Back

Account Deleted

Hey I am on Medial • 12m

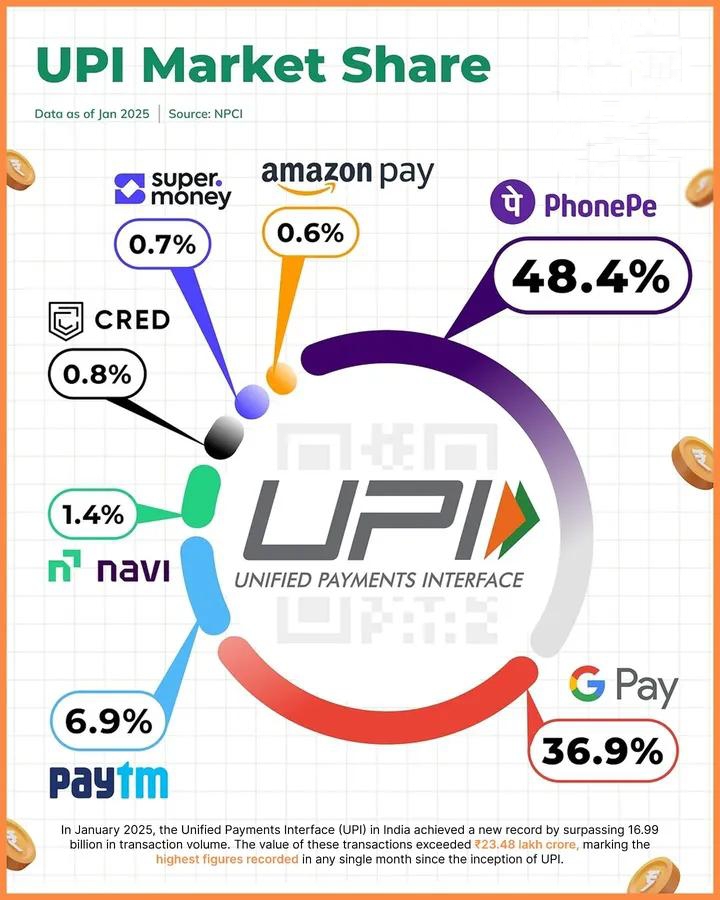

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling ₹12,000 crore annually, prompting new revenue models. UPI transactions surged to 16.99 billion worth ₹23.48 lakh crore in January 2025, marking a 39% YoY increase. The Indian government waives MDR for UPI payments under ₹2,000, but platforms still struggle with revenue generation

Replies (9)

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 10m

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

Jayant Mundhra

•

Dexter Capital Advisors • 10m

Days ago I posted this viral theory on how UPI going down thrice in a week - 26 & 31 March and 2 April - was most likely a staged drama! 🙏🙏 Following a kind update from supergood NPCI folks about how technical failures caused the outages, I decide

See More

Swamy Gadila

Founder of Friday AI • 7m

🚀 Should India Start Charging Fees for High-Value UPI Transactions? UPI is a world-class digital payments system — fast, free, and inclusive. But there's a hidden cost: 💸 Infra cost of ₹0.10–₹0.30 per transaction 🏦 Over ₹1,000 crore/month just t

See MoreAccount Deleted

Hey I am on Medial • 1y

SolarSquare’s Losses Surge Despite Revenue Growth in FY24 Rooftop solar provider SolarSquare saw a 63.5% YoY revenue growth in FY24, reaching ₹175 crore. However, its losses jumped 2.3X to ₹69 crore due to rising costs. Revenue from operations grew

See More

Mr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MoreShanu Chhetri

CS student | Tech En... • 8m

Pazy secure 6cr funding pazy is a Bengaluru-based fintech startup offering an integrated business-payments platform for finance teams. Founded in 2023, they just raised ₹6 crore in pre-seed funding led by Inuka Capital and Gemba Capital. The funds w

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)