Back

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 12m

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

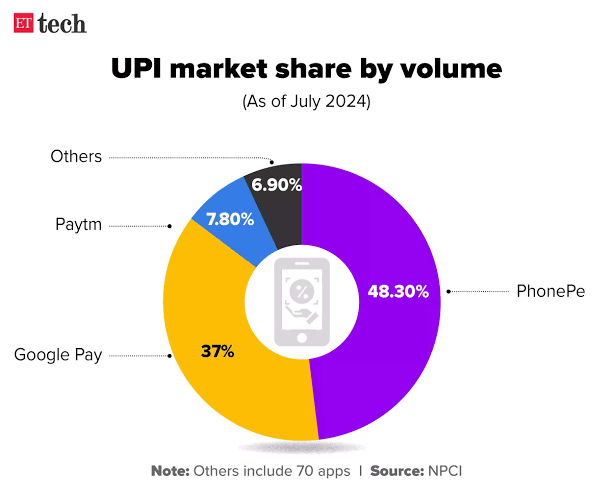

Case Study: PhonePe – India's UPI Leader Founded in 2015, PhonePe dominates India's digital payments landscape. Stats: Users: 350M+ registered Market Share: 40%+ of UPI transactions Business Model: Transactions, financial services, advertising. R

See More

Kimiko

Startups | AI | info... • 10m

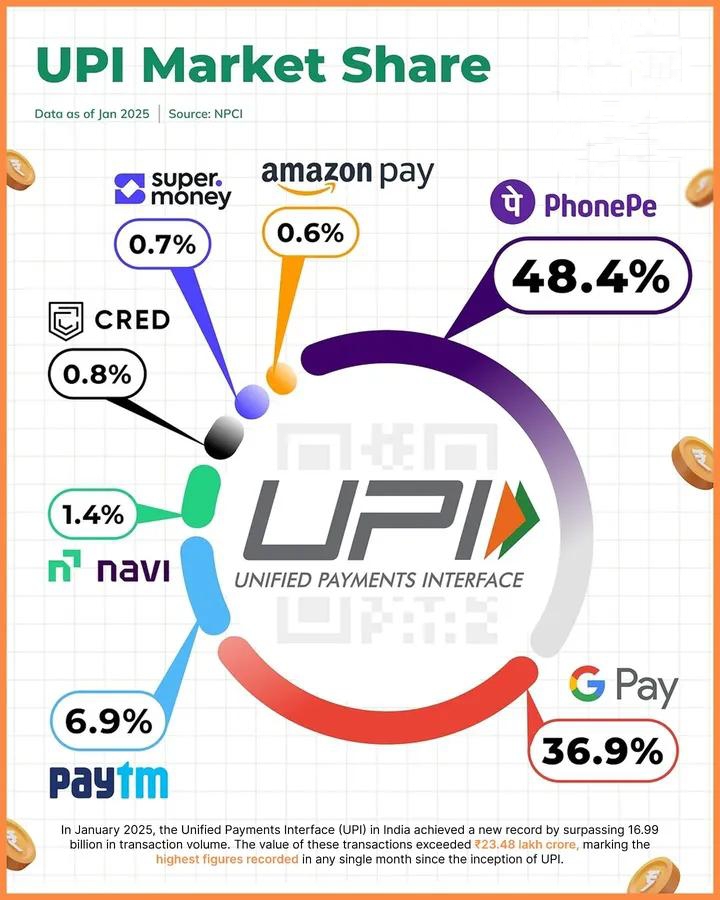

🚀 UPI hits historic highs in January 2025! PhonePe leads with 48.4%, Google Pay follows at 36.9%, and Paytm holds 6.9%. 📊 Over 16.99 billion transactions worth ₹23.48 lakh crore — marking the highest figures recorded in any single month since UPI's

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)