Back

Vishnu kumaran

Design guide for you... • 1y

Why does capturing the market matter more than anything? Let's take UPI as an example. While other UPI apps took time to build an excellent, cutting-edge product, Google Pay and PhonePe started by releasing their MVP first and later improved their apps with regular feedback. What happened then? Now, PhonePe and Google Pay hold the largest market share in UPI. Is it true? I made a UPI app in my hometown. When I asked merchants 'Do you have UPI?', they replied, 'We have PhonePe and Google Pay.' Seems obvious that people are more familiar with those brand names. Another incident is when I tried to pay through super.money and showed them the payment proof. They were confused. I asked what happened and then came to know that the shopkeeper was familiar with Google Pay and PhonePe's payment proof UI. Then I clarified it with them. So, if you are a founder of a startup in a competitive market, make sure you roll out your MVP to capture the market. You can always iterate with feedback.

Replies (3)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 1y

A few days ago, Flipkart introduced its new UPI service, Supermoney. ⏮️The interesting part: Let's go back a few years - Dec, 2015: 3 former Flipkart exec's start PhonePe. Apr, 2016: Flipkart acquires PhonePe for $20 M. Aug, 2018: Walmart acquires

See MoreKimiko

Startups | AI | info... • 10m

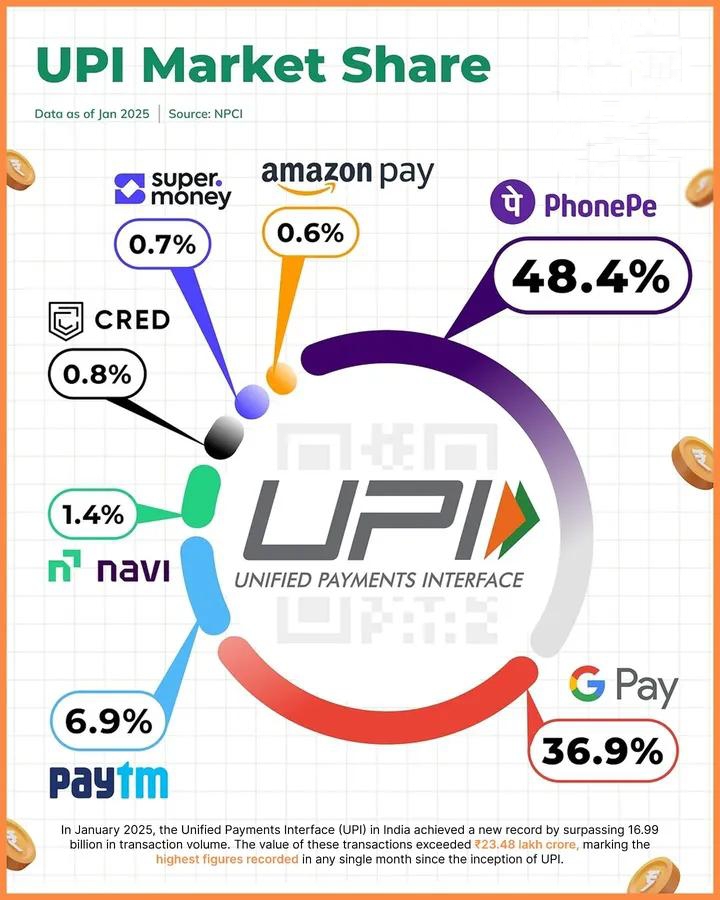

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

Account Deleted

Hey I am on Medial • 1y

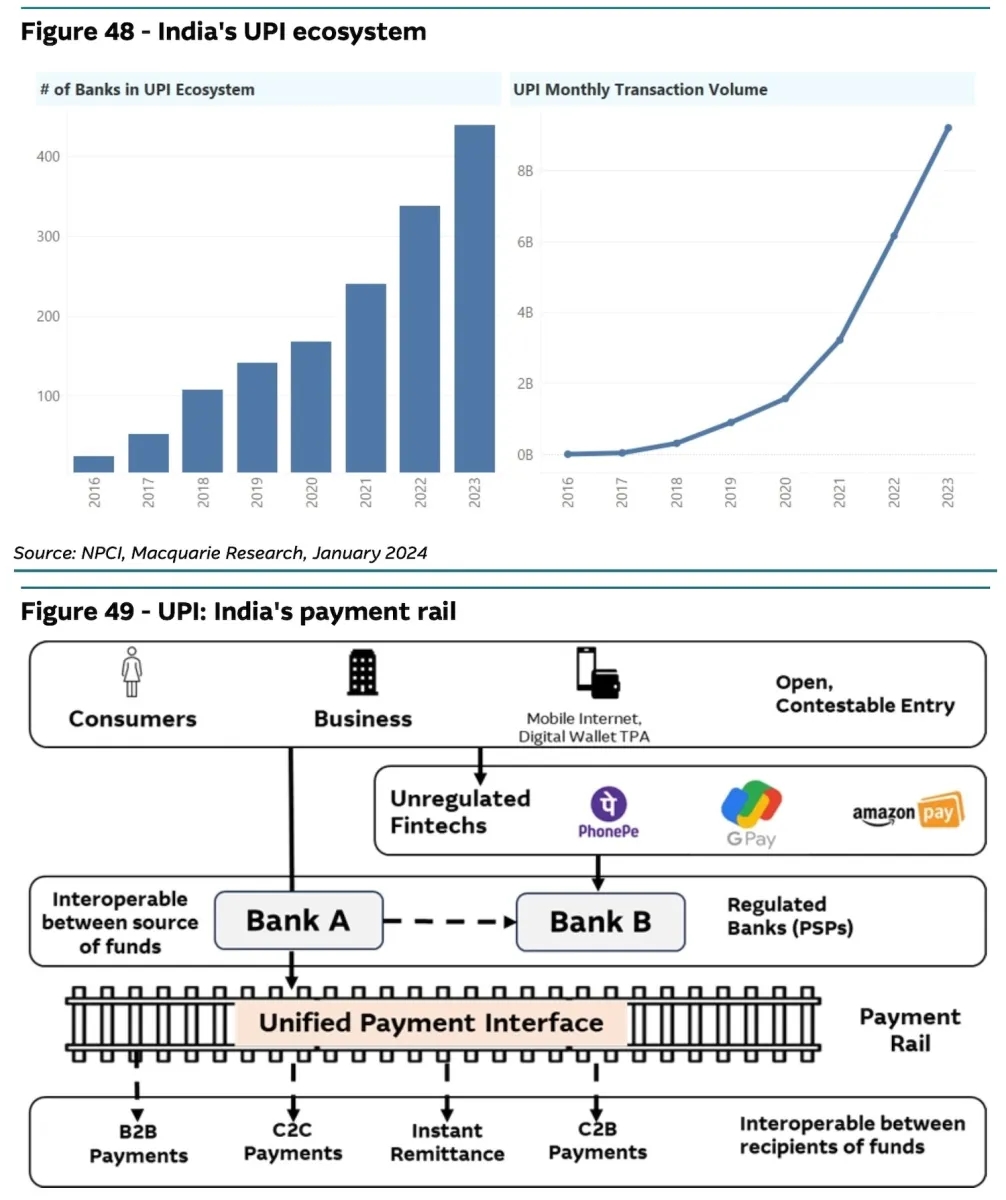

As you see in the picture , UPI is skyrocketing since 2016 to 2024 to approx . 8B transactions . • companies like Phonepe,Google pay are dominating the market with atleast 80% market share , Paytm market share fall from 13 to 9%. • Government will

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)