Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 12m

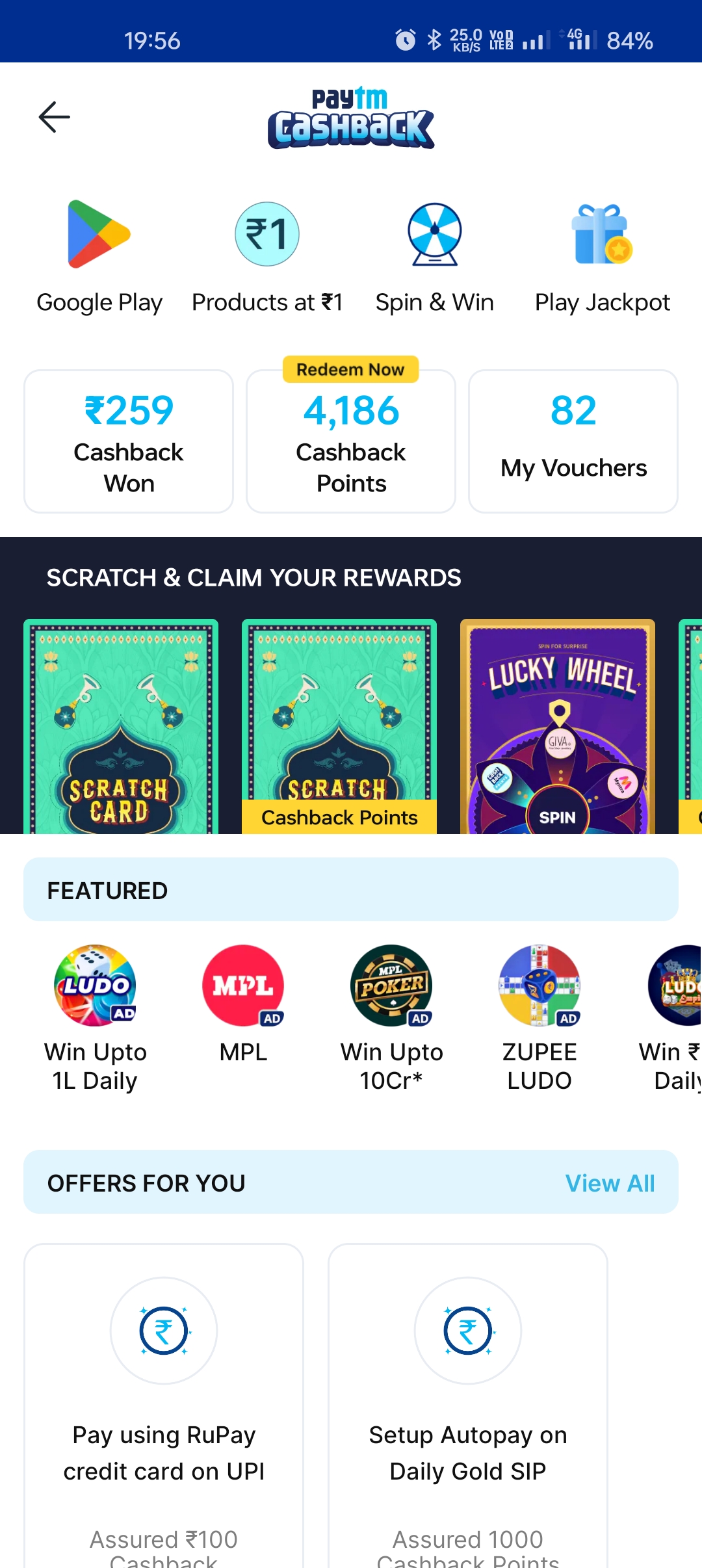

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

VCGuy

Believe me, it’s not... • 1y

A few days ago, Flipkart introduced its new UPI service, Supermoney. ⏮️The interesting part: Let's go back a few years - Dec, 2015: 3 former Flipkart exec's start PhonePe. Apr, 2016: Flipkart acquires PhonePe for $20 M. Aug, 2018: Walmart acquires

See More

Anonymous

Hey I am on Medial • 1y

UPI based payment gateway for developers. I want to enable UPI payments on my website. Which solution can I use? Paytm, Razorpay, Phonepe required documents proving you are a registered business. But I'm a dev, don't have any registered business. Loo

See MorePoosarla Sai Karthik

Tech guy with a busi... • 7m

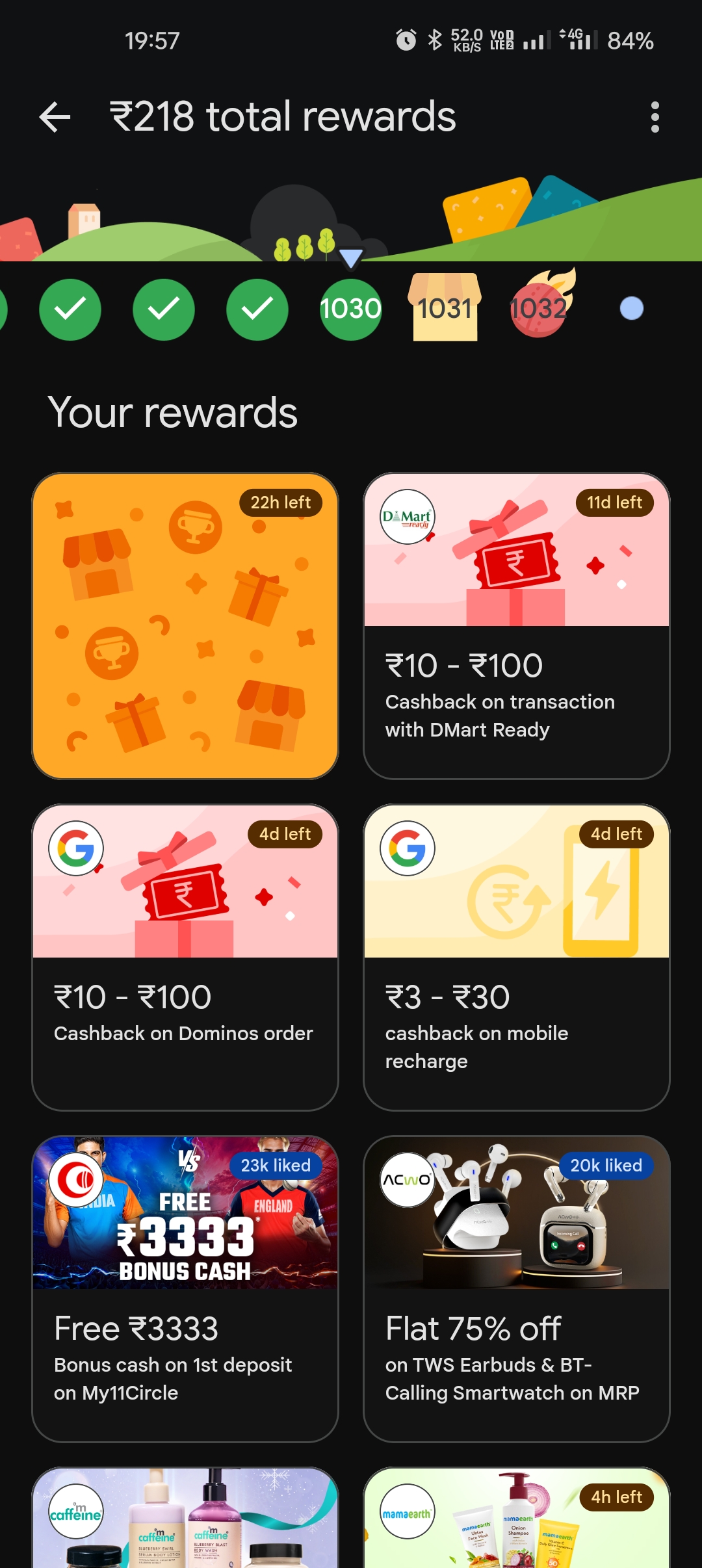

UPI on Credit? PhonePe’s Boldest Bet Yet In partnership with HDFC Bank and NPCI, the card is powered by Rupay and allows UPI payments through credit. NPCI had enabled this back in 2022, but PhonePe had to wait almost ten months to get RBI approval.

See MoreVishnu kumaran

Design guide for you... • 1y

Why does capturing the market matter more than anything? Let's take UPI as an example. While other UPI apps took time to build an excellent, cutting-edge product, Google Pay and PhonePe started by releasing their MVP first and later improved their

See MorePonGangaiRaman NKS

Front End Developer • 1y

Hi Everyone, I'm currently working on a fintech app which supports payment gateway like PhonePe, GPay, Paytm. We're not into payment gateway but we need to support Peer-to-Peer(P2P) and Peer-to-Merchant(P2M) transactions in our app. I tried implement

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)