Back

Vedant SD

Finance Geek | Conte... • 1y

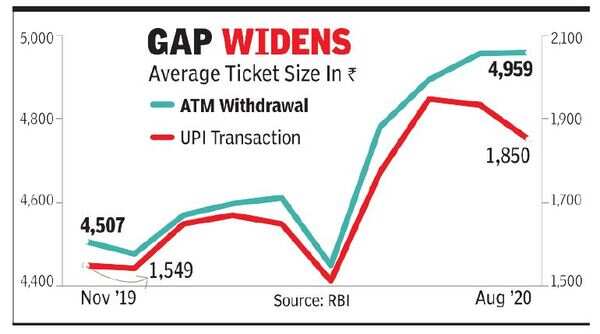

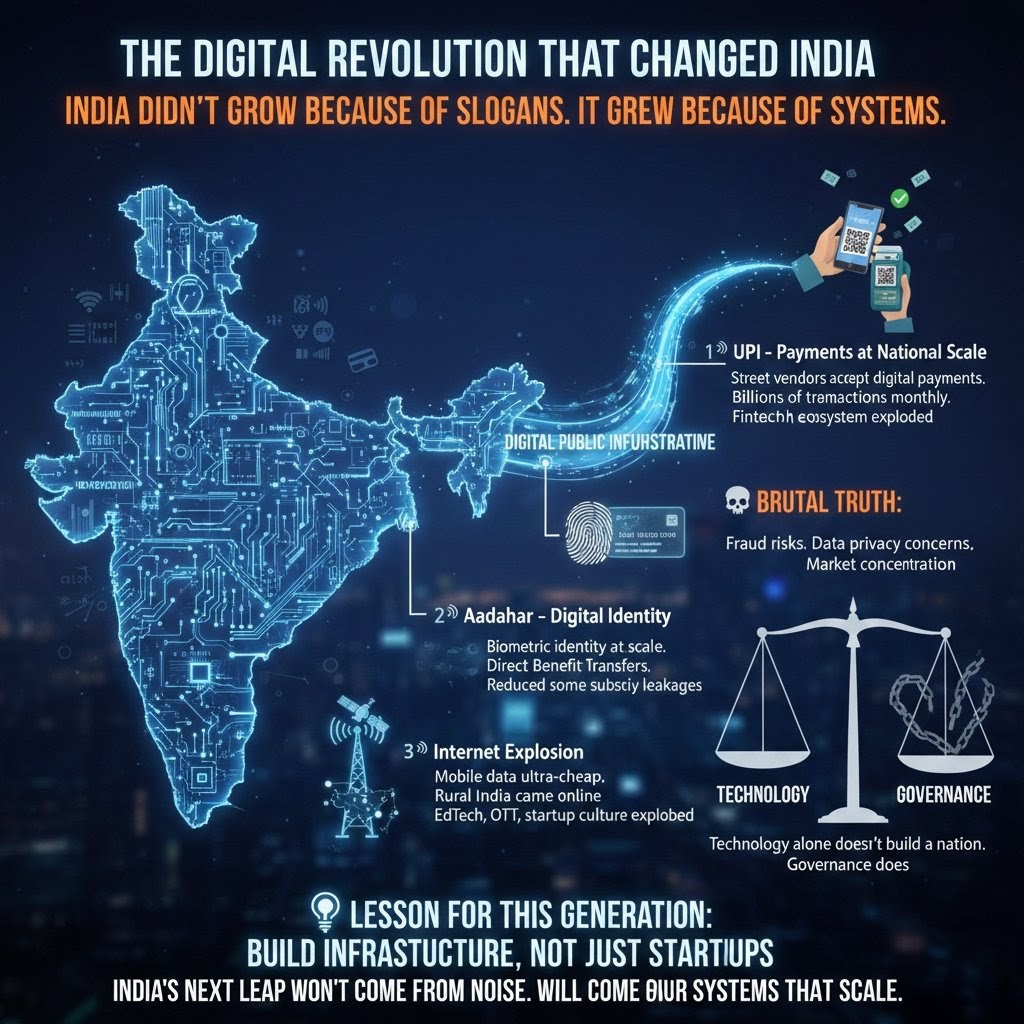

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large population and growing middle class offer a vast market potential for digital payments. Key Trends: * Unified Payments Interface (UPI): UPI has emerged as the most popular digital payment method in India, enabling instant peer-to-peer and person-to-merchant transactions. * Mobile Wallets: Mobile wallets like Paytm, PhonePe, and Google Pay have gained widespread adoption, offering a convenient way to make payments. * QR Codes: QR codes have become ubiquitous in India, allowing for contactless payments at various merchants. Government Initiatives: * Digital India Mission: * Demonetization: * Financial Inclusion: Challenges and Opportunities: * Internet Penetration: * Digital Literacy: * Security Concerns:

Replies (7)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Future of Fintech in India India's fintech sector has experienced rapid growth, driven by technological advancements, increasing smartphone penetration, and government initiatives. The country's large population and diverse demographics offer a s

See MoreMr khan

Smart. Sustainable. ... • 1y

UPI Statistics for December 2024: Total Transactions: December 2024 mein, UPI ne over 10 billion transactions process kiye, jo pehle ke months ke comparison mein kaafi zyada tha. Transaction Value: UPI transactions ki total value ₹15 lakh crore (app

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)