Back

Ashwin Jagtap

Keep walking • 4m

Problem Most people earn money but don’t clearly know where it goes. They use many apps — Google Pay, PhonePe, Paytm, bank UPI — and spend without tracking. At month-end, there’s confusion, overspending, and zero savings. Solution OneFin automatically connects all your financial platforms in one app. It tracks every transaction, organizes it into clear categories like petrol, food, shopping, and bills, and gives monthly reports so users can manage money better. --- How It Works 1. User links Google Pay, PhonePe, bank, and UPI accounts. 2. When salary (e.g. ₹1 lakh) arrives, OneFin starts monitoring spending. 3. Each payment — petrol, hotel, shopping — is automatically recorded and labeled. 4. At month-end, the app sends a notification: “You spent ₹3,200 on petrol.” “You saved ₹12,000 this month.” “Your food expense increased 10% from last month.” Vision “To make every Indian financially aware and confident — by showing exactly where their money goes.”

Replies (1)

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Paytm shareholders are ignoring this? 📛📛 The fintech giant was the only UPI app to be making money on UPI. And now that’s no more possible. Here's all you should know! .. The thing is, NPCI (via Govt grants) compensates the banks to up keep the

See MoreAccount Deleted

Hey I am on Medial • 1y

PhonePe IPO Is Coming! • PhonePe is planning an IPO to raise capital at a valuation of $8-10 billion. • In 2023, PhonePe raised $200 million from Walmart at a pre-money valuation of $12 billion. • PhonePe dominates the UPI payments business with a

See More

Account Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Kimiko

Startups | AI | info... • 10m

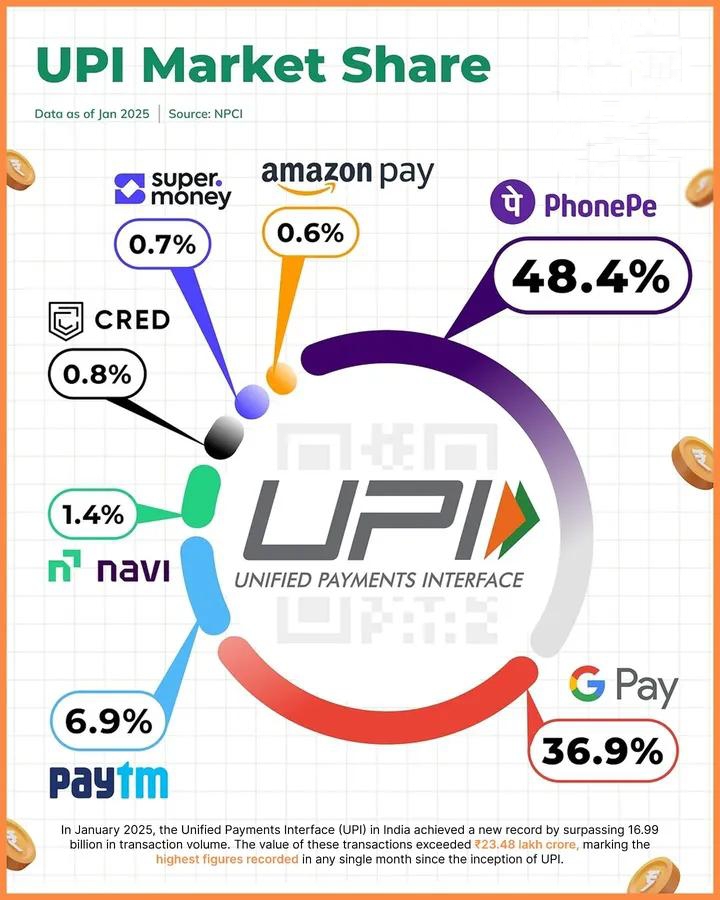

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

VCGuy

Believe me, it’s not... • 1y

A few days ago, Flipkart introduced its new UPI service, Supermoney. ⏮️The interesting part: Let's go back a few years - Dec, 2015: 3 former Flipkart exec's start PhonePe. Apr, 2016: Flipkart acquires PhonePe for $20 M. Aug, 2018: Walmart acquires

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)