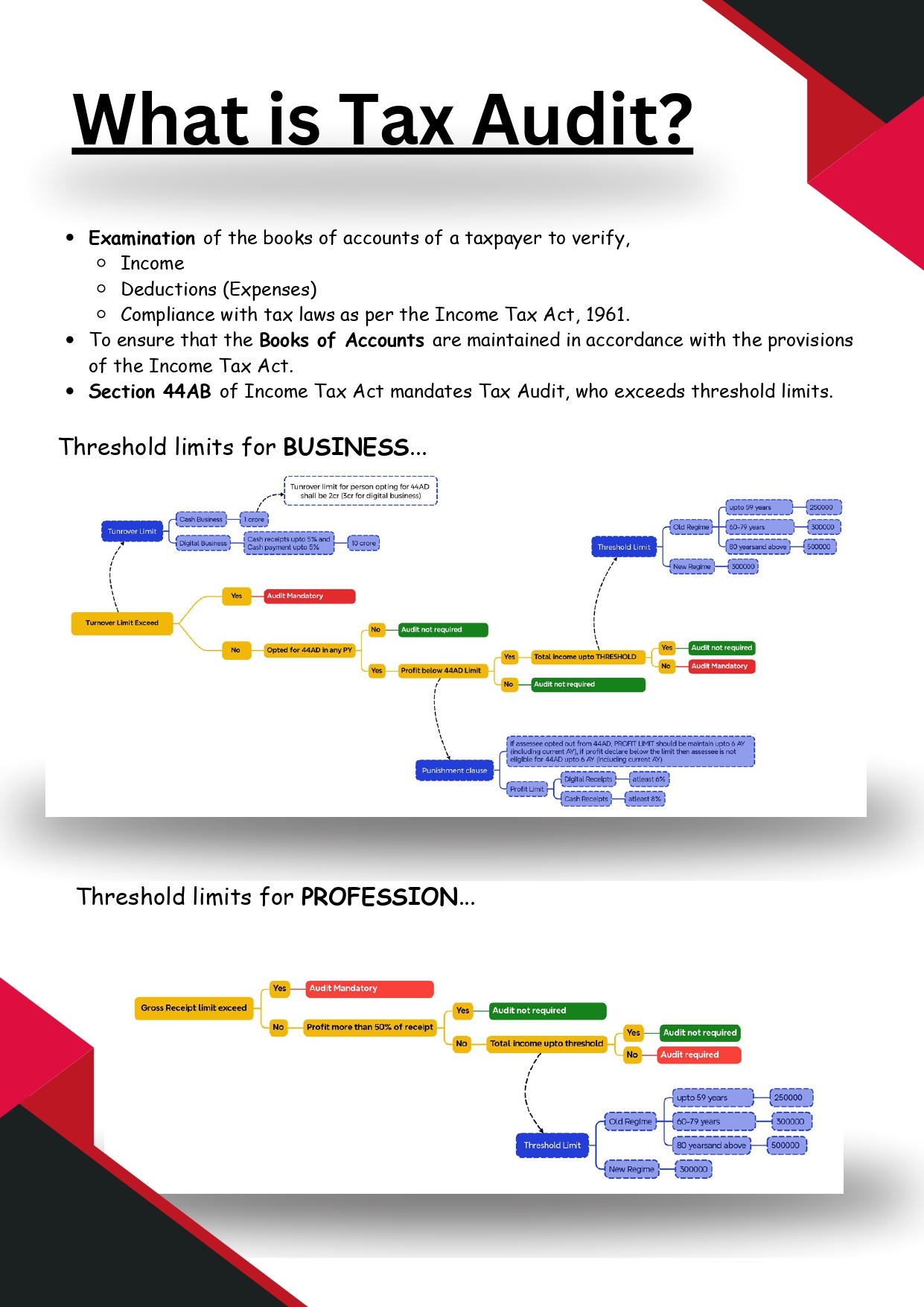

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Sai Vishnu

Income Tax & GST Con... • 11m

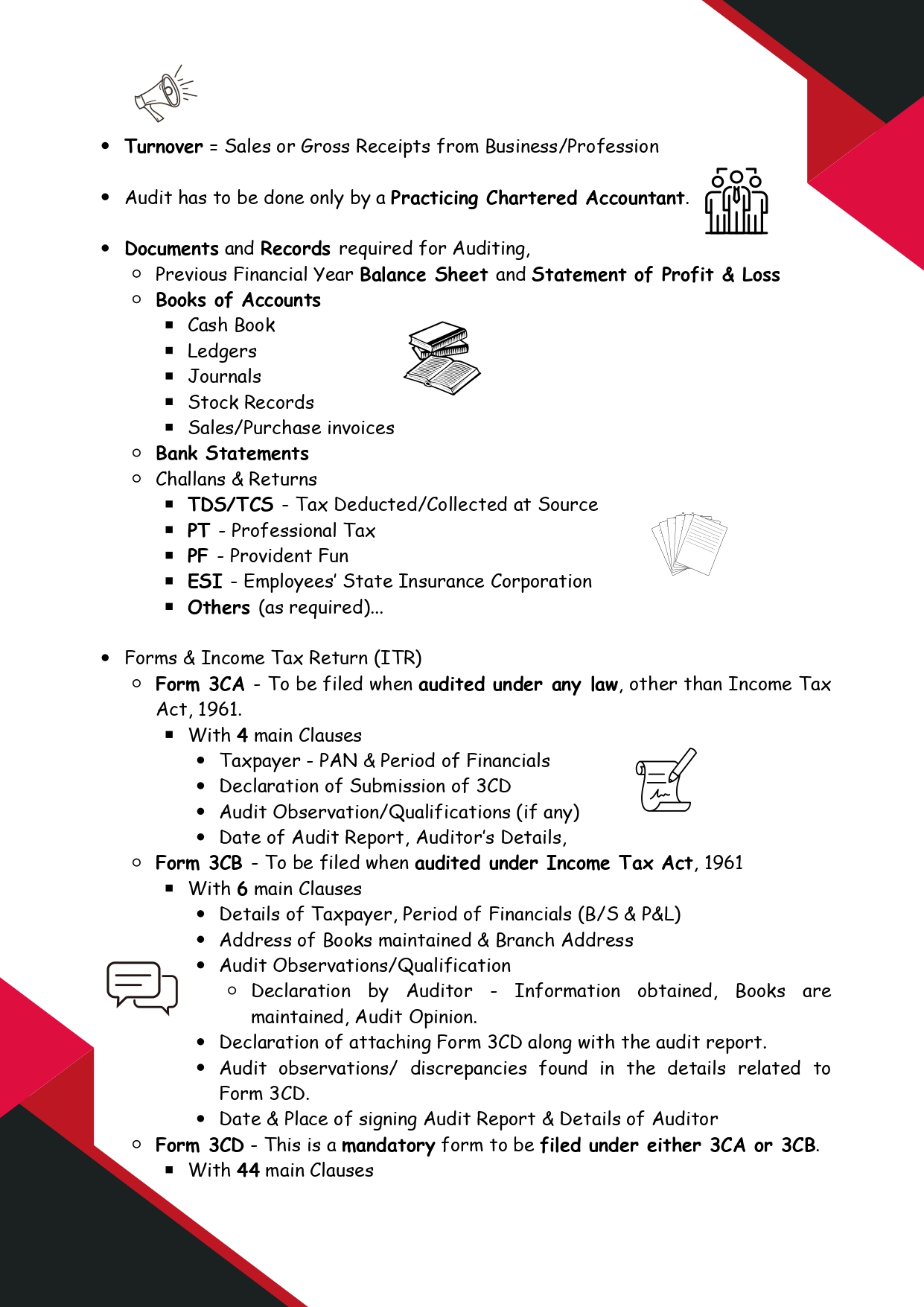

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)