Back

Ashutosh Mishra

Chartered Accountant • 1y

𝗨𝗣𝗜 𝗧𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗟𝗶𝗺𝗶𝘁 𝗧𝗼 𝗕𝗲 𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝗱 𝗙𝗿𝗼𝗺 ₹𝟭 𝗟𝗮𝗸𝗵 𝗧𝗼 ₹𝟱 𝗟𝗮𝗸𝗵 𝗙𝗼𝗿 𝗖𝗲𝗿𝘁𝗮𝗶𝗻 𝗖𝗮𝘁𝗲𝗴𝗼𝗿𝗶𝗲𝘀 The National Payments Corporation of India (NPCI), which manages UPI, has raised the per-transaction limit to ₹5 lakh, specifically for tax payments earlier. Now this higher limit applies to 'verified merchants,' allowing individuals to pay up to ₹5 lakh in a single UPI transaction. Following are the categories for which limits have been increased: • Educational Services • IPOs • Hospitals • Tax Payments • Government Securities This will be effective from September 15. This increase will be most helpful in emergency transactions. Follow Ashutosh Mishra for more such content https://www-livemint-com.cdn.ampproject.org/c/s/www.livemint.com/news/starting-sept-15-you-will-be-able-to-transfer-rs-5-lakh-in-a-single-upi-transaction-under-this-category-online-payment/amp-11726136155807.html

Replies (3)

More like this

Recommendations from Medial

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreGyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See Moregray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Prem Siddhapura

Unicorn is coming so... • 1y

**Tax Revenue Hits Record Highs** 📈 The government’s net direct tax collection, post-refunds, surged 15.4% to ₹12.3 lakh crore between April and November 10, 2024. Gross collections also saw a robust 21.2% increase, reaching ₹15.02 lakh crore. 💰

See MoreSwamy Gadila

Founder of Friday AI • 7m

🚀 Should India Start Charging Fees for High-Value UPI Transactions? UPI is a world-class digital payments system — fast, free, and inclusive. But there's a hidden cost: 💸 Infra cost of ₹0.10–₹0.30 per transaction 🏦 Over ₹1,000 crore/month just t

See MoreCA Dipika Pathak

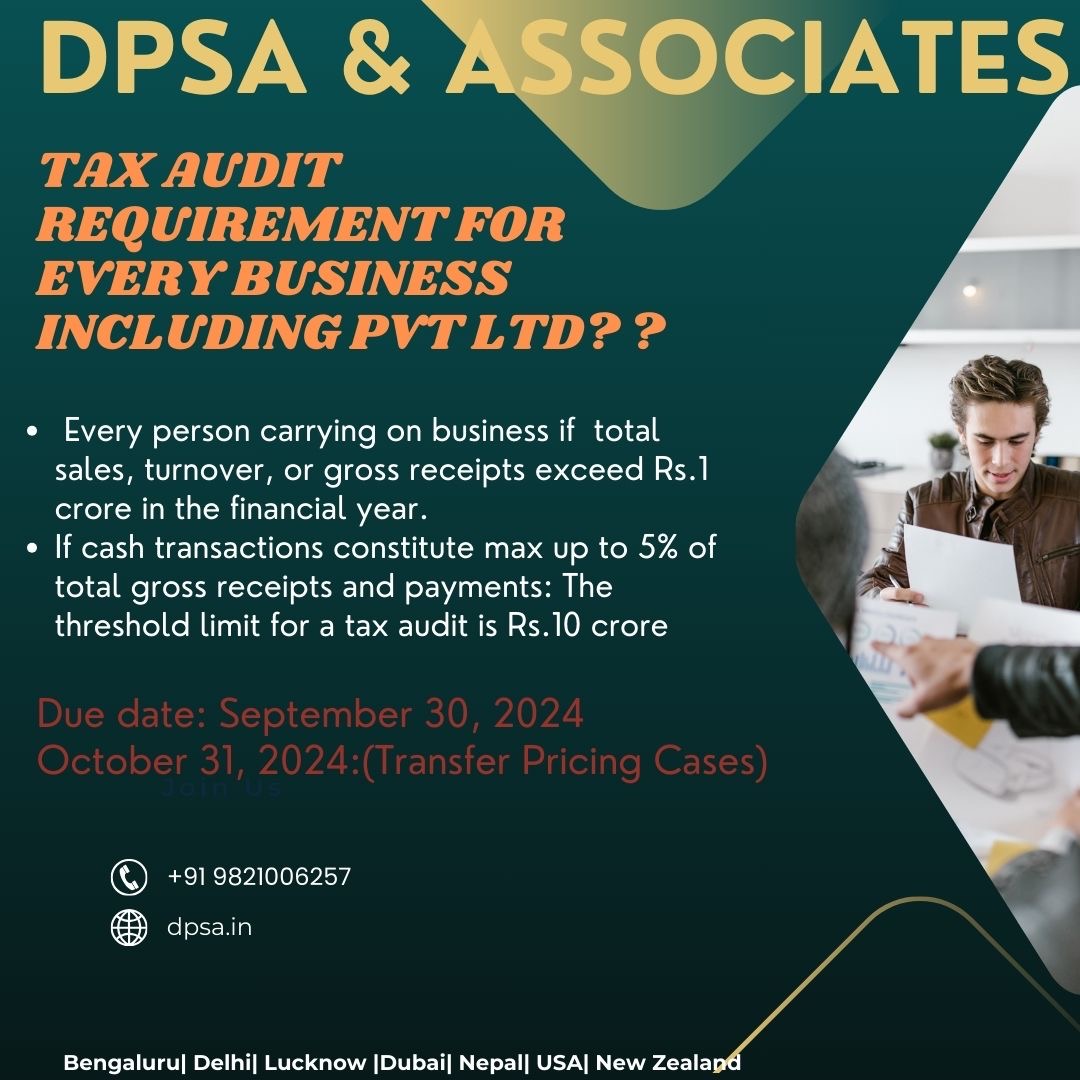

Partner at D P S A &... • 1y

Dear business🔊 please note your tax audit applicability ➡️Every business, including private limited companies, individuals, and partnership firms (excluding those opting for the presumptive taxation scheme), is subject to a tax audit ifTotal sale

See More

Account Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)