Back

CA Dipika Pathak

Partner at D P S A &... • 1y

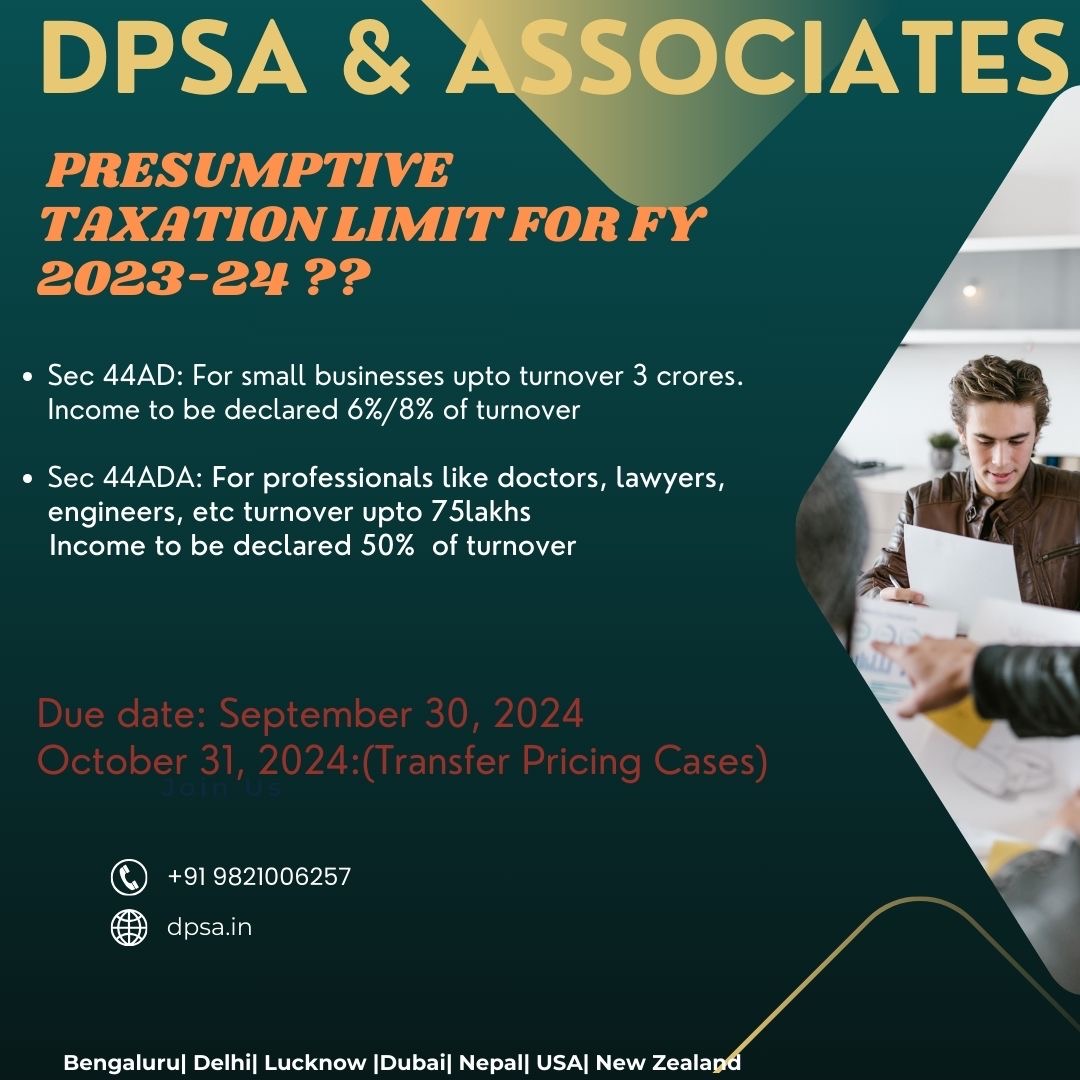

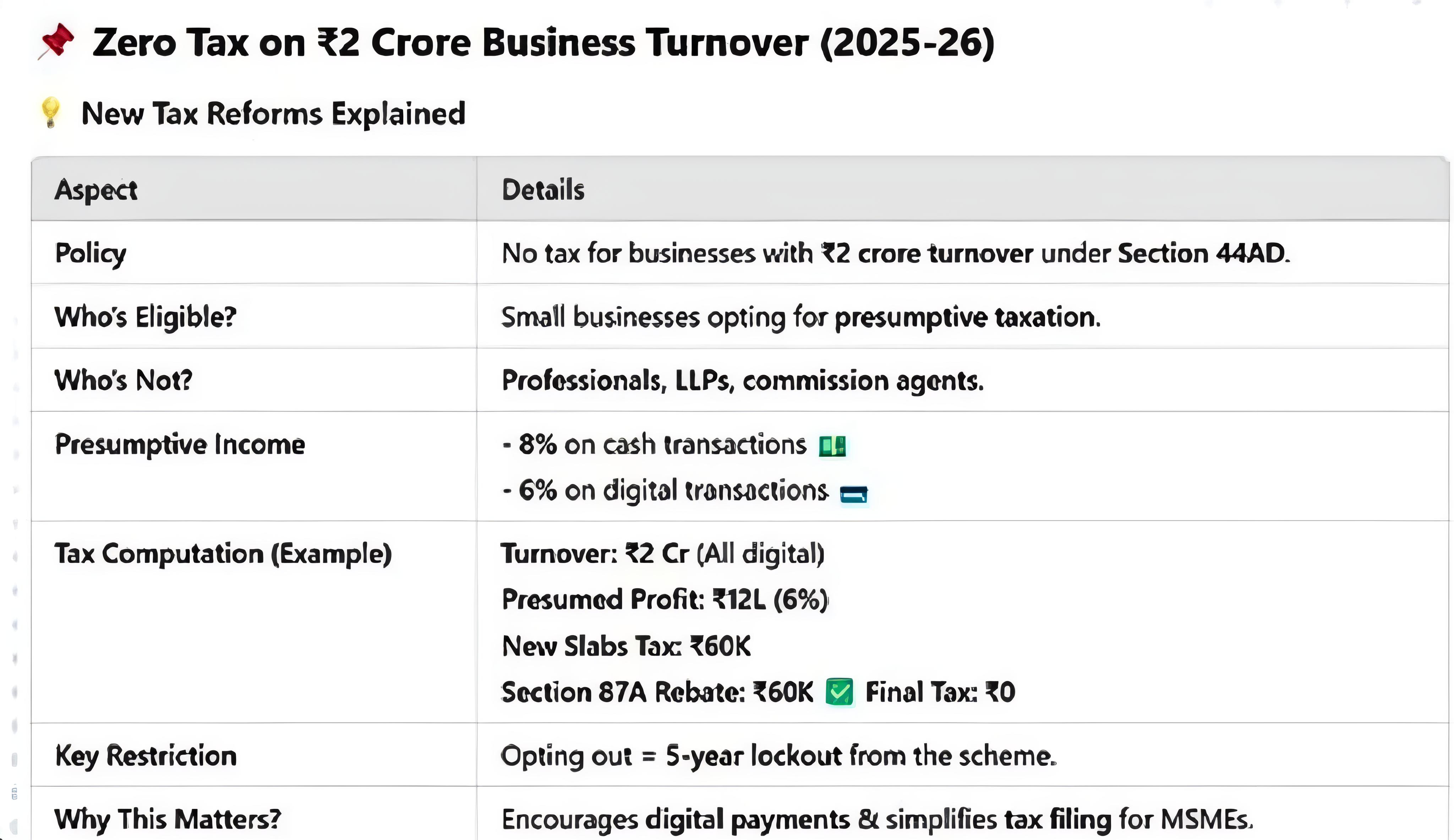

For Individuals & Partnership firm only (not LLP) . Know when 𝐓𝐚𝐱 𝐀𝐮𝐝𝐢𝐭 is applicable to you & about 𝐩𝐫𝐞𝐬𝐮𝐦𝐩𝐭𝐢𝐯𝐞 𝐭𝐚𝐱𝐚𝐭𝐢𝐨𝐧 For FY 2023-24, the presumptive taxation limits are as follows: If you fall within the limits and pay tax accordingly, you are exempt from a tax audit. ➡ For small businesses under Section 44AD, the limit has increased from Rs. 2 crore to Rs. 3 crore, with income to be declared as 8% of turnover, or 6% for digital receipts. ➡ For professionals like doctors and lawyers under Section 44ADA, the limit has been raised from Rs. 50 lakh to Rs. 75 lakh, with income to be declared as 50% of turnover. The increase in limits is subject to a condition that 95% of the receipts must be through recognised banking channel in both the above cases

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

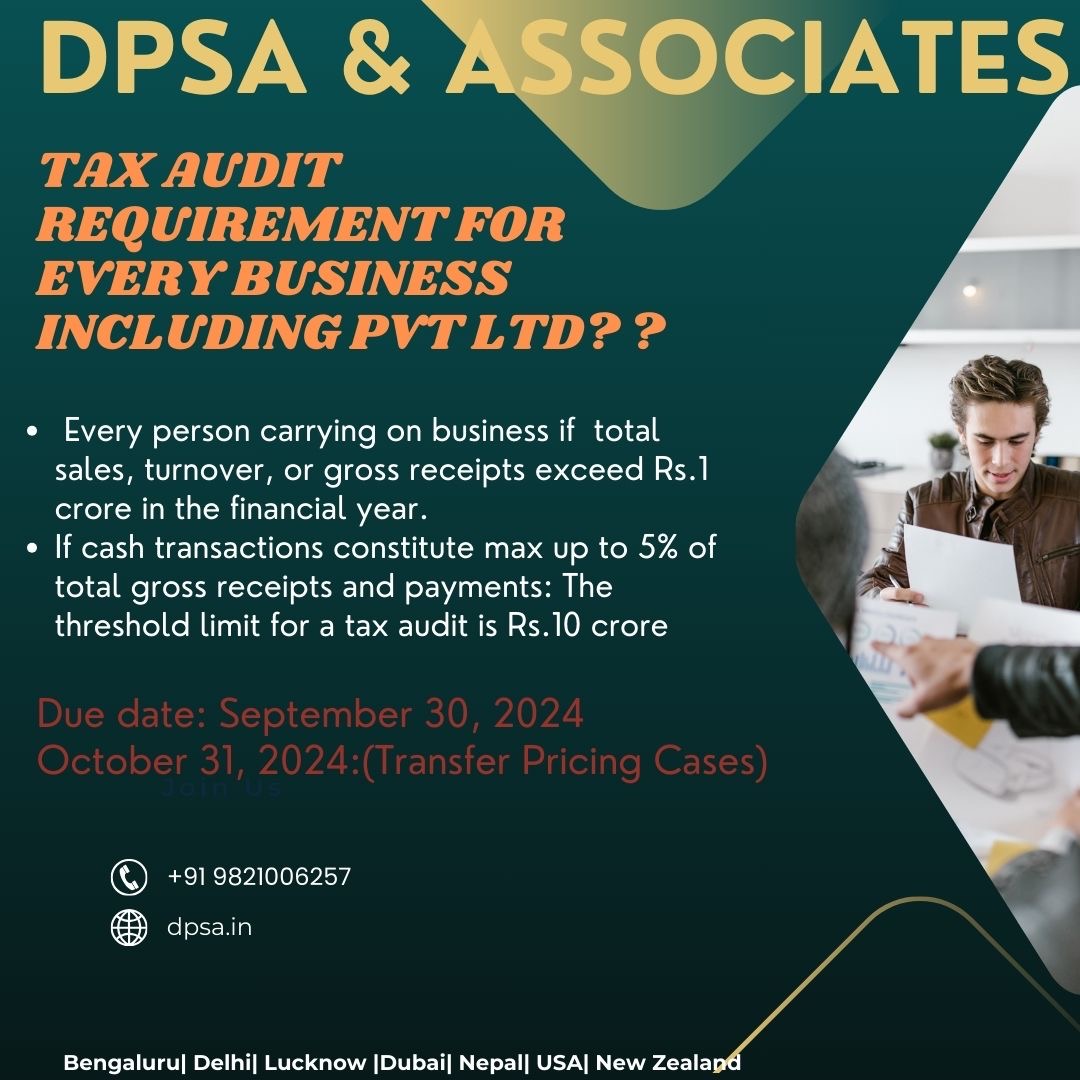

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Ishita Singh

I will rule the worl... • 1y

Bank of Baroda shares in focus as lender to raise funds via long-term bonds :- Bank of Baroda shares closed 2.07% lower at Rs 250.65 on Wednesday against the previous close of Rs 255.95 on BSE. Total 3.05 lakh shares of Bank of Baroda changed hands

See MoreCA Kakul Gupta

Chartered Accountant... • 10m

The Government of India has revised the investment and turnover limits for MSME classification. As per the latest notification, the new limits are: Investment criteria ✅ Micro Enterprises: Up to ₹2.5 crore (earlier ₹1 crore) ✅ Small Enterprises

See MoreSai Vishnu

Income Tax & GST Con... • 11m

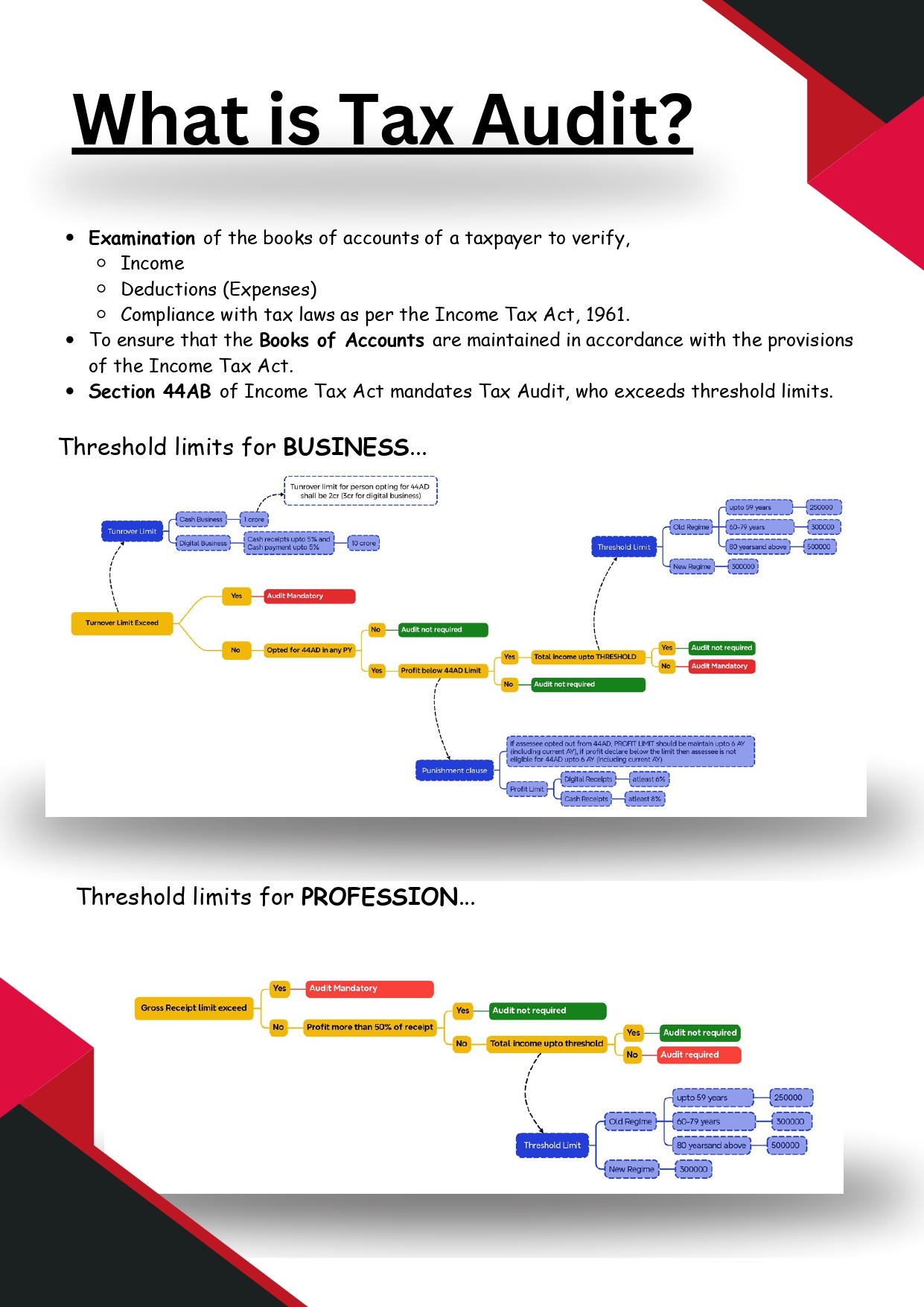

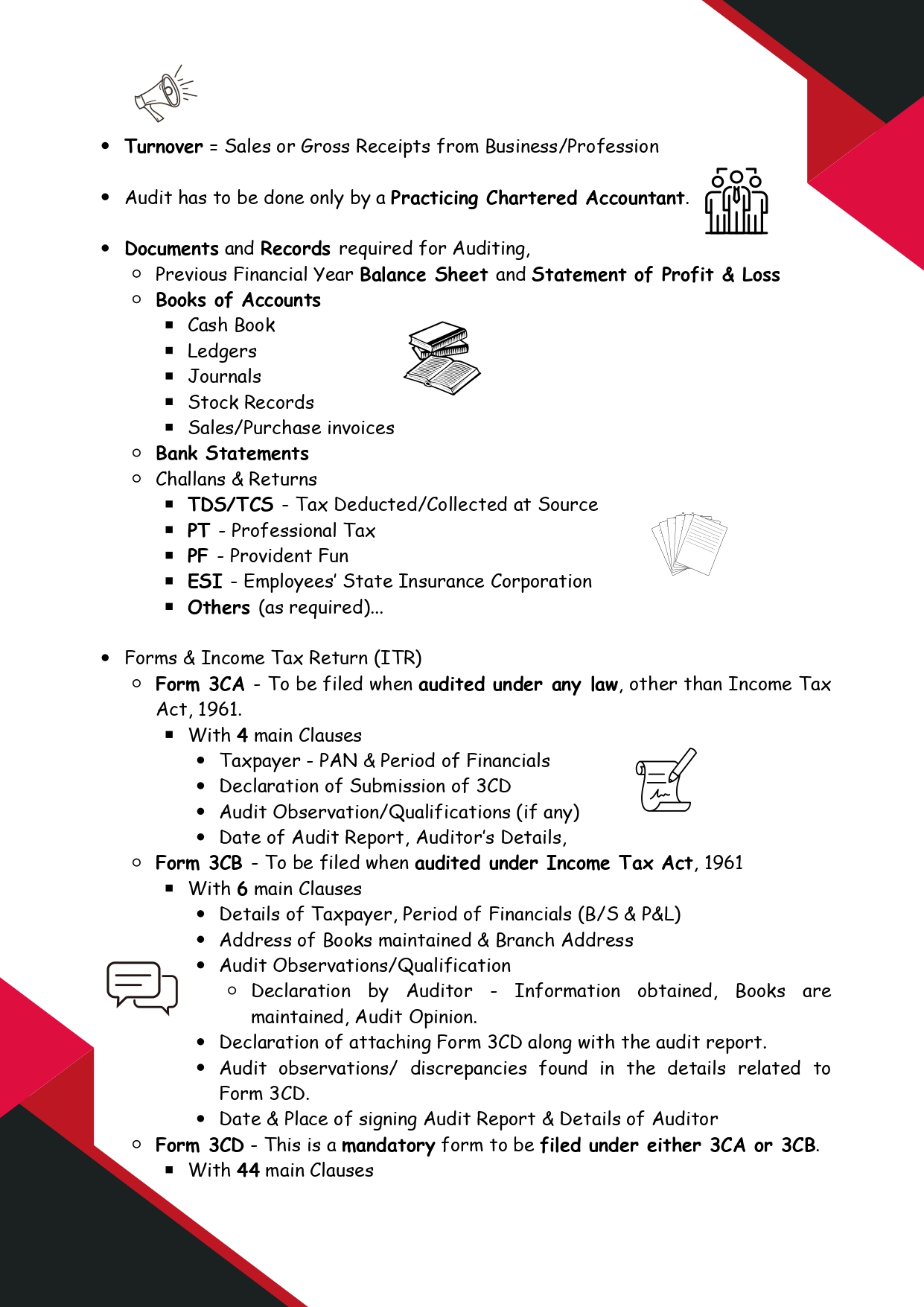

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

nuthan kalyan

Data Enthusiast • 6m

hii actually I have my ai application. and I used gemini for the ai model. as am scaling my application I had to use gemini more. so what I did was I created multiple projects and in each project i created a single key such that the limits are only

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)